Every time we hear government officials announce their big spending plans, their new welfare programs and their ambitious “job creating” schemes, they always present them as being in defense of the poorest and the most marginalized members of our societies. In coordination with their central bankers, they print and spend new money at will, claiming that it is all for the benefit of the weakest among us and that all the freshly created funds will support them without further burdening...

Read More »Cantillon effect: Who’s paying the highest price?

Every time we hear government officials announce their big spending plans, their new welfare programs and their ambitious “job creating” schemes, they always present them as being in defense of the poorest and the most marginalized members of our societies. In coordination with their central bankers, they print and spend new money at will, claiming that it is all for the benefit of the weakest among us and that all the freshly created funds will support them...

Read More »The weaponization of Economics – Part II

Part II of II, by Claudio Grass Slippery slope However, interesting as those experiments and observations might be, they are still the result of specific parameters within a particular setting and an environment that doesn’t resemble real life. Serious and honest behavioral economists both understand and freely admit this. Just because there was one experiment in which 12 university students chose to receive 1 chocolate today rather than 2 tomorrow, one cannot extrapolate from...

Read More »50 years since the closure of the “gold window”

Part I of IV by Claudio Grass What happened and why This year marked the 50th anniversary of President Nixon’s decision to unilaterally close the “gold window”. The impact of this move can hardly be overstated. It triggered a tectonic shift of momentous consequences and it changed not just the global economy and the monetary realities, but it also shaped modern politics and severely affected our society at large. The Nixon Shock In July 1944, representatives from 44...

Read More »Gold Is Money – Everything Else Is Credit – J.P. Morgan – Part II

Money – sound and unsound - Click to enlarge Interview with Rafi Farber: Part II of II Rafi Farber, pen name Austrolib, is the publisher of The End Game Investor, a daily market commentary written from an Austrian economics perspective focusing on precious metals, the Comex, and monetary analysis. His work is followed by leaders in the precious metals industry including Eric Sprott. He also writes a weekly column on the gaming industry at CalvinAyre. Contact him...

Read More »Gold Is Money – Everything Else Is Credit – J.P. Morgan – Part II

Interview with Rafi Farber: Part II of II Rafi Farber, pen name Austrolib, is the publisher of The End Game Investor, a daily market commentary written from an Austrian economics perspective focusing on precious metals, the Comex, and monetary analysis. His work is followed by leaders in the precious metals industry including Eric Sprott. He also writes a weekly column on the gaming industry at CalvinAyre. Contact him at [email protected] Claudio Grass (CG):...

Read More »The Forgotten Greatness of Rothbard’s Preface to Theory and History

Anyone who advocates the ideas of the Austrian school of economics, whether broadly and publicly or even in the context of private discussions with friends and acquaintances, will almost immediately find themselves grappling with the tricky question of how to distill the core essence of what Austrian economics actually is, and how to convey those truly definitive characteristics as briefly and simply as possible. Given the nearly 150 years during which Austrian...

Read More »Why Good Economics Matters Now More Than Ever

In a newsletter published in 1970, economist Murray Rothbard wrote, “It is no crime to be ignorant of economics, which is, after all, a specialized discipline and one that most people consider to be a ‘dismal science.’ But it is totally irresponsible to have a loud and vociferous opinion on economic subjects while remaining in this state of ignorance.” This is an oft-quoted platitude within circles of libertarian...

Read More »Money Creation and the Boom-Bust Cycle

A Difference of Opinions In his various writings, Murray Rothbard argued that in a free market economy that operates on a gold standard, the creation of credit that is not fully backed up by gold (fractional-reserve banking) sets in motion the menace of the boom-bust cycle. In his The Case for 100 Percent Gold Dollar Rothbard wrote: I therefore advocate as the soundest monetary system and the only one fully compatible...

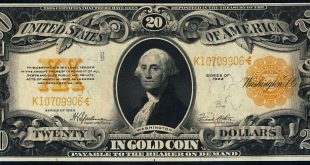

Read More »Why a “Dollar” Should Only Be a Name for a Unit of Gold

Once Upon a Time… Prior to 1933, the name “dollar” was used to refer to a unit of gold that had a weight of 23.22 grains. Since there are 480 grains in one ounce, this means that the name dollar also stood for 0.048 ounce of gold. This in turn, means that one ounce of gold referred to $20.67. Now, $20.67 is not the price of one ounce of gold in terms of dollars as popular thinking has it, for there is no such entity...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org