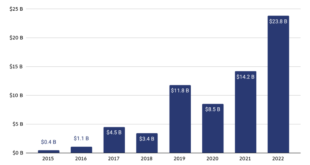

In 2022, cryptocurrency money laundering reached a new record, with illicit addresses sending US$23.8 billion worth of crypto, a figure which represents a 68% year-on-year (YoY) increase, new data from Chainalysis, an American blockchain analysis firm, show. Total cryptocurrency laundered by year, 2015-2022 Source: Chainalysis, Jan 2023 Just under half of the funds sent from these addresses traveled directly to centralized exchanges, making these services the biggest...

Read More »Markets Calm after Dramatic Swings on Powell’s Comments

Overview: The US dollar is mostly trading with a downside bias today against the G10 and most emerging market currencies. It had begun the week extending the gains spurred by the dramatic jump in nonfarm payrolls and the strong ISM services survey. Market expectations for the trajectory of Fed policy in the first part of this year converged with the Fed’s December dot plot. The market now leans toward two more quarter-point hikes this year. The bulk of the adjustment...

Read More »SWISS to resume regular passenger flights to China

SWISS will again operate regular flights to Shanghai from March 3 and boost services to Hong Kong. © Keystone/Christian Beutler Swiss International Air Lines (SWISS) says it will resume passenger flights to the Chinese city of Shanghai early next month following an easing of travel restrictions. In a first step, the national flag carrier will schedule one flight a week before increasing the frequency to three flights a week in April. SWISS stopped operating...

Read More »Another Recession Sign: Part-Time Work Is Growing Faster than Full-Time Work

The Bureau of Labor Statistic (BLS) released new jobs data on Friday. According to the report, seasonally adjusted total nonfarm jobs rose 517,000 jobs, which was well above expectations. The words used by the media to describe the report included “stunner” and “wow.” President Joe Biden claimed the number proves his administration has delivered economic prosperity. The administration has also noted that in the official numbers, the unemployment rate is at a...

Read More »Prepare to Be Bled Dry by a Decade of Stagflation

Our reliance on the endless expansion of credit, leverage and credit-asset bubbles will have its own high cost. The Great Moderation of low inflation and soaring assets has ended. Welcome to the death by a thousand cuts of stagflation. It was all so easy in the good old days of the past 25 years: just keep pushing interest rates lower to reduce the cost of borrowing and juice credit expansion ((financialization) and offshore industrial production to low-cost nations...

Read More »The Price-Gouging State

Friends and family are talking, on Facebook, about the rapid rise in the price of eggs. Their posts also report that there are plenty of eggs in the dairy sections of local grocery stores. A few people, along with some reporters, blame this rapid increase in the price of eggs on price-gouging corporations. State governments take price gouging seriously. Section 396-R of New York’s General Business law defines price gouging as “unconscionably excessive pricing of...

Read More »“Fundamentals and technical analysis are two sides of the same coin”

Interview with Laurent Halmos For most die-hard physical gold investors and students of history like myself and most of my readers and clients, technical analysis is often seen as a bit of a taboo, or at best something irrelevant to our worldview and investment approach. Nevertheless, to paraphrase the old saying about politics, just because you are not interested in the charts doesn’t mean that the charts are not interested in you. I met Laurent...

Read More »No Turn Around, but Consolidation Featured

Overview: After large moves yesterday, the capital markets ae quieter today. Stocks are mostly firmer, and the 10-year US yield is a little softer near 3.62%. Strong nominal wage increases in Japan and a hawkish hike by the Reserve Bank of Australia helped their respectively currencies recover, though remain within yesterday's ranges. The euro briefly traded below $1.07, and sterling has been sold through $1.20. That said, a consolidative tone is the main feature...

Read More »The most critical questions about the Swiss central bank’s huge losses

The Swiss National Bank (SNB) booked a CHF132 billion ($143 billion) loss in 2022 and suspended profit-sharing transfers to the Confederation and cantons. What does that mean exactly? And how does the SNB fare in international comparison? Last year, the SNB lost more money than ever before. And it is not alone: central banks around the world also recorded heavy losses. As a consequence, money from central banks in many countries ceased to flow to governments. Have...

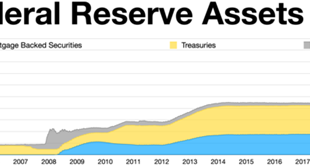

Read More »The Fed’s Portfolio Is Nonexistent: The Fed Does Not Invest. It Destroys Investments

Every so often, I check my investment portfolio to see how it is doing. (I stay out of stocks these days, but that is due to my personal situation and is not to be taken as investment advice.) Portfolios are collections of various financial instruments that one is holding, and one always hopes that their value will head in the right direction over time. When I purchase a financial instrument, I do so because I hope it will perform well in the future. I certainly do...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org