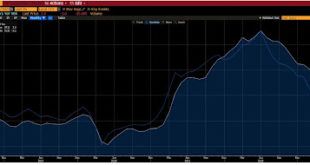

Overview: There are three main developments. First, the market is digesting the implication of the US employment data, where the optics were strong (336k increase in nonfarm payrolls compared with 170k median forecast in Bloomberg and Dow Jones surveys) but some details were disappointing (like the third consecutive decline in full-time posts, seasonally adjusted). Second, Chinese mainland market re-opened after a six-day holiday). Chinese stocks slipped and...

Read More »US Employment Data to Determine Whether the Greenback’s Rally since mid-July is Over…Maybe

Overview: One key issue for market participants is if the dollar's pullback is the beginning of something important or is largely position adjusting ahead of today's US jobs report. We suspect that the dollar's rally that began in mid-July is over, though a strong employment report that boosts the chances of a Fed hike before year-end could quickly demonstrate the folly of making claims ahead of what is still one of the most important reports in the monthly cycle of...

Read More »Greenback Bought on Pullback

Overview: The dollar was bought after yesterday's pullback spurred by Japanese and Chinese comments and the tighter capital controls from Beijing requiring permission to buy more than $50 mln. The economic and monetary policy divergence continues to underpin the greenback. It is firmer against all the G10 currencies and is mostly inside yesterday's ranges. Most emerging market currencies are lower, led by central European currencies. The Chinese yuan is steady....

Read More »Battle for $1.07 in the Euro

Overview: Despite disappointing German industrial output, where the 0.8% decline was twice expectations, the euro is holding above $1.07, where large options exist that are expiring over the next few sessions. The greenback is consolidating against the Japanese yen, where the fear of intervention has increased. Sterling remains on its back foot after yesterday's seemingly dovish comments by Bank of England Governor Bailey. Emerging market currencies are mostly...

Read More »The Greenback is Softer Ahead of CPI but Key Chart Points Remain Intact

Overview: The deluge of Treasury supply is nearly over for this week. On tap today are 4- and 8-week T-bills and $23 bln 30-year bonds to finish the quarterly refunding. The sales will come after the July CPI print that is expected to see the first year-over-year increase since last June. The market is going into the report with about a 15% chance of a Fed hike next month discounted. Meanwhile, September crude oil extended its recover from $80 seen on Tuesday to a...

Read More »After Strong Demand for US Three-Year Notes, Treasury will Sell $38 bln 10-year Notes

Overview: The first leg of the US refunding was well received, with the three-year note being scooped up by investors, driving the yield below it was trading in the when-issued market. Today, the Treasury sells $38 bln 10-year notes, whose auctions have been less than stellar recently. The US 10-year yield reached 4.20% last week and is now straddling 4%. Italian bonds are also firm as the Italian government clarifies the new tax on banks' windfall profits. Other...

Read More »Dollar Comes Back Bid

Overview: The US dollar is recovering today after it was sold following the jobs report before the weekend. It is enjoying a firmer bias against nearly all the G10 currencies. The dollar-bloc is faring best, while the Scandis are off close to 0.5%. Most emerging market currencies are also softer, with only a few Asian currencies edging higher today, including the South Korean won, Indian rupee, and Taiwanese dollar. With a stronger dollar and firmer interest rates,...

Read More »Markets Remain Unsettled, Bonds and Stocks Retreat, Dollar Gains Ahead of BOE

Overview: The global capital markets remain unsettled. The combination of the BOJ adjustment of its monetary policy, Fitch's downgrade of the US to AA+, ahead of a flood of supply, and new measures by China have injected volatility into the summer markets. The US dollar has extended it gains today against the G10 currencies and most emerging market currencies. The yen has recovered a bit after the BOJ stepped in and bought JGBs for the second time this week at...

Read More »RBA Surprises with a Quarter-Point Hike and German Factory Orders Disappoint

Overview: The Reserve Bank of Australia surprised many with a quarter-point hike and German factory orders unexpectedly fell. Reports suggest that China has asked banks to cut deposit rates. The next result is the Australian dollar is the strongest currency in the G10 and helped lift the Canadian dollar ahead of the Bank of Canada meeting tomorrow. Australian stocks sold off (~1.2%) while large markets outside of China rose in the region. Europe's Stoxx 600 is...

Read More »Fitch Puts US on Negative Credit Watch and the Dollar Extends its Gains

Overview: Concerned about the political wrangling over servicing US debt, Fitch put the US on negative credit watch. Besides chin wagging and finger pointing, it has had little perceptible impact. The dollar is mostly higher, reaching new highs for the year against the Japanese yen, Chinese yuan, and the Antipodean currencies. The euro and sterling met retracement objective we have targeted (~$1.0735 and $1.2435, respectively). The greenback is also firmer against...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org