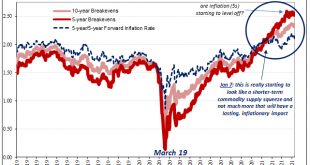

The benchmark 10-year US Treasury has obtained some bids. Not long ago the certain harbinger of bond rout doom, the long end maybe has joined the rest of the world in its global pause if somewhat later than it had begun elsewhere (including, importantly, its own TIPS real yield backyard). Even nearer-in inflation expectations have rounded off at their current top. Perhaps no more than a short-term rest before each rising again, then again with the rest of the...

Read More »Progressivism’s Failures: From Minimum Wages to the Welfare State

The empirical evidence shows that neither minimum wages or welfare reduce poverty. In fact, minimum wages tend to increase the cost of living while poverty rates have gone nowhere since the Great Society was introduced. Original Article: “Progressivism’s Failures: From Minimum Wages to the Welfare State” As I write, the Democratic Congress is contemplating various measures designed to alleviate poverty levels in the United States. They include: the doubling of the...

Read More »Anti-Vaccine and Anti-Vaping: Against Science and Innovation

Among the many problems originated by the Covid 19 pandemic, one of the most important is the resurgence of the anti-vaccine movement. Conspiracy theories, ridiculous arguments and unfounded accusations have given renewed fuel to one of the most anti-scientific and destructive trends we have ever seen. The nefarious contemporary anti-vaccine movement originated at the behest of a paper published in 1998. Former physician (his license has since been revoked)...

Read More »FX Daily, April 8: Calm Capital Markets See the Dollar Drift

Swiss Franc The Euro has fallen by 0.26% to 1.1003 EUR/CHF and USD/CHF, April 8 (see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global stocks are moving higher today. Fears of a new lockdown in Tokyo amid rising covid cases weighed on Japanese stocks, a notable exception as the MSCI Asia Pacific Index rose for its fifth session of the past six. Europe’s Dow Jones Stoxx 600 is edging to new record highs today...

Read More »All electric pledge by Swiss car-sharing firm

Mobility plans to complement its electric car fleet with a network of charging stations. Keystone / Obs/mobility Car-sharing company Mobility says it will electrify its entire fleet of 3,000 vehicles and build a network of e-charging stations by 2030. On Thursday, the company saidExternal link its first 300 e-charging stations should be operational within three years. Mobility, which is aims to be climate neutral as a company by 2040, has pledged that its fleet will...

Read More »Can Credit Suisse Avoid Becoming The ‘Deutsche Bank’ Of Switzerland?

“And the future is certain, give us time to work it out…” Markets were shaken but unstirred by the collapse of Greensill and the Archegos unwind trades. Credit Suisse is the ultimate loser of the two scandals – reputationally damaged and holed below the water line. The bank is paying the price of years of flawed management, poor risk awareness. and its self-belief it was still a Tier 1 global player. Its’ challenge is to avoid becoming the Deutsche Bank of...

Read More »Precious metals are and always have been the ultimate insurance

Interview with Robert Hartmann As we enter the second quarter of 2021, the year during which so many mainstream analysts and politicians have predicted we’ll see a miraculous recovery from the covid crisis, it is becoming increasingly clear that the damage inflicted by the lockdowns and the shutdowns is really very extensive an persistent. Of course, I’m referring to the damage to the real economy, that is, to actual businesses, households and the countless citizens...

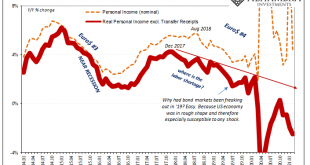

Read More »Real Dollar ‘Privilege’ On Display (again)

Twenty-fifteen was an important yet completely misunderstood year. The Fed was going to have to become hawkish, according to its models, yet oil prices crashed and the dollar continued to rise. Both of those things were described as “transitory” by Janet Yellen, and that they were helpful or positive (rising dollar means cleanest dirty shirt!), but domestically American policymakers’ clear lack of conviction and courage about that rate hike regime showed otherwise....

Read More »The Annapolis Convention: The Beginning of the Counterrevolution

[Chapter 12 of Rothbard’s newly edited and released Conceived in Liberty, vol. 5, The New Republic: 1784–1791.] By 1787, the nationalist forces were in a far stronger position than during the Revolutionary War to make their dreams of central power come true. Now, in addition to the reactionary ideologues and financial oligarchs, public creditors, and disgruntled ex-army officers, other groups, some recruited by the depression of the mid-1780s, were ready to be...

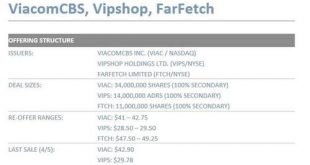

Read More »Credit Suisse Dumping Huge Archegos Blocks; Liquidating Millions In VIACS, VIPS And FTCH

Literally moments ago we said that the Archegos portoflio was being sold off all day on fears of “stealth” prime broker deleveraging, as tens of millions of shares were yet to be accounted for. Then, moments after 5pm, Credit Suisse – the firm that was hammered the hardest by the Archegos implosion and which had yet to provide a detailed breakdown of its Bill Hwang-linked P&L – confirmed what we said, when it unveiled a massive secondary offering dump, including...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org