(Disclosure: Some of the links below may be affiliate links) PostFinance is a well-known Swiss bank and broker. They are generally considered to be very affordable and very easy to use. If you want a Swiss broker, should you use PostFinance as a Swiss investor, especially as a passive investor? This is what we are going to find out in this in-depth review. In this article, we will see what PostFinance offers as a broker, how much it costs, and much more too. By the...

Read More »PostFinance E-Trading Review 2021 – Pros and Cons

(Disclosure: Some of the links below may be affiliate links) PostFinance is a well-known Swiss bank and broker. They are generally considered to be very affordable and very easy to use. If you want a Swiss broker, should you use PostFinance as a Swiss investor, especially as a passive investor? This is what we are going to find out in this in-depth review. In this article, we will see what PostFinance offers as a broker, how much it costs, and much more too. By the end of the review, you...

Read More »Interview: Candid Coffee – Mid-Year Market Review

Last weekend, I joined Richard Rosso, CFP and Danny Ratliff, CFP to discuss the outlook for the markets for the rest of this year and take questions from our attendees. We cover a lot of ground from: The financial markets now and what to expect. Valuations Inflation outlook. The dollar. Why Government actions are destroying the foundation of capitalism. Plus some interesting questions on Why you shouldn’t put real estate in a tax-deferred account. Better ways to...

Read More »Taper Is Coming: Got Bonds?

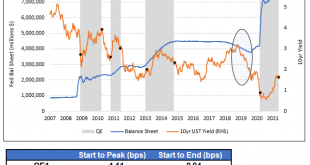

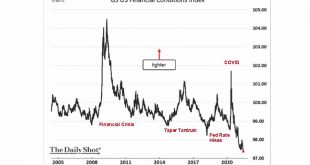

Taper Is Coming: Got Bonds? The solid economic recovery and easing of COVID restrictions lead us to believe a tapering of QE may not be far off. Further supporting our opinion, inflation has fully recovered to pre-pandemic levels, and employment is improving rapidly. On top of that are whispers from within the Fed questioning financial stability given extreme asset valuations driven to some degree by excessive QE. Most importantly, various Fed members are starting to...

Read More »Yuh Review 2021: A new mobile banking service

(Disclosure: Some of the links below may be affiliate links) PostFinance and Swissquote just started a new joint venture: The Yuh banking application. With Yuh, you can save money on your account, pay in Switzerland and abroad and invest in the stock market and cryptocurrencies. Yuh is an entirely digital offer. They have no offices. You can manage all your money directly from your phone. So, you will pay your bills and invest your money on your smartphone. So, should you use Yuh? What...

Read More »Technically Speaking: Yardeni – The Market Will Soon Reach 4500

“The strong economic recovery will not get interrupted by inflation or a credit crunch, and the market will soon reach 4,500.” – Ed Yardeni via Advisor Perspectives After discussing BofA’s view of why the market could drop to 3800, I thought it fair to discuss a more optimistic view. BofA’s view of a market correction was a function of the more exuberant “optimism” in the market. To wit: “This analysis is interesting, particularly when analysts are rushing to...

Read More »How to buy an ETF on Interactive Brokers the easy way

(Disclosure: Some of the links below may be affiliate links) I have been using Interactive Brokers (IB) for several years. It took me a while to get used to this broker. However, I am now able to do all the operations I need easily. I will show you exactly how to buy an ETF from start to finish on IB, the easy way! I have been contacted a few times by readers that were having a hard time starting with Interactive Brokers. This is indeed a little complicated at first, but it becomes very...

Read More »Technically Speaking: If Everyone Sees It, Is It Still A Bubble?

“If everyone sees it, is it still a bubble?” That was a great question I got over the weekend. As a “contrarian” investor, it is usually when “everyone” is talking about an event; it doesn’t happen. As Mark Hulbert noted recently, “everyone” is worrying about a “bubble” in the stock market. To wit: “To appreciate how widespread current concern about a bubble is, consider the accompanying chart of data from Google Trends. It plots the relative frequency of Google...

Read More »The 6 Biggest Problems with Dividend Investing

(Disclosure: Some of the links below may be affiliate links) Many people invest only in dividend-paying stocks. More specifically, they only invest in stocks that have a good history of paying dividends. This means that these stocks do not cut dividends. They expect that investing in these stocks will yield more returns than invest in the broad stock market. Some people plan to retire entirely based on the dividends. As a result, many people ask me why I do not invest in dividend stocks...

Read More »#MacroView: Are Stocks Cheap, Or Just Another Rationalization?

Are stocks “cheap,” or is this just another bullish “rationalization.” Such was the suggestion by the consistently bullish Brian Wesbury of First Trust in a research note entitled “Yes, Stocks Are Cheap.” To wit: “The Fed remains highly accommodative, there are trillions of dollars of cash on the sidelines, vaccines have reached over 50% of Americans, and the economy is expanding rapidly. Some valuations have been stretched, but the market as a whole remains...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org