Major representatives of the European Central Bank—including ECB president Christine Lagarde—continue to warn against bitcoin. In a recent article, addressed to the inflation-adverse German audience, the ECB representative Klaus Masuch together with the former ECB chief economist Otmar Issing has stressed five risks of bitcoin: a lack of intrinsic value, risks to financial market stability, the use in financing organized crime, high energy consumption, and the danger that taxpayers are held liable for financial risks. It is good that the ECB wants to protect us against possible risks, but a comparison between bitcoin and the euro in the five points mentioned should be allowed. First, the authors write that bitcoin has no intrinsic value, i.e., no direct use value

Topics:

Gunther Schnabl considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Major representatives of the European Central Bank—including ECB president Christine Lagarde—continue to warn against bitcoin. In a recent article, addressed to the inflation-adverse German audience, the ECB representative Klaus Masuch together with the former ECB chief economist Otmar Issing has stressed five risks of bitcoin: a lack of intrinsic value, risks to financial market stability, the use in financing organized crime, high energy consumption, and the danger that taxpayers are held liable for financial risks. It is good that the ECB wants to protect us against possible risks, but a comparison between bitcoin and the euro in the five points mentioned should be allowed.

First, the authors write that bitcoin has no intrinsic value, i.e., no direct use value as gold does, for example (see also Thiele 2017). This is true, but some value arises from the fact that bitcoin makes electronic transactions possible without a bank account (peer to peer). The euro also has no intrinsic value; at best it has value in the form of the burning value of the notes and the metal value of the coins. Euro credit money has been backed by the investment projects it has financed, but the persistently loose monetary policy of the ECB is increasingly zombifying euro area enterprises. More and more private deposits at the commercial banks are backed by the commercial banks’ deposits at the central bank instead of credit-financed investment. |

Thus, the trust in the two currencies depends on how credible they are, with this question being strongly linked to the restraints on the supply of the currencies. The number of bitcoins is credibly limited to a maximum of 21 million. Bitcoin miners have to do substantial work to create bitcoin (proof of work). The necessary efforts increase with the number of bitcoins created.

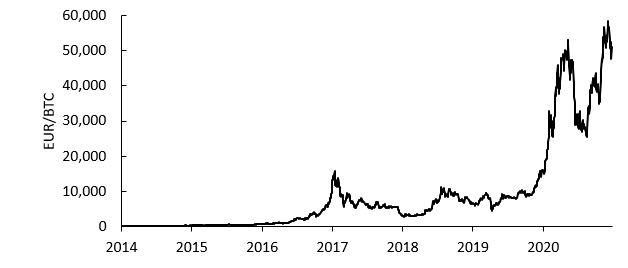

The supply of euros was intended to be limited by the ECB’s objective of price stability as outlined in article 127 of the Treaty on the Functioning of the European Union (TFEU) as well as by the prohibition of government financing by the central bank (article 123 of the TFEU). But these rules seem to be increasingly undermined, as the ECB’s balance sheet continues to grow at a high speed. Moreover, it is less and less clear whether the government bonds and loans on the asset side of the ECB’s balance sheet—which match commercial banks deposits and euro bills issued on the liability side of the ECB’s balance sheet—are at risk of default. Therefore, confidence in the euro is dwindling and confidence in bitcoin is growing, with bitcoin strongly appreciating against the euro (despite strong fluctuations; see chart above).

Second, Masuch and Issing express concern that bitcoin could suddenly lose all its value and thus destabilize the financial system. This risk is low because the supply of bitcoin is limited and a large share of bitcoin is held decentrally. At best, financial instability may emerge if bitcoins are an essential part of a financial product (but see below). Perhaps for this reason, the German legislature has limited investment in bitcoins to special funds and there to a maximum of 20 percent.

On the other hand, the ECB creates risks to financial market stability, because the ultra-loose monetary policy is depressing risk premiums. Speculation and high levels of debt are encouraged, which can lead to new debt and financial crises. In addition, the ECB’s low, zero, and negative interest rate policy is squeezing banks’ interest rate revenues, thereby destabilizing many banks in the euro area. The risks for banks could grow further if the ECB itself issues a digital central bank currency and savers shift their deposits from the commercial banks to the central bank.

Third, the authors object that bitcoin can serve organized crime. Yet, money laundering and terrorist financing existed even before cryptocurrencies, which did not lead to criticism of or even bans on the dollar or the euro. Unlike transactions in fiat money, bitcoin transactions can be viewed on a public ledger (blockchain). Moreover, aren’t there currently concerns that parts of the EU reconstruction fund, which is indirectly backed by the ECB, could end up in the hands of the Italian mafia?

Fourth, there is criticism regarding bitcoin’s impact on the climate, as the energy consumption during production (mining) is high. However, bitcoin production is geographically independent. Bitcoins can be mined where electricity capacity is idle (and therefore cheap). Since electricity is difficult to store, bitcoin is a way to solve the problem of too much electricity (grid fluctuations).

Furthermore, it also takes energy and resources to create and distribute euros—whether in paper or electronic form. Unlike the decentralized bitcoin, the euro is maintained in a huge new fully air-conditioned skyscraper and nineteen national central banks with large numbers of highly paid staff. An extensive network of commercial banks distributes and stores euros in paper and electronic form. From this perspective, bitcoin seems very lean in terms of resource consumption.

Moreover, the ECB’s ultraloose monetary policy is unsustainable in its effect, as persistently low interest rates are boosting debt and consumption (Schnabl and Sepp 2020). The loss of confidence in the euro has triggered a flight into real assets, resulting in construction booms. Between 2003 and 2007, low ECB interest rates contributed to real estate bubbles in Spain and other southern euro area countries, which left many construction ruins in their wake. Since then, low interest rates have boosted construction activities in most euro area countries. From the perspective of Hayek’s overinvestment theory, the ECB’s persistently loose monetary policy is causing an unprecedented misallocation (and thereby waste) of resources (Schnabl 2019). As bitcoin is scarce, it helps to avoid such overinvestment booms.

Finally, concerns are expressed that a financial crisis triggered by a sharp drop in the value of bitcoin could force policymakers to offset losses in order to prevent a systemic crisis in the financial system. The warning against a suspension of the liability principle is justified. Everyone should invest and speculate at their own risk.

In line with the liability principle, the bitcoin network creates default risks on an individual level due to its decentralized nature. From this point of view, there is no systemic crisis. In contrast, in the financial system of the euro area, the liability principle was suspended with the bailout of banks and highly indebted euro states in the course of the European financial and debt crisis back in 2008–12. Since Mario Draghi’s “whatever it takes,” the ECB has been keeping a growing number of highly indebted euro states fiscally stable with the help of extensive government bond purchases. Individual risks are thus socialized, thereby paralyzing growth.

The upshot is that the persistently loose monetary policy of the ECB and other central banks has led to a loss of confidence in the euro. This loss is not only reflected in rising bitcoin prices as well as in hiking stock prices, real estate prices, gold prices, etc. The ECB’s ongoing low, zero, and negative interest rate policy is leading to an immense misallocation and waste of resources, which is likely to dwarf the energy consumed by bitcoin mining by far. If bitcoin—via currency competition with the euro—helps to discipline the ECB’s monetary policy, then it makes an important contribution to both financial market stability and sustainability in the European Union.

Tags: Featured,newsletter