Overview: The yen and sterling are trading quietly after the recent drama, but with the Party Congress ending, the Chinese yuan has been permitted to fall faster. It approached the 2% band today and its loss of about 0.65% today makes it the weakest among the emerging market currencies. Most of the major currencies seem to be consolidating. Chinese stocks pared earlier losses as foreign buying via the Hong Kong link returned after large sales yesterday. Asia Pacific...

Read More »Wie Deutschland deindustrialisiert werden sollte. Der Morgenthau Plan und an was er heute erinnert

Die Konsequenzen der Energiewende und der Deindustrialisierung Deutschlands erinnern an den amerikanischen Morgenthau Plan von 1944. Dieser sah neben der territorialen Zerstücklung die Umwandlung Deutschlands in einen Agrarstaat vor. Zehn bis zwanzig Millionen Menschenopfer sollten in Kauf genommen werden. Erst 1947 wurde der Morgenthau-Plan offiziell fallen gelassen und 1948 durch die Marshallplanhilfe ersetzt. Worin bestanden die Zielsetzungen des...

Read More »Powell’s Epiphany: There is No Free Lunch p2 Neutralizing the Money is Inflationary

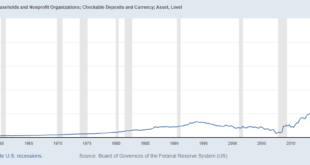

Pandemic Wealth Effect The top 1% of the US made about $14T or $4.2M per person. The next 19% made about $20T or $318,000 per person. The next 30% made about $5T or $50,000 per person. The bottom 50% made about $1T or $6,000 per person. The resulting inflation is at a 40yr high and Powell wants the money back. Let’s recap what happened in the last 2 to 3 years. In addition to the Fed providing liquidity during the pandemic, there was a coordinated effort between...

Read More »Public transport will not cost more in 2023

Buying a train ticket with a bicycle will become easier; getting the bike onto the train won’t Keystone / Gaetan Bally Ticket prices for Swiss public transport will remain stable for 2023 for the seventh consecutive year. Only “a few tourist businesses” are planning to adjust their fares for next year, says the SwissPass Alliance. In addition, from December 11, when the new Swiss Federal Railways timetable comes into effect, there will be a customer group specific to...

Read More »Can We Have Scarcity but Reject the “Scarcity Mindset?” in a Word, No

Since I am an economist and my school year is not too far along, my classroom discussion of how all of economics traces back to the fact of scarcity (the combination of limited resources, which implies a limited ability to produce, along with wants that always exceed the amount that can be produced) facing everyone was quite recent. That was why Brad Polumbo’s recent article, “What AOC and Nina Turner Get Wrong about the ‘Scarcity Mindset,’” so quickly drew my...

Read More »SPECIAL REPORT: Follow The Money Series – Dawn Of A New Era

With inflation recently hitting a high not seen since 1981, it is now apparent that the factors that drove the disinflation trend of the last four decades are coming to an end. Globalization and demographics, the two big factors that combined to hold down prices and wages for so long, are reversing, and so too is the downtrend in prices, wages, and interest rates. While 1970s levels of inflation seem unlikely, several trends are converging to keep upward pressure on...

Read More »Weekly Market Pulse: Did Powell Just Blink?

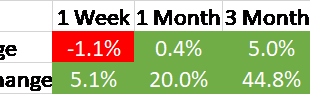

Did Jerome Powell blink last Friday? It was just before the market open Friday and interest rates were jumping higher, as they had all week. The 10-year Treasury yield was up to 4.33%, another 11 basis points higher than the previous close and 32 basis points higher than the previous week’s close. Then, “the article” hit the front page of the WSJ: Fed Set to Raise Rates by 0.75 Point and Debate Size of Future Hikes By Nick Timiraos The article led with this quote:...

Read More »BOJ Injects More Volatility, while UK’s Tory Party Leadership Contest may be Over Today

Overview: Japanese efforts to curb the weakness of the yen provided drama today. What many suspect was intervention before the weekend was wearing off and officials may have sold dollars again today in front of JPY150. Despite initial success, the dollar is back near JPY149.50 as the North American session is about to begin. The end of the Chinese Congress has seen the yuan weaken to new lows. While the large bourses in the Asia Pacific region rose, China and Hong...

Read More »Energy crisis ‘will last many years’, says economics minister

Parmelin said that before the end of March next year the risk of a shortage was very small © Keystone / Jean-christophe Bott Swiss Economics Minister Guy Parmelin assumes the energy crisis will last several years. It is important, he says, not only to think about the winter, but to do everything to ensure that Switzerland produces more energy – that means more renewable energies and greater efficiency. In 2023 and 2024 Switzerland will still be dependent on oil...

Read More »Wealth Managers Reluctant to Invest in Crypto

Wealth managers around the world are still reluctant to invest in cryptocurrency on behalf of their clients amid concerns over the lack of regulation, the lack of education as well as high volatility, a new study by American asset management company Mercer found. The survey, which polled 125 wealth managers worldwide, found that just 8% of participants indicated having invested in crypto for their customers. Wealth managers in Europe were found to be the most open to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org