Swiss Franc EUR/CHF - Euro Swiss Franc, April 20(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge FX Rates With the exception of the yen, the US dollar is lower against all the major currencies. US Treasury yields are firm, extending yesterday’s rise a little. This may help keep the dollar straddling JPY109, but unwinding long yen cross positions is helping underpin the other major currencies. The Dollar Index is making a new low for the week and appears poised to test support around 98.85-99..00. The Indonesian rupiah is one of the few emerging market currencies under water today, following what appears to be an electoral defeat for an ally of President Widodo in the Jakarta gubernatorial race. Separately, the central bank kept rates unchanged at 4.75%. It is the fourth consecutive losing session for the rupiah. The news stream is actually light, suggesting the pressure on the dollar may be emanating from sentiment and positioning. There were three economic reports of note. The most important of which was the Japanese trade figures. FX Daily Rates, April 20 - Click to enlarge Separately, we note that the MOF weekly figures show Japanese investors continue to repatriate funds.

Topics:

Marc Chandler considers the following as important: AUD, CAD, EUR, EUR/CHF, Eurozone Consumer Confidence, Featured, FX Daily, FX Trends, Germany Producer Price Index, Japan Exports, Japan Imports, Japan Trade Balance, JPY, newsletter, NZD, U.S. Initial Jobless Claims, U.S. Philadelphia Fed Manufacturing Index, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss Franc |

EUR/CHF - Euro Swiss Franc, April 20(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge |

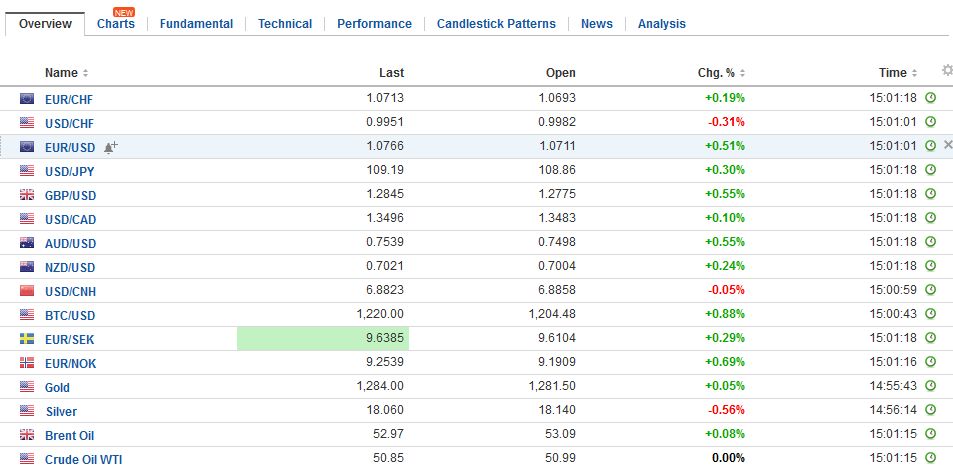

FX RatesWith the exception of the yen, the US dollar is lower against all the major currencies. US Treasury yields are firm, extending yesterday’s rise a little. This may help keep the dollar straddling JPY109, but unwinding long yen cross positions is helping underpin the other major currencies. The Dollar Index is making a new low for the week and appears poised to test support around 98.85-99..00. The Indonesian rupiah is one of the few emerging market currencies under water today, following what appears to be an electoral defeat for an ally of President Widodo in the Jakarta gubernatorial race. Separately, the central bank kept rates unchanged at 4.75%. It is the fourth consecutive losing session for the rupiah. The news stream is actually light, suggesting the pressure on the dollar may be emanating from sentiment and positioning. There were three economic reports of note. The most important of which was the Japanese trade figures. |

FX Daily Rates, April 20 |

| Separately, we note that the MOF weekly figures show Japanese investors continue to repatriate funds. Between foreign stock and bond sales, Japanese investors sold a JPY1 trillion of foreign assets last week. For their part, foreign investors bought about JPY726 bln yen of Japanese paper assets, about a 25% decline from the previous week. Evidence that yen strength reflects safe haven demand still seem elusive.

There are some sizeable yen options set to expire today. There are options worth $1.9 bln struck at JPY109 that roll off today, and another $315 mln at JPY108.95. Tomorrow, there the JPY109 strike seen another $1.9 bln roll-off. It looks like resistance near JPY109.20 will be sufficient to check dollar gains now. Support is pegged in the JPY108.40-JPY108.70. New Zealand reported somewhat higher than expected inflation. The central bank’s inflation target was reached for the first time in five years in Q1 17. The 1.0% quarter-over-quarter increase lifted the year-over-year pace to 2.2% from 1.3%. However, the overall underperformance of the dollar-bloc currencies continued. The New Zealand dollar stalled near yesterday’s highs (~$0.7050), but support near $0.7000 continues to hold. For its part, the Australian dollar is a doing a bit better as bid emerged again on the dip below $0.7500. However, to lift the tone it needs to get back above $0.7540. About A$222 mln in options expire today struck at $0.7500. The Canadian dollar is consolidating yesterday’s losses and is practically unchanged on the day. Resistance for the US dollar is seen in the CAD1.3500-CAD1.3535 area. The upper end of the range is the high for the year set on March 9. There are about $380 mln of options struck at CAD1.35 that will test nerves today. |

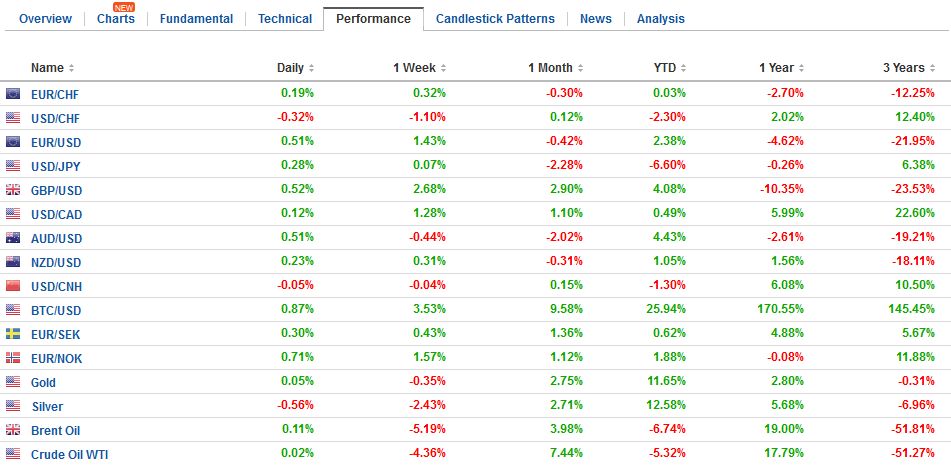

FX Performance, April 20 |

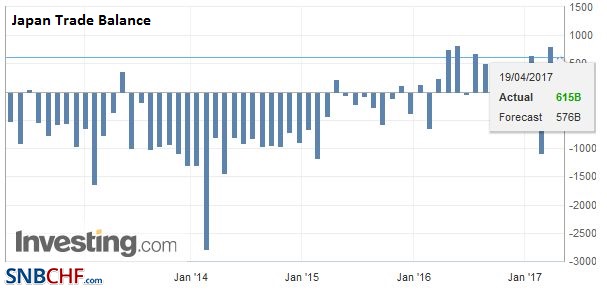

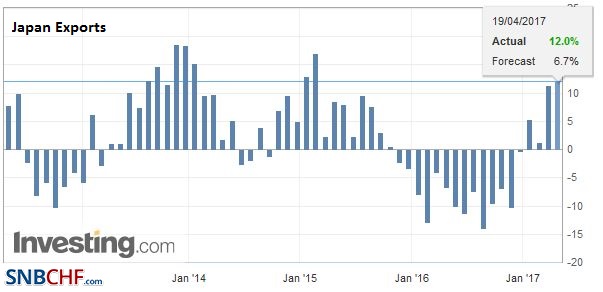

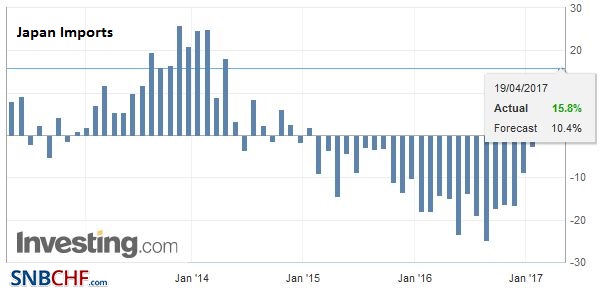

JapanJapan’s trade March trade surplus of JPY614.7 bln was larger than the Dow Jones survey of economists projected (JPU576 bln), but still off more than 17% from a year ago. Merchandise exports rose 12% year-over-year, nearly twice the median guesstimate. Exports to Asia were strong (16.3% year-over-year), reaching a record high, helped by Chinese demand for autos and auto parts. Imports rose 15.8%, well above February’s 1.2% gain and half again as much the as 10% anticipated. The value of Japanese exports rose to the highest level since September 2009. |

Japan Trade Balance, March 2017(see more posts on Japan Trade Balance, ) Source: Investing.com - Click to enlarge |

| Japan’s trade figures are under closer political scrutiny given the stance of the Trump Administration. Exports to the US rose 3.5%, the second consecutive increase, though auto exports were off 7.2% (in volume terms). |

Japan Exports YoY, March 2017(see more posts on Japan Exports, ) Source: Investing.com - Click to enlarge |

| Imports from the US rose 16.3% (in value terms). The US bilateral deficit with Japan narrowed 8.1% from a year ago. |

Japan Imports YoY, March 2017(see more posts on Japan Imports, ) Source: Investing.com - Click to enlarge |

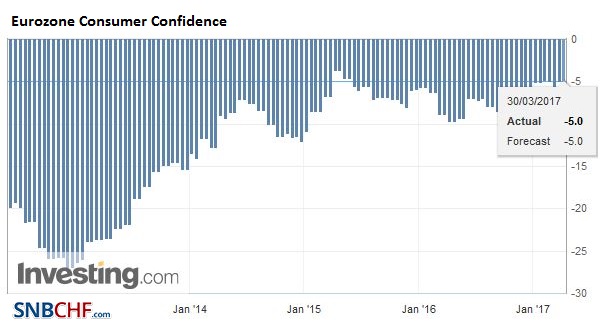

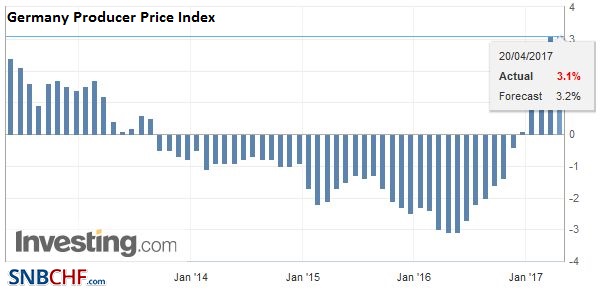

EurozoneThe eurozone reported a strong recovery in February construction output after January’s weather-induced weakness. The month-over-month output jumped 6.9% after a 2.4% slide in January, lifting the year-over-year pace to 7.1%. It was the strongest monthly gain in five years.

|

Eurozone Consumer Confidence, March 2017(see more posts on Eurozone Consumer Confidence, ) Source: Investing.com - Click to enlarge |

| We note that the French 10-year premium over Germany has narrowed a little today and now is the narrowest in a month. France raised 5.5 bln euros at today’s bond auctions, on the eve of the election. Demand for French paper was strong. The bid-cover, for example for the 50-year bond, was 1.99 up from 1.86 in the January sales. |

Germany Producer Price Index, March 2017(see more posts on Germany Producer Price Index, ) Source: Investing.com - Click to enlarge |

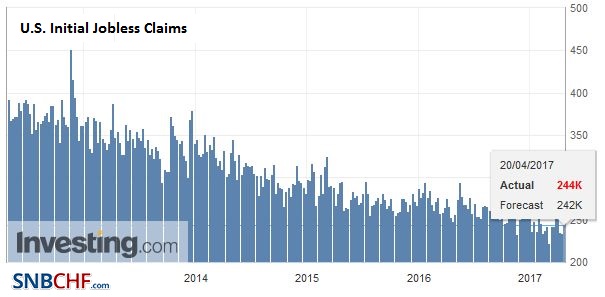

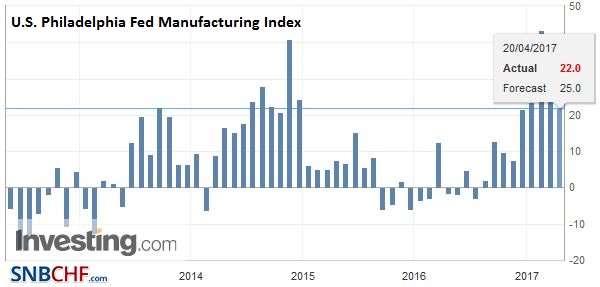

United StatesToday’s US session features initial jobless claims, which covers the week of the non-farm payroll survey, the April Philly Fed, and the leading economic indicators. What appears to be the near stagnation of the US economy in Q1 (Atlanta Fed GDPNow tracker is 0.5%, annualized) has given rise to new concerns about the health of the US economy. |

U.S. Initial Jobless Claims, March 2017(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

| We suspect the market is exaggerating the significance in terms of Fed policy for the June FOMC meeting. Financial conditions, as we have noted before, are easier now than when the Fed hiked in December 2016 and against last month. |

U.S. Philadelphia Fed Manufacturing Index, March 2017(see more posts on U.S. Philadelphia Fed Manufacturing Index, ) Source: Investing.com - Click to enlarge |

Demand for the euro against sterling and the yen appear to be helping the single currency against the greenback. The euro, which neared the GBP0.8300 in response to May’s election call, is testing the GBP0.8400 area now. It finished last week near GBP0.8480. The euro reversed higher against the yen on Monday and had been climbing since. Monday’s low was below JPY115, and now it is trading near JPY117.40. The JPY117.80-JPY1180.00 area may offer formidable resistance.

Against the dollar, the euro has approached $1.0780. Many are monitoring the trendline drawn off the high from last November and the late March high. It is found near $1.0835 today Support is pegged near $1.0700. Between $1.0750 and $1.0800, there are around 720 mln euros in options rolling off today. There are another 1.3 bln euro of options rolling off struck between $1.0715 and $1.0725. Tomorrow the $1.07 strike has 1.2 bln euros expiring.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$AUD,$CAD,$EUR,$JPY,EUR/CHF,Eurozone Consumer Confidence,Featured,FX Daily,Germany Producer Price Index,Japan Exports,Japan Imports,Japan Trade Balance,newsletter,NZD,U.S. Initial Jobless Claims,U.S. Philadelphia Fed Manufacturing Index