We think some of the ECB’s critics are missing the point. In particular, we expect TLTRO II to lower bank funding costs, mitigate the adverse consequences of low (negative) rates on bank margins, strengthen the ECB’s forward guidance and improve the transmission of monetary policy. We expect the take-up at all four TLTRO II operations to exceed EUR500bn, of which roughly EUR400bn should be rolled over from TLTRO I. The resulting reduction in terms of the cost of negative rates could be...

Read More »SNB Monetary Policy Assessment and Critique

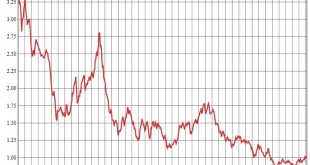

We examine the SNB monetary assessment statement of March 17 and the Swiss economy. We explain why negative rates may be a “toothless measure” if a central bank wants to weaken a currency. They have rather an inexpected consequence, they slow down GDP growth, in particular for banks and pension funds. The following are the extracts from the monetary policy assessment of Swiss National Bank, 17 March 2016, and my comments.All SNB statements appear in quotes, my comments without quotes....

Read More »The dark side of negative interest rates

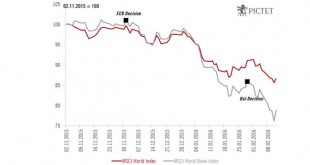

Recent equity market peaks coincided with the ECB and BoJ decisions to impose negative rates. From December 1st to last Friday, the MSCI World index declined by 14%. During the same period, the MSCI world banks index declined by 24%. Recent chronology of events Since 2009 and up until recently, central bank action has helped to stabilise equity markets. Looking at recent events, it now seems that the opposite is becoming true. The last two monetary decisions (ECB on 3 December 2015 and BoJ...

Read More »3.3. FAQ: The Why and What For of BOJ’s Negative Interest Rates

The Bank of Japan surprised investors last week by introducing negative interest rates. At the World Economic Forum in Davos a couple weeks ago, BOJ Governor Kuroda appeared to deny that such a move was under consideration. The market's focus, like ours, was on the pace by which it was expanding its balance sheet (JPY80 trillion a year). The FAQ format may be the most effective way to explain what the BOJ did, why and the implications for investors. What did the Bank of Japan do? ...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org