Italy’s structural weakness explain higher level of concern around its deficit target. Each EU member state is currently preparing 2019 budget plans for formal submission to the European Commission (EC) before mid- October. Among them, France and Italy’s budget plans have been raising eyebrows. Why is the EC concerned about Italy’s proposed 2.4% GDP deficit target for 2019 and not France’s target of 2.8%? Is Italy being treated unfairly by its European partners and by markets? Italy and France both have high public debts (133.4% of GDP and 97.7% of GDP, respectively, in Q1 2018) so some argue that the difference in public debt is “not so big”. But a deeper look is required to form a precise idea of the difference

Topics:

Nadia Gharbi considers the following as important: 2) Swiss and European Macro, Featured, France public deficit, Italian debt, Italy budget plan, Macroview, newsletter, Pictet Macro Analysis

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Italy’s structural weakness explain higher level of concern around its deficit target.

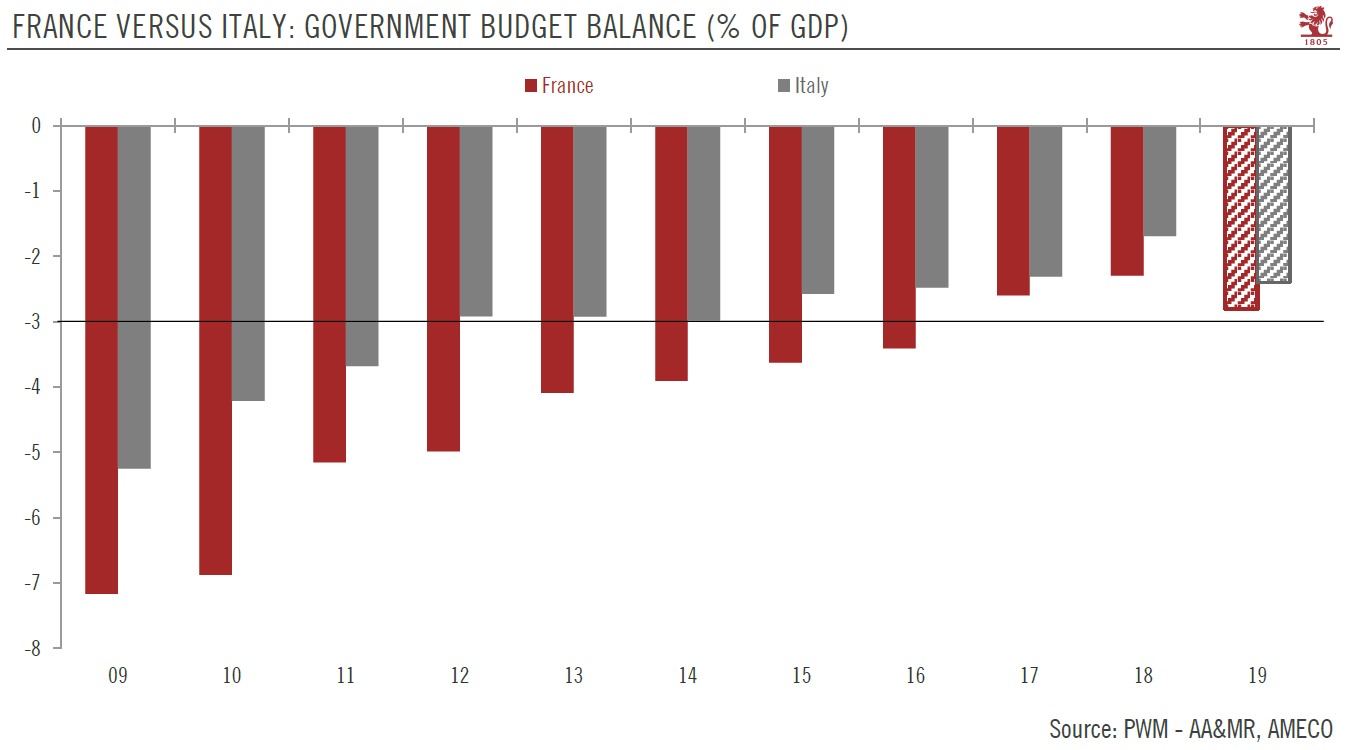

Each EU member state is currently preparing 2019 budget plans for formal submission to the European Commission (EC) before mid- October. Among them, France and Italy’s budget plans have been raising eyebrows. Why is the EC concerned about Italy’s proposed 2.4% GDP deficit target for 2019 and not France’s target of 2.8%? Is Italy being treated unfairly by its European partners and by markets? Italy and France both have high public debts (133.4% of GDP and 97.7% of GDP, respectively, in Q1 2018) so some argue that the difference in public debt is “not so big”.

But a deeper look is required to form a precise idea of the difference between the two countries.

| First of all, while France has committed to tighten its structural budget by o.3pp of GDP next year, Italy has plans to loosen its by 0.8pp. Second, while French growth slowed in the first half of this year, the latest indicators suggest that French economic activity is rebounding whereas they show Italian growth slowing. Third, structural factors in France (demographics, labour productivity) are relatively more favourable than in Italy, where weak potential growth is a real issue.

Politics makes the current situation highly complex. In a sense, choosing a fight with the EC is a “win-win” game for the Italian government coalition. Since the government’s formation this spring, its leaders have focused on boosting their standing with domestic voters. If the EC gives in to the government’s budget plans, Rome gets away with a significant fiscal stimulus, defying austerity. If, on the other hand, Brussels stands firm, the coalition leaders will likely exploit the situation by revving up rhetoric against the ‘Brussels elite’. Either way, the Italian government currently has no reason to soften its tone against the EC. At the end of the day, market pressure and the threat of rating downgrades may make the difference and convince the Italian government to adjust its budget plans. |

France Versus Italy: Government Budget Balance (% of GDP) 2009-2019 |

Tags: Featured,France public deficit,Italian debt,Italy budget plan,Macroview,newsletter