© Deaconsdocs | Dreamstime.com In 2020, the Covid-19 pandemic hit the Swiss economy. GDP fell by 2.9% compared to 2019. However, despite the fall in economic output the number of bankruptcies fell by 6.7% compared to 2019. In addition to a fall in the number of bankruptcies, the sum lost from closed bankruptcies fell 27%, after adjusting for the CHF 6.5 billion lost from the collapse of the Erb empire, Switzerland’s second largest bankruptcy after Swissair. Rolf Erb,...

Read More »Foreign firms creating more jobs in Switzerland despite pandemic

Switzerland has remained an attractive destination for foreign firms © Keystone / Peter Klaunzer Switzerland has remained an attractive location for foreign firms, creating more jobs last year than in 2019 – despite the economic effects of the coronavirus pandemic, Swiss public television SRF and RTS have reported. Foreign firms accounted for 11% more jobs in 2020, bringing the total to almost 1,200, even if the total number of companies moving to the country dropped...

Read More »How Federal Funding Is Used to Control Colleges and Universities

The Washington Post reports that a group of thirty-three current and former students at Christian colleges are suing the Department of Education in a class action lawsuit in an attempt to abolish any religious exemptions for schools that do not abide by the current sexual and gender zeitgeist sweeping the land. The plaintiffs argue that by holding to orthodox Christian teachings on sexuality these universities are engaged in unconstitutional discrimination due to the...

Read More »IMF praises Switzerland’s economic response to the pandemic

© Marekusz | Dreamstime.com According to the International Monetary Fund (IMF), Switzerland has economically navigated the Covid-19 pandemic well so far. In 2020, the Swiss economy shrank by 2.9%, far less than many other advanced European economies. France (-8.2%), Germany (-4.9%), Italy (-8.9%) and the UK (-9.9%) all performed far worse. According to the IMF, the impact of the pandemic in Switzerland was cushioned by solid public and household finances, competitive...

Read More »Is ESG Investment the Future of Gold & Silver?

‘ESG’ is a great buzzword in investing right now. For years the momentum has been building for the idea that retirement savings should do more than keep you secure, it also should help the planet. Obviously, no one wants to hurt the planet since its our only home. ESG Investment is shorthand for Environmental, Social and Governance, which are the three lenses through which investments are to be ranked. High ranking companies get more money from investors than low...

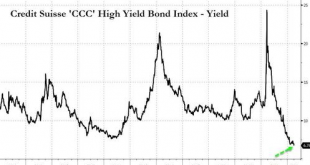

Read More »“They’re Just Chasing” – The Fed Has Put Distressed Investors Out Of Business… Again

“People aren’t investing, they’re just chasing.” That is the ominous, ponzi-like warning from Adam Cohen, Caspian Capital’s managing partner as the distressed debt investor has chosen to return some money to investors because the rewards don’t justify the high risks anymore. He is not wrong as it’s party time for zombie companies everywhere as “high yield” is now officially “low yield.” “People aren’t investing, they’re just chasing.” That is the ominous, ponzi-like...

Read More »The Property-Based Social Order Is Being Destroyed by Central Banks

Private property is an institution central to civilization and beneficial human interaction. When central banks distort this institution with easy money, the social effects can be disastrous. Original Article: “The Property-Based Social Order Is Being Destroyed by Central Banks” Readers of the Mises Wire are no doubt familiar with the negative consequences of central banking and the inflationary capacity of fiat currency and how such a system drives malinvestment...

Read More »Delta Exchange Closes US$5 Million Raise From Blockchain Valley Ventures Among Others

Delta Exchange, a UK-based institutional-grade crypto derivatives exchange, announced that it has closed a US$ 5 million token raise from existing and new investors where Swiss venture firm Blockchain Valley Ventures (BVV) backed and advised the former on their token raise. The token raise adds to existing investors like Aave, Coinfund and Kyber Network. New investors of the company include Spartan Group, QCP Soteria, Gumi Crypto, LuneX Ventures, Tembusu Partners and...

Read More »France asks Switzerland for help with Covid patients

© Hideko1979 | Dreamstime.com The French region of Bourgogne-Franche Comté has contacted several Swiss cantons and asked them if they would take Covid patients, according to RTS. Jacques Gerber, the minister of health in the canton of Jura told RTS that there had been a request from France to prepare in case French hospitals become overloaded. New cases have only been rising moderately in Switzerland since mid March. In France the number has risen steeply, reaching...

Read More »Results of the Annual General Meeting 2021 of UBS Group AG

Shareholders confirmed the re-election of the Chairman and the members of the Board of Directors. They elected Claudia Böckstiegel and Patrick Firmenich as new members of the Board. Shareholders approved a dividend distribution of USD 0.37 (gross) in cash per share. They also approved the new share buyback program 2021–2024. Shareholders approved the proposals relating to the remuneration of the members of the Board of Directors and the Group Executive Board and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org