The US dollar rally is of historic proportions. Its climb is relentless, though there was around a 4-7% pullback for a few weeks beginning in mid-July. Since then, the greenback has made up for lost time and appreciated to multiyear highs against most of the major currencies. The first real bout of profit-taking in nearly a month seen in recent days looks corrective in nature. The different performances cannot be entirely traced to monetary policy differences,...

Read More »Dogecoin nicht mehr in Top 10 des Marktes

Diese Woche fiel DOGE aus den Top 10. Zwar konnte der Cryptocoin im Wochenvergleich sogar leicht zulegen, aber da andere Cryptocoins ihn outperformten, liegt Dogecoin nun nur noch auf Platz 11 nach Marktkapitalisierung. Crypto News: Dogecoin nicht mehr in Top 10 des MarktesInzwischen ist der Hype abgeflaut. Nachdem unter anderem Elon Musk versuchte, den Hunde-Coin bis auf einen Dollar zu pushen, ist es mittlerweile ruhiger um DOGE geworden. Im Jahresvergleich verlor...

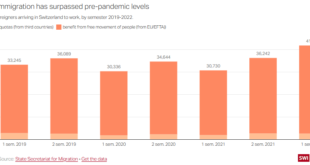

Read More »Migrant workers head back to Switzerland as Covid-19 restrictions end

Switzerland has returned as a popular destination for foreigners looking for work after two years of Covid-19 restrictions. Over 75,000 people have immigrated to Switzerland so far in 2022, driven largely by an economic boom and unemployment levels falling to a 20-year low. Alexander Thoele began working for SWI swissinfo.ch in 2002. He is of German and Brazilian origin. He was born in Rio de Janeiro and completed studies in journalism and computer science in...

Read More »We Didn’t Print Money… Honest We Didn’t And More Baseless ClapTrap from Central Banks

One of the reasons people choose to invest in gold bullion or to buy silver coins is because they are simple and they are finite; basically the opposite of fiat currency. The complexity of fiat-driven markets and infinite possibilities to create money works to the advantage of central banks. . And they particularly like to take advantage when asked by the general public a very obvious question… Central banks are on the defensive over printing too much money during...

Read More »By Compensating Slave Owners, Great Britain Negotiated a Peaceful End to Slavery

The 2018 announcement that the British government completed the payment of a loan that was borrowed to compensate slave owners for the abolition of slavery continues to evoke a flurry of emotions. Many find it outrageous that the British government would contemplate compensating planters rather than the enslaved. Such responses are expected because people are using current moral standards to judge historical realities. But an appreciation of the sociopolitical events...

Read More »BOC’s Rogers: We are not where we were in July, but a long way from where we need to be

Bank of Canada’s Senior Deputy Gov. Carolyn Rogers: We are not where we were in July, but we are a long way from where we need to be Bank has seen early signs monetary policy is working the bank still sees a path to a stop to soft landing, that’s still our objective neutral territory is a range, it’s an estimate, there is no magic formula There has been a lot of central banks speak from the Swiss National Bank to the Federal Reserve to the ECB, and now additional...

Read More »SNB-Chef Jordan begrüsst Zinsschritt der EZB

SNB-Präsident Thomas Jordan: Der Schritt der EZB war wichtig. (Bild: PD)Die Forward Guidance – die Leitlinien für die zukünftige Geldpolitik, auf welche die US-Notenbank und die Europäische Zentralbank achten, um die Finanzmärkte auf ihre Entscheide vorzubereiten und dem ihnen einen Schock zu ersparen – ist für die Schweizerische Nationalbank unbedeutend. Man sei sehr zurückhaltend mit Ankündigungen betreffend einem Zinsentscheid. Damit wäre die Diskussion an der...

Read More »Sharp Dollar Setback may offer Bulls a Bargain

Overview: The dollar is having one of the largest setbacks in recent weeks. We expected the dollar to soften ahead of next week’s CPI, which may fan ideas/hopes of a peak in US price pressures, but the magnitude and speed of the move is surprising, and likely speaks to the extreme positioning. Still, we caution that the intraday momentum indicators are stretched, and the underlying bullish sentiment, may see North American operators take advantage of the dollar’s...

Read More »Too soon to say inflation has peaked, says SNB boss

“You cannot say we have passed the zenith and now it is certainly heading lower,” Swiss National Bank President Thomas Jordan told a Finanz and Wirtschaft financial conference on Thursday. © Keystone / Anthony Anex The president of the Swiss National Bank (SNB), Thomas Jordan, says the inflation outlook is more uncertain than normal and it is premature to say prices have peaked. “You cannot say we have passed the zenith and now it is certainly heading lower,”...

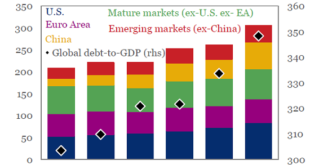

Read More »The EU’s Crisis Is Global

The EU’s crisis isn’t limited to energy. It is a manifestation of the global breakdown of Neocolonialism, Financialization and Globalization. The European Union (EU) was seen as the culmination of a centuries-long process of integration that would finally put an end to the ceaseless conflicts that had led to disastrous wars in the 20th century that had knocked Europe from global preeminence. Wary of the predations of the U.S. and rising Asian powers, European nations...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org