Rome’s budget plans put it on a collision course with the European Commission. The Italian government has submitted its 2019 draft budget plan (DBP) to the European Commission. The proposed DBP is not in line with European Union rules and sets the government on a collision course with the European authorities. Several elements within the Italian government’s budget plan have been raising eyebrows. First, the plans’ economic assumptions seem too optimistic to us, and there is a risk that the budget deviates from its owns deficit targets. Second, the budget’s composition appears insufficient to overcome Italy’s structural problems. Third, the budget plans put Italy’s government on a collision course with Europe,

Topics:

Nadia Gharbi considers the following as important: 2) Swiss and European Macro, Featured, Italian 2019 draft budget, Italy budget plan, Italy debt, Macroview, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Rome’s budget plans put it on a collision course with the European Commission.

The Italian government has submitted its 2019 draft budget plan (DBP) to the European Commission. The proposed DBP is not in line with European Union rules and sets the government on a collision course with the European authorities.

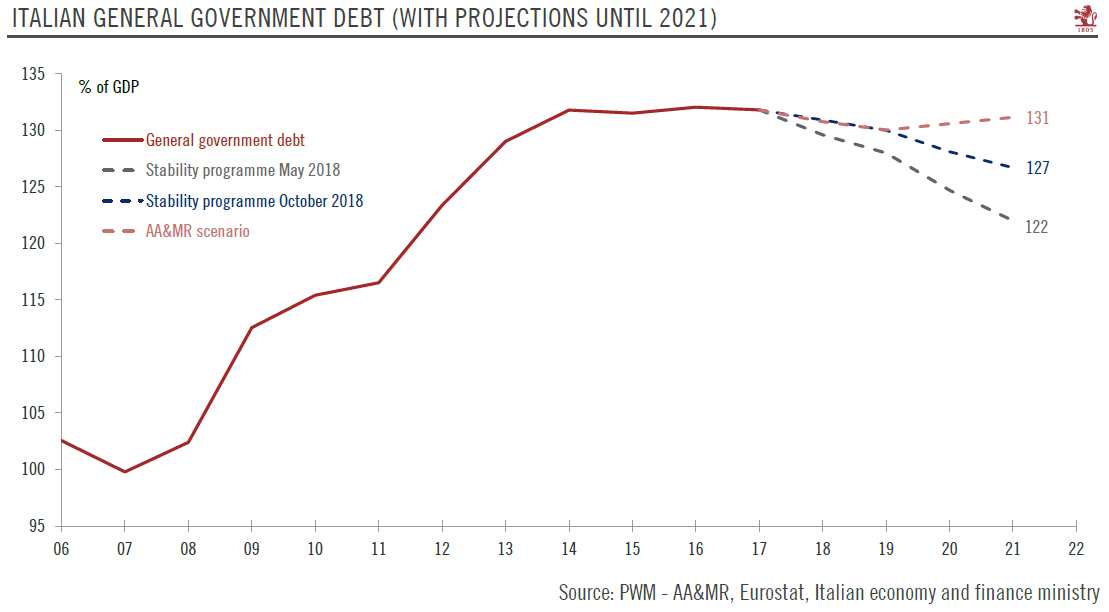

Several elements within the Italian government’s budget plan have been raising eyebrows. First, the plans’ economic assumptions seem too optimistic to us, and there is a risk that the budget deviates from its owns deficit targets. Second, the budget’s composition appears insufficient to overcome Italy’s structural problems. Third, the budget plans put Italy’s government on a collision course with Europe, setting the stage for further volatility. Finally, Italy’s systemic importance is a potential issue. Not only is it too big to fail, it is also too big to bail out.

| We have elaborated three possible scenarios describing the way forward for Italy’s government and the European Commission. The first, to which we assign a probability of 60%, is for tensions to persist beyond the approval of a budget by the Italian government at the end of the year. This would cause recurring volatility spikes with a deterioration of financial conditions. An alternative negative scenario, to which we assign a probability chance of 30%, sees an escalation in the fight between Brussels and Rome, leading to a greater tightening of financial conditions. Finally, an alternative positive scenario sees the Italian government revising its budget to bring it in line with EU rules. This scenario is the most unlikely, as both governing parties would lose a lot of popular support if they make concessions to the European Commission without a fight. We therefore assign a 10% probability to this scenario.

Taking account of the probability of the various scenarios we have elaborated for Italian budget negotiations, we believe the spread for 10-year government bonds (BTPs) over Bunds could be in the range of 270-320 bps at year’s end. |

Italy Update Chart, 2006 - 2022 |

Tags: Featured,Italian 2019 draft budget,Italy budget plan,Italy debt,Macroview,newsletter