(Disclosure: Some of the links below may be affiliate links) Do you feel overwhelmed with investing? And you do not know where to start with investing? Do you want a simple guide on how to get started with investing?Then, this guide is exactly what you need! It will guide you through the steps of starting to invest.I have written many articles about investing on this blog. But I have recently been reminded that I did not have an article on how to get started! I should have started with this...

Read More »All you need to know about The Third Pillar to retire in Switzerland

(Disclosure: Some of the links below may be affiliate links) In our Three Pillars of Retirement of Switzerland series, we already talked about the first and second pillar. We now have to cover the most important of the three pillars: The Third Pillar.The third pillar is the only one that is not mandatory. Everybody is free to choose to invest in the third pillar or not. It is simpler than the second pillar. But there are many more choices than you can make. You can optimize a lot of things...

Read More »All you need to know about The Second Pillar to retire in Switzerland

(Disclosure: Some of the links below may be affiliate links) We have studied the first pillar in the previous post in the series. Now, it is time to see the second pillar. The second pillar is an occupational pension for people working in Switzerland.The first pillar covers the basic needs of everybody. If you did not read the previous part, I would encourage you to do it before you read this article. The second pillar is here to cover a larger part of your salary than the first one. It is an...

Read More »All you need to know about The First Pillar to retire in Switzerland

(Disclosure: Some of the links below may be affiliate links) The retirement system of Switzerland is a system with three pillars. Each pillar is paid differently and will cover different needs. The first pillar is the state pension.If you are working in Switzerland, it is essential to know these three pillars. Even if you do not plan to retire in Switzerland, it is essential to understand how they work. It will help you plan your retirement.In this post, I am going to talk in detail about the...

Read More »The Little Glossary of Investing: Every term you need to know

(Disclosure: Some of the links below may be affiliate links) The world of investing is complex and extensive. There are tons of concepts such as stocks, bonds, leverage, bear markets, and such.Today, I want to provide you with a glossary of all these investing terms. This glossary has been requested several times by some of my readers. Hopefully, this will help you navigate the investing world easily.If you think I should include some other terms in the glossary, let me know in the comments...

Read More »Transferwise vs Revolut: Which Is Best For You?

(Disclosure: Some of the links below may be affiliate links) TransferWise and Revolut offer services that are quite similar. They are both offering cheap money transfers in many different currencies. How can you decide between both services?I have both cards. But, I am mostly using my Revolut card. So, many of my readers asked me why I was mainly using my Revolut card, where I could have only used my TransferWise card. Today, I am going to answer the question: Which is better between...

Read More »Revolut in Switzerland Top Up For Free with Revolut Swiss IBAN

(Disclosure: Some of the links below may be affiliate links) I think Swiss investors will agree that the biggest problem with Revolut was that they did not have a Swiss IBAN. Some good news just arrived for us!Revolut now includes a Swiss IBAN when you want to top it up! It means you can now top up your Revolut account for free directly from your bank account. It is great since that was missing from the start on the Revolut account.And probably even bigger news for Revolut: they got a...

Read More »My 11 Biggest Investing Mistakes – How to Avoid Them!

TwitterFacebookPinterestLinkedin(Disclosure: Some of the links below may be affiliate links) Everybody will make some mistakes in his life. There is no way around it. Over the years, I made many investing mistakes.One thing that is very important with mistakes is that you learn from them. Not only should you not repeat your mistakes. But you should also improve your knowledge after you have made this mistake. You need to understand why this was a mistake and how not to do it again.It is...

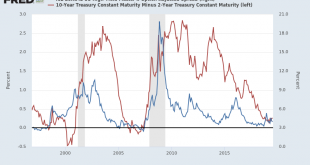

Read More »Monthly Macro Monitor: We’re Not There Yet

It’s been a slow turnin’ From the inside out A slow turnin’ But you come about Slow learnin’ But you learn to sway A slow turnin’ baby Not fade away Now I’m in my car I got the radio on I’m yellin’ at the kids in the back ‘Cause they’re bangin’ like Charlie Watts Slow Turning by John Hiatt “How did you go bankrupt?” Bill asked. “Two ways”, Mike said. “Gradually and then suddenly.” The Sun Also Rises, By Ernest...

Read More »Living In The Present

The secret of health for both mind and body is not to mourn for the past, nor to worry about the future, but to live in the present moment wisely and earnestly. Buddha Review It’s that time of year again, time to cast the runes, consult the iChing, shake the Magic Eight Ball and read the tea leaves. What will happen in 2019? Will it be as bad as 2018 when positive returns were hard to come by, as rare as affordable...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org