The Biden administration has increased federal government spending by a record .4 trillion since January 2021. That includes such signature bills as the American Rescue Plan Act of .8 trillion, the Inflation Reduction Act of .6 billion, and the Infrastructure Investment and Jobs Act of 4.9 billion. As well as providing official costings for those bills, the Congressional Budget Office has found that a number of executive orders contribute nearly another trillion of spending including college student debt cancellation, the end result being an additional .8 trillion to the net deficit. To make a bad situation worse, there has since been the Consolidated Appropriations Act omnibus of .7 trillion which includes, until September 2023, 2.5 billion in

Topics:

Darren Brady Nelson considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

The Biden administration has increased federal government spending by a record $3.4 trillion since January 2021. That includes such signature bills as the American Rescue Plan Act of $1.8 trillion, the Inflation Reduction Act of $50.6 billion, and the Infrastructure Investment and Jobs Act of $764.9 billion.

As well as providing official costings for those bills, the Congressional Budget Office has found that a number of executive orders contribute nearly another $1 trillion of spending including college student debt cancellation, the end result being an additional $4.8 trillion to the net deficit.

To make a bad situation worse, there has since been the Consolidated Appropriations Act omnibus of $1.7 trillion which includes, until September 2023, $772.5 billion in nondefense discretionary spending, plus $858 billion in defense nondiscretionary spending.

In December 2022, the America First Policy Institute provided the top ten reasons to reject this omnibus. Three key points were

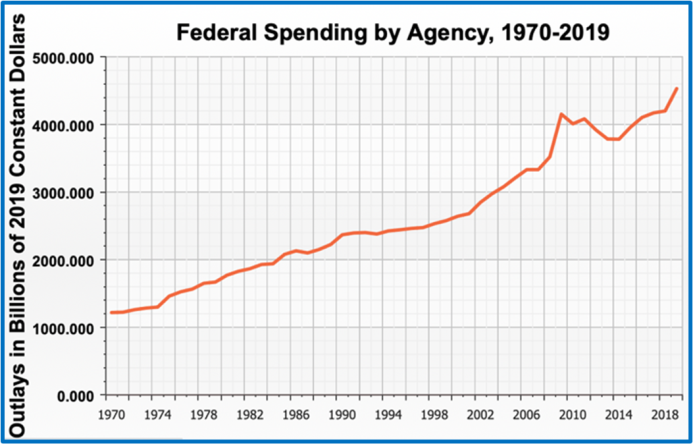

As the political Left has so often preached, especially in the 2020s, context matters. The minor context is that it personally took this author all 365 days of 2022 to read the New King James Bible cover to cover. The major context can be seen in the above chart (from Downsizing Government), which shows that since 1970, actual spending reductions, not just slower growth, are—to say the least—few and far between. |

Government Spending Harms . . . Again and Again

In his book Power and Market, economist Murray Rothbard wrote,

There are fundamentally two ways of satisfying a person’s wants: (1) by production and voluntary exchange with others on the market and (2) by violent expropriation of the wealth of others. The first method [is] termed “the economic means” for the satisfaction of wants; the second method, the “political means.”

The former means is driven by Say’s law which, in short, is the economic reality that markets “produce in order to consume.” In similar fashion, the latter means is driven by the political reality that governments “spend in order to control.”

Greater government spending by its very nature, scale, and scope reduces the private sector by diminishing

- wealth on both Main Street and Wall Street, respectively by extracting ever more goods and services and by crowding out debt and equity;

- liberty through greater regulation, taxation, and inflation, which grants monopoly and cartel power to big government and woke capitalists, respectively; and

- morality as businesses increasingly seek political privilege and consumers seek welfare from the state.

Don’t Look to Washington for Inspiration; Look to Maine . . . Yes, Maine

The Maine Policy Institute recently published the Maine Policy Budget, a landmark report for the lobster state largely modeled and written by this author. This blueprint did two main things (no pun intended) in terms of spending:

- Provided a budget methodology (based on regulatory economics and objective statistics) not just for slowing spending growth but for reducing actual spending over a reasonable period of four financial years

- Delivered an actual budget, based on official data and simple formulas, that will produce budget surpluses (taxes minus spending) over the course of over four financial years

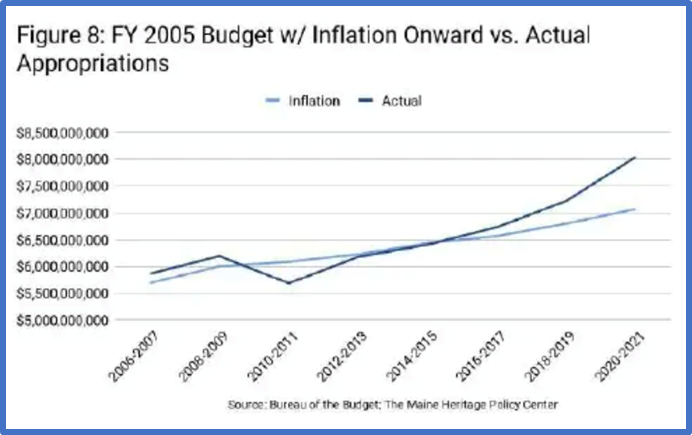

The 2019 Maine Policy Institute report entitled Cracking the Code provided the essence of the Maine state budget problem:

So-called natural monopolies, such as alleged public utilities, have been regulated in the United Kingdom since the 1980s and in Australia since the 1990s using a CPI-X approach. CPI is a measure of price inflation called the consumer price index. The X factor is derived from benchmarking efficiency. Sound economics and history clearly demonstrate that the only natural monopoly is government itself, especially government spending. CPI-X best applies to such spending, and in an innovative world-first, this was the main approach to reducing state spending in the Maine Policy Budget. |

CPI, along with gross domestic product and the unemployment rate, are the “big three” of economic statistics. However, surprisingly, there is no official CPI for Maine nor for any other American state.

The Bureau of Labor Statistics does provide CPI metrics for the Boston-Cambridge-Newton area, the New England states, the Northeast Region’s population centers of under 2.5 million, and the USA as a whole. The Bureau of Economic Analysis provides the CPI-related regional price parity and implicit regional price deflator.

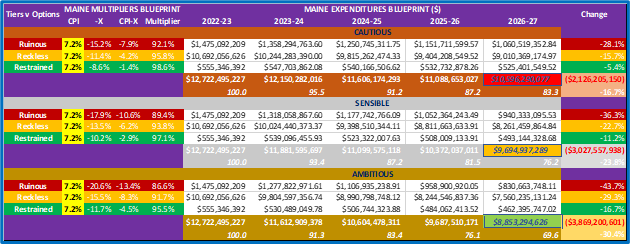

The 2016–17 to 2021–22 data for these six metrics were combined and tested in Microsoft Excel using objective statistical formulas for the maximum, average, and minimum. The result was an expected CPI of 7.2 percent. This number is also in line with inflationary expectations and modern monetary theory influences.

Internal X-factor benchmarking was based on Maine’s government agencies—thirty-three umbrellas and 351 units—which were categorized into nineteen departments, eight offices, and six independents. That is a lot of bureaucracy, given a 2020 state population of less than 1.4 million, which, by the way, only grew by 2.6 percent from 2010 to 2020. The statistical maximum, median, and minimum were modeled in terms of four-year money materiality, four-year index change (I = 100), and a one-year percentage change, resulting in three umbrella-agency tiers: ruinous, reckless, and restrained. For example, labor agencies are classified as ruinous, education agencies as reckless, and regulatory agencies as restrained.

For the four most recent historical financial years, external X-factor benchmarking was calculated in the same way as internal benchmarking, with the difference the nine Maine spending policies (for the thirty-three umbrellas) were mapped onto thirteen state spending policies from the US Census Bureau. The Census Bureau keep record of all fifty states’ spending policies, but only thirteen states were chosen, not including Maine itself. These were the New England six, the rural six, and the fiscal six (of two best, two mid, and two worst). Ruinous states included Pennsylvania, reckless ones Rhode Island, and restrained ones South Dakota.

| The combined internal and external benchmarks formed the basis for the potential X factors in CPI-X. Only the restrained agencies ones were used as actual X factors to calculate the three spending options of cautious, sensible, and ambitious. In a very similar way objective measures of maximum, minimum, average, and median, and the midpoint between the latter two were calculated. Standard deviation was also employed.

This led to a set of CPI-X multipliers—cautious, sensible, and ambitious—for each of the three spending tiers of agencies (ruinous, reckless, and restrained), which yielded three possible significant spending reductions for each type of agency: −16.7 percent, −23.8 percent, and −30.4 percent over a four-year period. |

If Maine Can Slash Spending, So Can Washington . . . and Sooner, Not Later

As they say, “Where there is a will there is way.” This year and next should show whether there is a will to cut federal spending, at least in the US House of Representatives. Nonetheless, the watershed Maine Policy Budget report has certainly provided a main way, or perhaps even the main way, to finally cut government spending.

Tags: Featured,newsletter