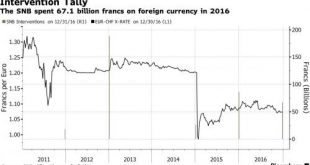

While Donald Trump has repeatedly expressed his displeasure with China for manipulating its currency, he appears to have recently figured out that over the past 2 years Beijing has been spending hundreds of billions in dollar to strengthen, not weaken, the Yuan and to halt the ~$1 trillion in capital flight from China. But while everyone knows that the biggest currency manipulation in the world, and perhaps the Milky...

Read More »The VIX Will Be Over 100 due to Central Bank Created Tail Risk

By EconMatters We discuss the manner in which Central Banks have destroyed financial markets, and have the stage for what I label as the Red Swan Event in this video. When the Swiss National Bank holds risky Tech stocks in its portfolio, we are in unchartered territory! We had the Financial Crisis of 2008, and instead of learning from the mistakes of incentivizing excessive risk taking, the Central Banks were allowed to...

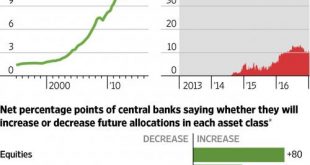

Read More »80 percent Of Central Banks Plan To Buy More Stocks

Regular readers remember how, when we first reported around the time of our launch eight years ago that central banks buy stocks, intervene and prop up markets, and generally manipulate equities in order to maintain confidence in a collapsing system, and avoid a liquidation panic and bank runs, it was branded “fake news” by the established financial “kommentariat.” What a difference eight years makes, because today none...

Read More »Risk Reward Analysis for Financial Markets

We focus this video regarding the potential upside for stocks versus the considerable downside risk for investors. All Technical Analysis is flawed and backward looking, it is a Critical Thinking flaw to extrapolate the future from the most recent past. I want to know the next market move, and not still be stuck on the most recent market move. And the most important fact of all is valuations, stocks are in a bubble...

Read More »Risk Reward Analysis for Financial Markets

By EconMatters We focus this video regarding the potential upside for stocks versus the considerable downside risk for investors. All Technical Analysis is flawed and backward looking, it is a Critical Thinking flaw to extrapolate the future from the most recent past. I want to know the next market move, and not still be stuck on the most recent market move. And the most important fact of all is valuations, stocks are in a bubble right now due to Central Banks extreme monetary...

Read More »As Central Bankers Spin

Posted with permission and written by Tim Taschler, Sprott Global I know that I resemble the old guy in this cartoon, standing by helplessly as I watch central bankers experiment with the global economy. Bubbles are blown, again, in several asset classes. Negative interest rates have become an acceptable concept, as if they are just words and have no real economic meaning. Stock markets trade based on the next set...

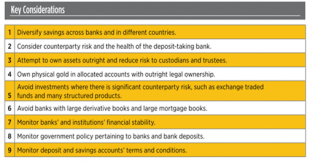

Read More »If You Can’t Touch It, You Don’t Own It

The pending Brexit has, not surprisingly, caused a shakeup in the investment world, particularly in the UK. Of particular note is that, recently, asset management firms in Britain began refusing their clients the right to cash out of their mutual funds. Of the 35 billion invested in such funds, just under £20 billion has been affected. For those readers who live in the UK, or are invested in UK mutual funds, this is...

Read More »Will Ireland Be First Country In World To See Bail-in Regime?

Deposit bail-in risks are slowly being realised in Ireland, after it emerged overnight that FBD, one of Ireland’s largest insurance companies, have been moving cash out of Irish bank deposits and into bonds. Revelations regarding deposit bail-in risks came in the wake of warnings of a new property crash centred on the housing market in Ireland. The former deputy governor of the Central Bank warned in an op-ed in a...

Read More »Will Ireland Be First Country In World To See Bail-in Regime?

Deposit bail-in risks are slowly being realised in Ireland, after it emerged overnight that FBD, one of Ireland's largest insurance companies, have been moving cash out of Irish bank deposits and into bonds. Revelations regarding deposit bail-in risks came in the wake of warnings of a new property crash centred on the housing market in Ireland. The former deputy governor of the Central Bank warned in an op-ed in a leading international financial publication, Project...

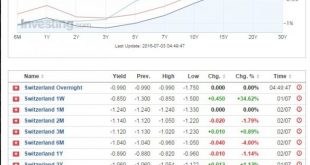

Read More »Swiss Bond Yields all Negative up to 30 years: Greatest Bubble in Financial History

Graham Summers says that central banks have lost control and investors are crazy. They pay the Swiss government for the right to own their bonds. One point is missing: Swiss rates are “more negative than others”, because investors expect a slow appreciation of the Swiss franc. Sometimes it’s critical to look clearly at the big picture. The big picture is that the financial world has allocated capital… trillions of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org