There is an element of inevitability in play, but it isn’t about central bank bailouts, it’s about Death Spirals and the collapse of unsustainable systems. The vapid discussions about “soft” or “hard” landings for the economy are akin to asking if the Titanic’sencounter with the iceberg was “soft” or “hard:” either way, the ship was doomed, just as the global economy is doomed by The New Normal of Death Spirals and Speculative Frenzies. Death Spirals are the...

Read More »Three Reasons Why Secession and Decentralization Are Better for Human Rights

[This article is the Introduction to Breaking Away: The Case of Secession, Radical Decentralization, and Smaller Polities.] The world is now, and has always been, politically decentralized. At no time in history has all of humankind been ruled by a single political regime. Although the Roman Empire claimed to be universal, the Romans never even conquered all of Europe, let alone the whole inhabited world. Roman power never extended to India, China, Sub-Saharan...

Read More »Shortage of workers cited as top obstacle to Swiss economy

© Keystone / Christian Beutler The president of the Swiss Employers’ Association wants to increase the potential workforce in Switzerland by 300,000 people. To achieve this, women, young people, the elderly and refugees must be integrated into the labour market or be given more work, said Valentin Vogt on Swiss public radio SRF on Saturday. “The lack of labour is the biggest obstacle to the growth of the Swiss economy,” he warned. According to him, if this...

Read More »Weekly Market Pulse: Look Up In The Sky! It’s A UFO! Or Not!

As I sit here writing this Sunday afternoon, the US has just shot down a third UFO in the last 3 days in addition to the Chinese “weather” balloon last week. I have no insight into what these things might be but I do wonder if we haven’t declared war on the National Weather Service. The federal government has become so sprawling that it could easily be the case that NORAD has no idea what the NWS has up in the air. And with all the UFO shooting going on, the NWS...

Read More »Where did it all go wrong for Credit Suisse?

Widespread analysis of what went wrong at Credit Suisse converges on a constant theme: an international bank that lost touch with its Swiss roots, led by people who put profits ahead of prudence. This has resulted in massive financial losses and a restructuring drive that will see 9,000 staff lose their jobs. Credit Suisse CEO Ulrich Körner is leading a major restructuring of the bank. © Keystone / Michael Buholzer What happened? Credit Suisse has lurched from...

Read More »Commodities trader Trafigura stung by ‘CHF500 million fraud’

[caption id="attachment_994215" align="alignleft" width="400"] The Swiss commodities trader is taking legal action. Keystone / Martial Trezzini[/caption] Swiss commodities trading company Trafigura says it has been defrauded to the tune of $577 million (CHF530 million) by fake nickel shipments. The firm has launched legal action against a Dubai-based metals trader and the group of companies he runs out of the Middle East emirate. “The fraud...

Read More »Why Mises’s Theory of Economic Calculation Still Is Relevant Today

Until the publication in 1920 of Ludwig von Mises’s work on the problem of economic calculation in socialism, there was no scientifically useful analysis of the economics of the socialist economy. With that work , and its development in the comprehensive treatise Die Gemeinwirtschaft (1922 and 1932, published in English in 1951 as Socialism: An Economic and Sociological Analysis), Mises demonstrated that because of the absence of private ownership of the means of...

Read More »Rekordzahlen ZKB: Das sagt die Kantonalbank zum CS-Effekt

Die Zürcher Kantonalbank profitierte von der Krise der CS und machte im vergangenen Jahr Rekordgewinne. Das sagt die ZKB-Führung dazu. Fassade der Filiale der Zürcher Kantonalbank bei der Hardbrücke im Industriequartier. Quelle: imago images / Andreas Haas Zwei Zahlen stechen beim Jahresabschluss der ZKB ins Auge: Zum einen knackt die grösste Kantonalbank der Schweiz zum ersten Mal in ihrer Geschichte die Marke von einer Milliarde Franken beim Gewinn. Der Überschuss...

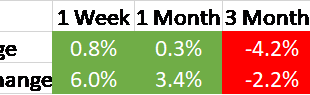

Read More »Week Ahead: US CPI to Begin Sharper Deacceleration through H1 23

After selling off sharply in the past four months, the dollar rebounded. Since the FOMC meeting on February 1, it has enjoyed one of the strongest bounces since it topped out in late September/early October. The incredible US jobs data, sharp bounce in the January services ISM, speculation of BOJ Governor Kuroda’s successor, and some easing of the euphoria over China’s re-opening have been notable drivers. The dramatic rise in the US two-year note illustrates the...

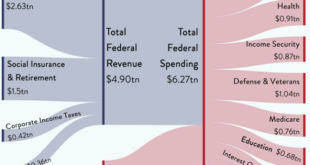

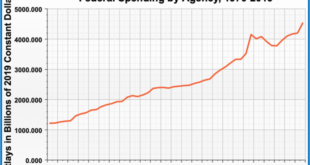

Read More »Federal Government Spending Is Out of Control and Unsustainable. Maine Shows a Way to Reduce Spending.

The Biden administration has increased federal government spending by a record $3.4 trillion since January 2021. That includes such signature bills as the American Rescue Plan Act of $1.8 trillion, the Inflation Reduction Act of $50.6 billion, and the Infrastructure Investment and Jobs Act of $764.9 billion. As well as providing official costings for those bills, the Congressional Budget Office has found that a number of executive orders contribute nearly another $1...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org