Black entrepreneurship in the United States has a remarkable history. Even during the inhospitable climate of Southern slavery, both enslaved and free blacks managed to establish lucrative ventures. Research on black entrepreneurship has revealed that in the Antebellum South black entrepreneurs’ pursuits spanned the entire gamut of industry, ranging from merchandising to transportation. Indeed, the success of some black entrepreneurs was so astounding that the demand...

Read More »Here We Go Again: The Fed Is Causing Another Recession

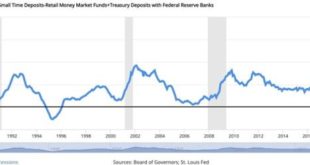

Cause of the Boom-Bust Business Cycle The primary cause of the recurring “boom and bust” business cycle is central banks like the Federal Reserve creating money out of thin air. This was first explained by Austrian economist Ludwig von Mises over a century ago. His student F.A. Hayek won the 1974 Nobel Prize in economics for his work on this theory, which is now known as Austrian business cycle theory. The basic outline of Austrian business cycle theory is as...

Read More »The Dollar Remains Bid, while Sterling Shrugs Off Johnson’s Political Woes

Overview: The dollar jumped yesterday making new highs against most of the major currencies, including the euro, sterling, the dollar-bloc and the Scandis. The yen and Swiss franc held in better, but the greenback still closed firmly against the yen despite a six-basis point decline in the 10-year yield. The Swiss franc rose to its highest level against the euro since the lifting of the cap in early 2015. After opening sharply lower, the S&P 500 and NASDAQ...

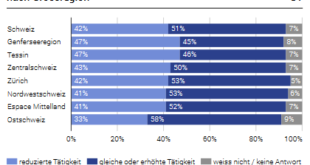

Read More »Medical practices played an active part in the vaccination campaign in 2021

05.07.2022 – In 2021, for the second consecutive year, the activity of medical practices was affected by the COVID-19 pandemic. Despite an improved situation compared with 2020, two out of five medical practices experienced reduced activity and one in five had to resort to short-time work. Three out of five primary care practices participated in the vaccination campaign that began at the end of 2020. These are some of the results from the latest survey of structural...

Read More »Private property rights under siege – Part II

Part II of II, by Claudio Grass, Hünenberg, Switzerland An astonishing acceleration Even though the downhill trajectory we saw over the last decades in terms of property rights was bad enough, nothing could have ever prepared us for what the covid crisis would bring. Even those of us who have read enough history to know that there’s really no line that the State will not cross in its fervent pursuit of absolute power were sincerely surprised; how could it be that...

Read More »Almost every sixth person lived in a household with arrears in 2020

04.07.2022 – Vehicle leases and arrears are the most common types of debt in Switzerland. In 2020, 15.5% of the population lived in a household with at least one vehicle lease and 14.9% in a household with at least one arrear in the past 12 months. 6.9% lived in a household with at least three different types of debt. These are some of the findings from the Survey on Income and Living Conditions (SILC) conducted by the Federal Statistical Office (FSO). The results...

Read More »Krugman Is Wrong (Again): Artificially Low Interest Rates Created Bubbles

In his June 21 New York Times article “Is the Era of Cheap Money Over?,” Paul Krugman argues against the view that the Fed has kept interest rates artificially low for the past ten to twenty years. Other commentators have argued that these low interest rates have inflated bubbles everywhere as investors desperately look for something that will yield a decent rate of return. Krugman expresses strong disagreement that the decline in interest rates caused bubbles and...

Read More »Über das Bestreben, Bargeld abzuschaffen und digitales Zentralbankgeld einzuführen

[Der folgende Beitrag wurde Mitte Mai 2022 als Vortrag auf der Gottfried Haberler Konferenz in Liechtenstein gehalten.] Gleich zu Beginn möchte ich Ihnen die Schlussfolgerungen meiner Überlegungen mitteilen: Das Bargeld zurückzudrängen oder aus dem Verkehr zu ziehen und digitales Zentralbankgeld auszugeben, sind äußerst problematisch, weil (1.) die Missbrauchsmöglichkeiten und Fehlentwicklungen des staatlichen Fiat-Geldmonopols gewaltig erhöht werden, ohne dass...

Read More »The One Solution to All Our Problems

Pick one, America: national security of the essential material foundation of everything, the industrial base, or “global markets,” maximizing greed / corporate profits. Sorry about the clickbait title. We all know there isn’t “one solution” to anything as complex as a socio-economic-cultural-political system. But this is based on looking at all the problems from one very shaky perspective: that the foundations of any solutions are rock-solid and all we need to do is...

Read More »Swiss debt enforcement offices aiding money laundering

In Switzerland, it is possible to pay delinquent debts with large sums of cash. Some criminals are using the loophole to launder money, reports Le Matin. Photo by MART PRODUCTION on Pexels.com Swiss broadcaster SRF investigated several official debt enforcement offices across Switzerland and found that large sums of cash were passing through some of them. In Geneva, CHF 24 million of cash passed through its cantonal offices des poursuites in 2021, some of it dirty,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org