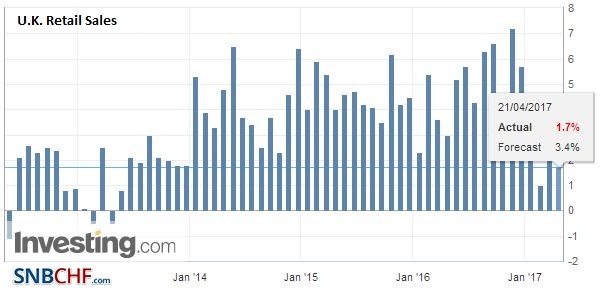

Swiss Franc EUR/CHF - Euro Swiss Franc, April 21(see more posts on EUR/CHF, ) - Click to enlarge FX Rates Neither the terrorist attack in Paris nor the strong eurozone flash PMI has managed to shake investors. Judging from the social media, many suspect that the terrorist attack plays into Le Pen’s hands, but investors do not seem particularly concerned. The French interest rate premium over Germany has narrowed, and gold is flat. UK retail sales fell sharply, yet sterling is holding on to the bulk of this week’s gains, which are the most here in 2017. The US 10-year yield is holding on to the lion’s share of its gains as well. It had bottomed on Tuesday near 2.16% and rose to 2.25% yesterday and is at 2.24% now. Treasury Secretary Mnuchin’s claim that tax reform will be passed by the end of the year seems to be more a statement of intent than a reliable forecast. As President Trump’s 100th day in office approaches, the legislative agenda still seems to be tied up between the different wings of the Republican Party. Indeed, the attempt by the Republicans to forge a majority instead of reach across the aisle to some Democrats is proving more difficult and frustrating than many anticipated. FX Daily Rates, April 21 - Click to enlarge Sterling was fairly resilient to the retail sales shock.

Topics:

Marc Chandler considers the following as important: China, EUR, Eurozone Current Account, Eurozone Manufacturing PMI, Eurozone Markit Composite PMI, Eurozone Services PMI, Featured, France, France Manufacturing PMI, France Services PMI, FX Trends, GBP, Germany Composite PMI, Germany Manufacturing PMI, Germany Services PMI, newsletter, South Korea, U.K. Retail Sales, U.S. Existing Home Sales, U.S. Manufacturing PMI, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss Franc |

EUR/CHF - Euro Swiss Franc, April 21(see more posts on EUR/CHF, ) |

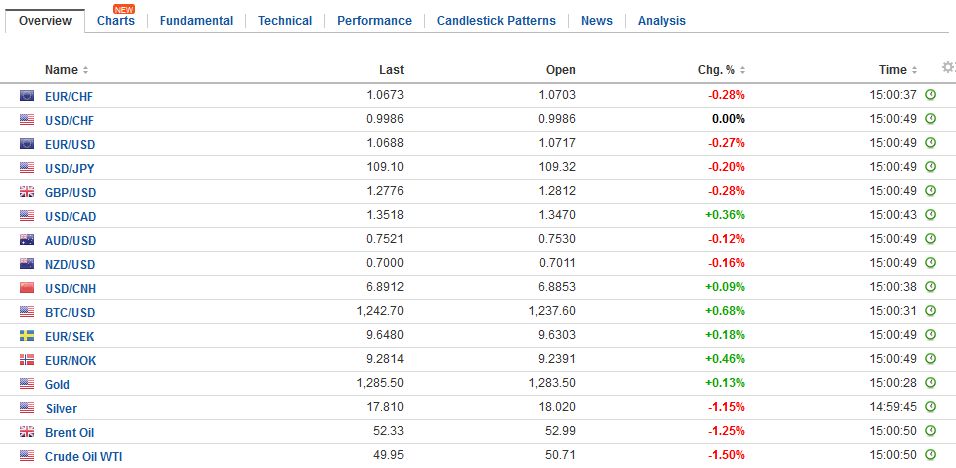

FX RatesNeither the terrorist attack in Paris nor the strong eurozone flash PMI has managed to shake investors. Judging from the social media, many suspect that the terrorist attack plays into Le Pen’s hands, but investors do not seem particularly concerned. The French interest rate premium over Germany has narrowed, and gold is flat. UK retail sales fell sharply, yet sterling is holding on to the bulk of this week’s gains, which are the most here in 2017. The US 10-year yield is holding on to the lion’s share of its gains as well. It had bottomed on Tuesday near 2.16% and rose to 2.25% yesterday and is at 2.24% now. Treasury Secretary Mnuchin’s claim that tax reform will be passed by the end of the year seems to be more a statement of intent than a reliable forecast. As President Trump’s 100th day in office approaches, the legislative agenda still seems to be tied up between the different wings of the Republican Party. Indeed, the attempt by the Republicans to forge a majority instead of reach across the aisle to some Democrats is proving more difficult and frustrating than many anticipated. |

FX Daily Rates, April 21 |

| Sterling was fairly resilient to the retail sales shock. It eased on the news but remains within yesterday’s ranges, which was within Wednesday’s range. After rallying strongly (we suspect mostly on short covering) in response to the surprise call for a snap election, sterling appears to be forming a continuation pattern (flag, pennant, or triangle). Initial support is seen near $1.2770. Many have their sights set on the $1.30 area.

Sterling’s gains are the FTSE 100’s losses. This index that tracks many UK multinationals has fallen over 3% this week, which is its worst performance since early last November. More broadly, the Dow Jones Stoxx 600 is off about 0.2% today, and unless there is a strong recovery in the next few hours, it will post its second consecutive losing week and its largest weekly loss since late January. Comments by the Fed Governor Powell were in line with most other Fed officials; recognizing that full employment is at hand. These comments, however, are noteworthy because they illustrate a point we have made about the Fed and the upcoming appointments by Trump. Powell is the lone Republican nominee among the Governors. His analysis does not differ much from the other governors. The point is that a new member will see the same set of facts. The Fed is close to its mandates. A gradual removal of accommodation is not an ideological position, but a technocrat judgment about the prudent course. |

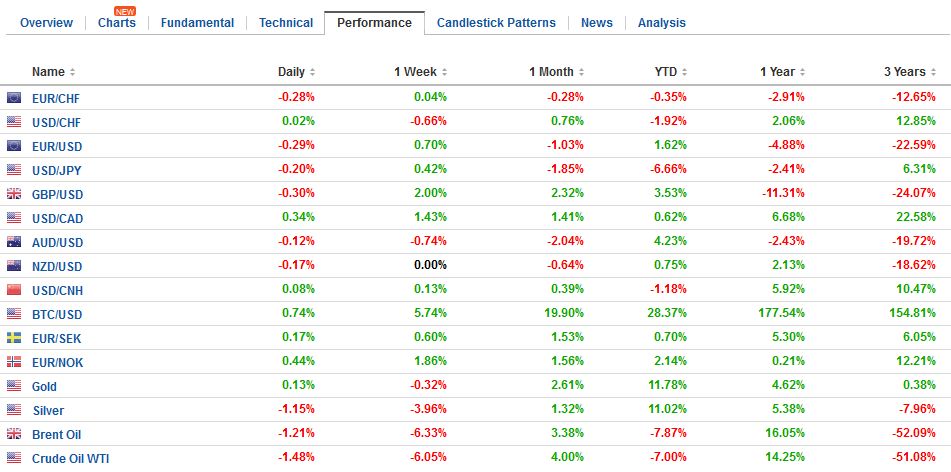

FX Performance, April 21 |

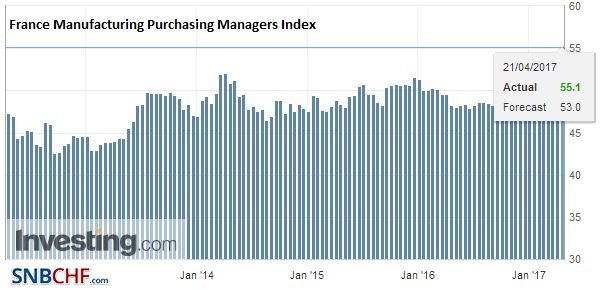

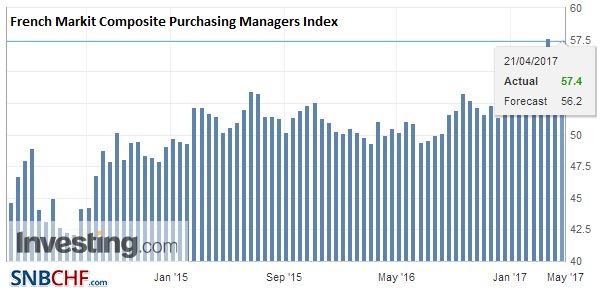

FranceAlthough it is too late to have much impact on the French election, the flash PMI reading for April was impressive as it pulls further ahead of Germany, if such comparisons are valid. French manufacturing rose to 55.1 from 53.3. |

France Manufacturing Purchasing Managers Index (PMI), April 2017(see more posts on France Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

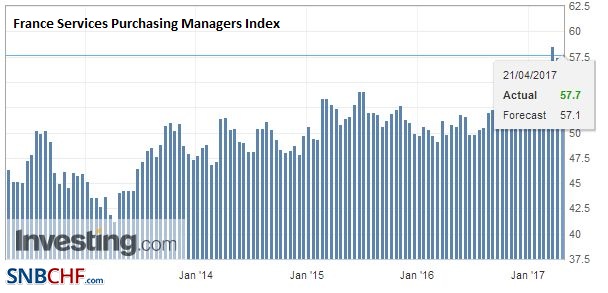

| The service reading rose to 57.7 from 57.3. |

France Services Purchasing Managers Index (PMI), April 2017(see more posts on France Services PMI, ) Source: Investing.com - Click to enlarge |

| This lead to the composite is rising to 57.4 from 56.8. All were above expectations. |

French Markit Composite Purchasing Managers Index (PMI), March 2017 Source: Investing.com - Click to enlarge |

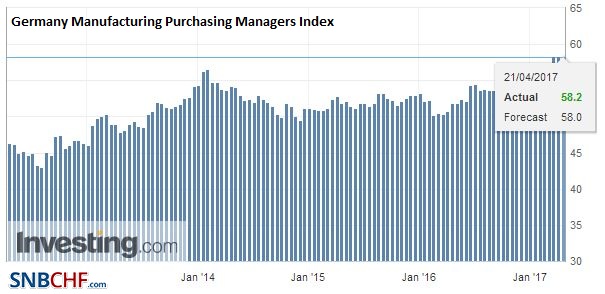

GermanyThe German manufacturing edged to 58.2 from 58.3. |

Germany Manufacturing Purchasing Managers Index (PMI), April 2017(see more posts on Germany Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

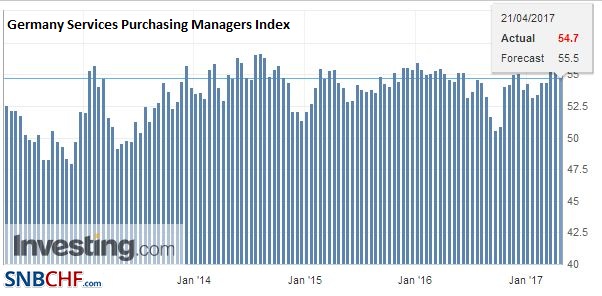

| Germany Service PMI fell to 54.7 from 55.6. |

Germany Services Purchasing Managers Index (PMI), April 2017(see more posts on Germany Services PMI, ) Source: Investing.com - Click to enlarge |

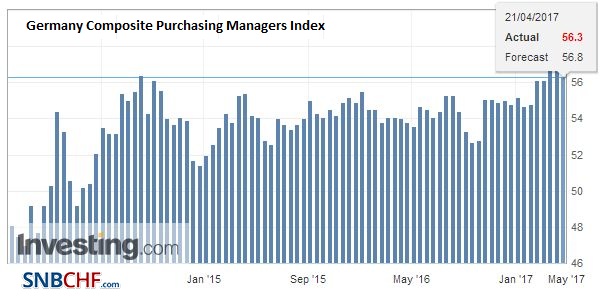

| The latter was weaker than expected. The composite stands at 56.3 from 57.1. |

Germany Composite Purchasing Managers Index (PMI), April 2017(see more posts on Germany Composite PMI, ) Source: Investing.com - Click to enlarge |

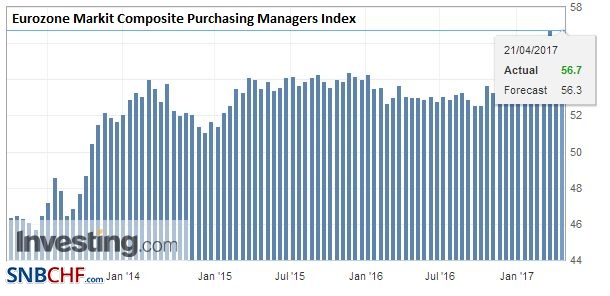

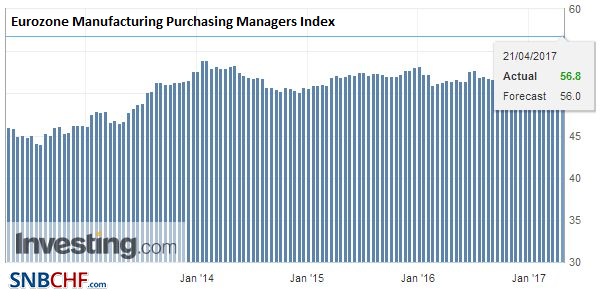

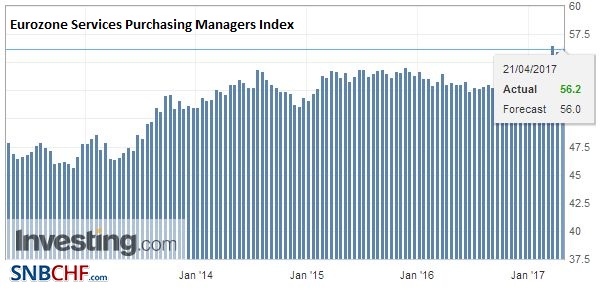

EurozoneThe flash EMU composite of 56.7 represents a new six-year high. The chief caveat is that survey data has been running ahead of real sector data. The US and UK report Q1 GDP next week, but Europe’s estimates are in the first week in May. Next week’s highlights will include the flash CPI readings, with a small uptick expected, and the ECB policy meeting. There is room to adjust the securities lending program to relieve strain in the repo market. |

Eurozone Markit Composite Purchasing Managers Index (PMI), April 2017(see more posts on Eurozone Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

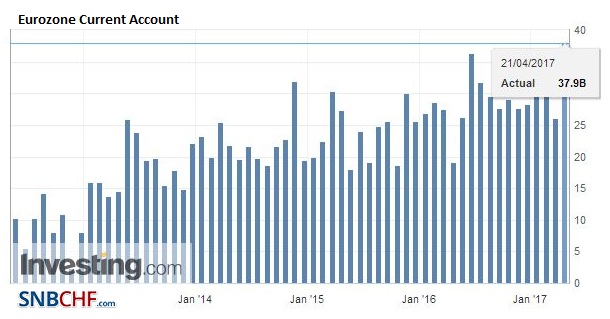

Eurozone Current Account, February 2017(see more posts on Eurozone Current Account, ) Source: Investing.com - Click to enlarge |

|

Eurozone Manufacturing Purchasing Managers Index (PMI), April 2017(see more posts on Eurozone Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

|

Eurozone Services Purchasing Managers Index (PMI), April 2017(see more posts on Eurozone Services PMI, ) Source: Investing.com - Click to enlarge |

|

United KingdomThe UK provided the biggest surprise of the day with a poor retail sales report. The BRC report had already warned that UK consumers pulled back, but the 1.5% decline in retail sales (excluding petrol) was three times more than expected. The small upward revision in the February series was not sufficient to ease the shock. Sales were off broadly, including clothing, footwear, household goods and food. The quarterly decline was the largest in seven years. The main culprit appears to be rising prices, but the March decline may have been aggravated by the Easter holiday, which was earlier this month rather than in March as in 2016. UK GDP expanded by 0.7% in Q4 16 and is expected to have slowed to 0.4% in Q1 17. The UK provided the biggest surprise of the day with a poor retail sales report. The BRC report had already warned that UK consumers pulled back, but the 1.5% decline in retail sales (excluding petrol) was three times more than expected. The small upward revision in the February series was not sufficient to ease the shock. Sales were off broadly, including clothing, footwear, household goods and food. The quarterly decline was the largest in seven years. The main culprit appears to be rising prices, but the March decline may have been aggravated by the Easter holiday, which was earlier this month rather than in March as in 2016. UK GDP expanded by 0.7% in Q4 16 and is expected to have slowed to 0.4% in Q1 17. |

U.K. Retail Sales YoY, March 2017(see more posts on U.K. Retail Sales, ) Source: Investing.com - Click to enlarge |

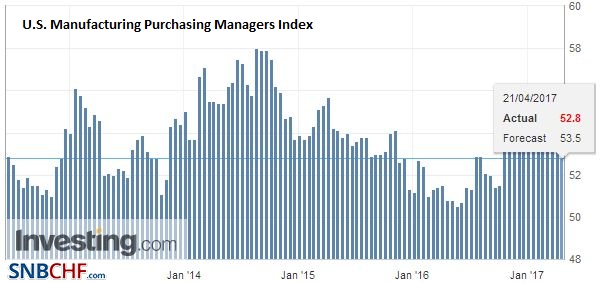

United StatesUS data today includes the Markit flash PMI and existing home sales. Barring a significant surprise, the former does not typically elicit much of a market reaction. |

U.S. Manufacturing Purchasing Managers Index (PMI), March 2017(see more posts on U.S. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

| Existing home sales are expected to rebound from the 3.7% decline posted in February. There may be some risk of a disappointment given the weather. Canada’s reports March CPI. Although the month-over-month rate may tick up, the year-over-year rate may ease to 1.8% from 2.0%. The new core rate is expected to be unchanged at 1.3%. DBRS, the last of the key credit raters (from the ECB’s point of view) to recognize Portugal as an investment credit is due to release its review today. With growth appearing more solid, it would be a surprise to investors if it cut the rating. |

U.S. Existing Home Sales, March 2017(see more posts on U.S. Existing Home Sales, ) Source: Investing.com - Click to enlarge |

The most market friendly French election result would likely be a Macron-Fillon run-off in the second round, assuming that it is unrealistic than any candidate garners more than 50% of the vote. Many suggest that the euro could rally on a Macron-Le Pen second round, given the tradition of forging a united front against the National Front. Yet this would seem to be the least surprising result. Nearly every poll suggests this is the most likely scenario. And as we have noted, investors are relative calm.

The relative calm in the face of geopolitical uncertainty is also evident in Korea. The strongest currency in Asia this week, gaining 0.5%. This snaps a two-week slide. Korean stocks gain 0.75% today, which is about half of the weekly advance. The Kospi and KOSDAQ are among the best-performing equity markets in Asia this week. The MSCI Asia Pacific Index is up 0.7% on the day, which is enough to push the index higher in the week to break the four-week down leg. Chinese shares posted their worst week of the year with the Shanghai Composite off 2.25%. Regulators have tightened up their enforcement and also seem to be attempting to curb leverage.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$EUR,China,Eurozone Current Account,Eurozone Manufacturing PMI,Eurozone Markit Composite PMI,Eurozone Services PMI,Featured,France,France Manufacturing PMI,France Services PMI,Germany Composite PMI,Germany Manufacturing PMI,Germany Services PMI,newsletter,South Korea,U.K. Retail Sales,U.S. Existing Home Sales,U.S. Manufacturing PMI