Inflation is unlikely to be a constraint on central bank’s policy.The headline consumer price index (CPI) in China picked up slightly in September, rising by 2.5% year-over-year (y-o-y) compared with 2.3% in August, driven by higher food price and fuel prices. Excluding food and energy, core inflation in China actually eased to 1.7% y-o-y in September from 2.0% in August.Looking forward, we see some moderate upward pressure on Chinese headline inflation due to tariffs on US imports and surging crude oil prices. However, slower household income growth and moderating domestic demand will likely keep inflation below the government’s target of 3%. The price increase for services was 2.1% y-o-y in September, down from 2.6% in August. Housing rentals, which rose strongly in some first-tier

Topics:

Dong Chen considers the following as important: China inflation, China monetary policy, Macroview, People's Bank Of China

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Inflation is unlikely to be a constraint on central bank’s policy.

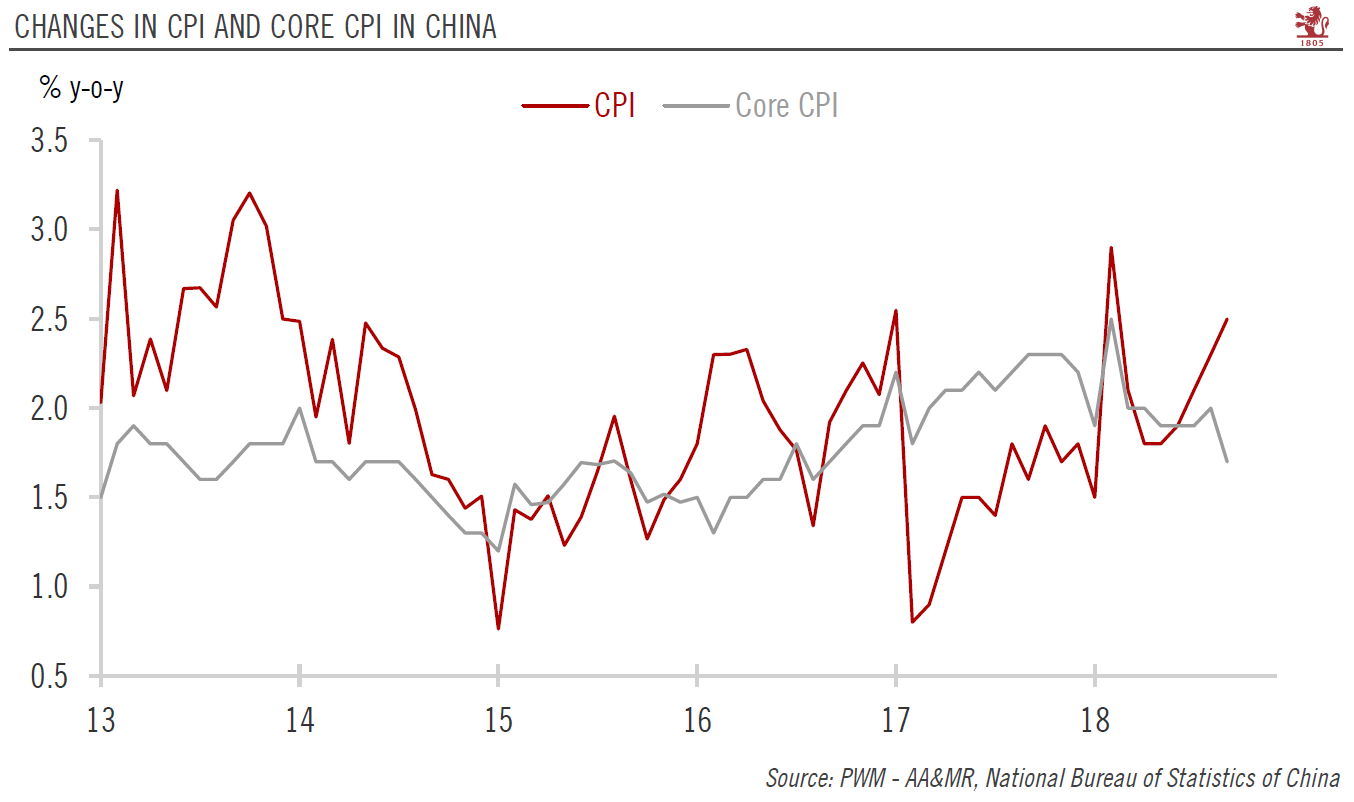

The headline consumer price index (CPI) in China picked up slightly in September, rising by 2.5% year-over-year (y-o-y) compared with 2.3% in August, driven by higher food price and fuel prices. Excluding food and energy, core inflation in China actually eased to 1.7% y-o-y in September from 2.0% in August.

Looking forward, we see some moderate upward pressure on Chinese headline inflation due to tariffs on US imports and surging crude oil prices. However, slower household income growth and moderating domestic demand will likely keep inflation below the government’s target of 3%. The price increase for services was 2.1% y-o-y in September, down from 2.6% in August. Housing rentals, which rose strongly in some first-tier cities in recent months, increased only moderately at a national level in September.

Income growth, oil prices and trade tensions with the US are factors which may drive future inflation. However, in the short term, the upward pressure from wage growth on inflation is likely to dissipate somewhat. The Chinese labour market has showed signs of slackening as of late, and wage growth has slowed according to the National Bureau of Statistics.

By contrast, elevated crude oil prices, a weakening renminbi and additional tariffs on US imports will likely continue to exert external pressure on inflation. For the moment, we are keeping our forecast of Chinese inflation unchanged at 2.2% for 2018 and 2.5% for 2019. Both forecasts are below the Chinese government’s target of 3%.

In our view, the overall inflation environment in China will likely remain benign. As a result, inflation is unlikely to be a constraint on the People’s Bank of China’s (PBoC) monetary policy stance in the short term.