Credit Suisse has confirmed that the Swiss bank, some of its employees and hundreds of account holders are the subjects of a major tax evasion probe launched in UK, France, Australia, Germany and the Netherlands, setting back Swiss attempts to clean up its image as a haven for tax evaders. According to Bloomberg, Dutch investigators seized jewellery, paintings and even gold bars as part of a sweeping investigation into tax evasion and money laundering in the Netherlands. They added that the...

Read More »Blocher and the People That Ruined the EU

Last weekend, European leaders gathered in Rome for the 60th anniversary of the Treaty of Rome. They discussed, not for the first time, how to get the EU back on track. And they told each other they are still committed to the Union and believe in its future. (We’ve heard that one before, too.) But let’s just suppose that, when the European leaders sat down for lunch at the Quirinal Palace, some of them had a little too...

Read More »100 Years Ago, Russian Stocks Had A Very Bad Day

In recent months, Ray Dalio seems to be undergoing a deep midlife and identity crisis, which has not only led to dramatic recent management changes at the world’s largest hedge fund, Bridgewater, but also resulted in some fairly spectacular cognitive dissonance, as Dalio first praised, then slammed, president Trump. Yesterday. in the latest expression of his building anti-Trumpian sentiment, Bridgewater released a...

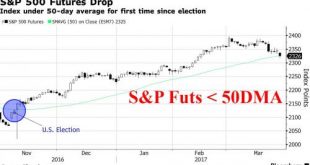

Read More »Global Stocks Slide, S&P Futures Tumble Below 50DMA As “Trump Trade” Collapses

Global stocks are lower across the board to start the week, as concerns about Trump's administration to pull off a material tax reform plan finally emerge, pressuring S&P futures some 20 points lower this morning, following European and Asian shares lower, while crude oil prices fall unable to find support in this weekend's OPEC meeting in Kuwait where a committee recommended to extend oil production cuts by another 6 months. Safe havens including the yen and bonds climbed as did gold,...

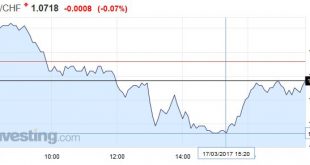

Read More »FX Daily, March 17: Dollar Remains Heavy

Swiss Franc EUR/CHF - Euro Swiss Franc, March 17(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF Article 50 – Invocation Imminent With the House of Commons voting against amendments to the brexit bill, it was passed to the Queen for approval which was really a formality, more a mark of respect to a bygone age. Article 50 is now ready to be invoked at anytime. It is anticipated to be next week. I am of...

Read More »Turkey Vows “Harsh Retaliation” After Dutch PM Says “Not Apologizing, Are You Nuts”

The diplomatic scandal between Turkey and the Netherlands deteriorated overnight, when Prime Minister Binali Yildirim warned on Sunday that Turkey would retaliate in the "harshest ways" after Turkish ministers were barred from speaking in Rotterdam, leading to a major protest in front of the Turkish consulate in Rotterdam, while the Dutch embassy in Istanbul was closed off due to "safety concerns." "This situation has been protested in the strongest manner by our side, and it has been...

Read More »Economic Dissonance, Too

Germany is notoriously fickle when it comes to money, speaking as much of discipline in economy or industry as central banking. If ever there is disagreement about monetary arrangements, surely the Germans are behind it. Since ECB policy only ever attains the one direction, so-called accommodation, there never seems to be harmony. But that may only be true because “accommodation” doesn’t ever achieve what it aims to....

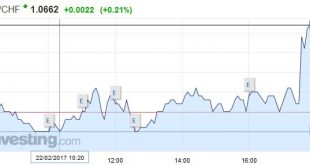

Read More »FX Daily, February 22: Euro Meltdown Continues

Swiss Franc EUR/CHF - Euro Swiss Franc, February 22(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The pound has made good gains against the Swiss Franc this morning with rates for GBP CHF now sitting at 1.2650 for this pair. The pound seems to have found support as the Brexit bill is still expected to pass through the House of Lords next week when the bill comes under additional scrutiny. There is a...

Read More »FX Daily, February 20: Marking Time on Monday

Swiss Franc EUR/CHF - Euro Swiss Franc, February 20(see more posts on EUR/CHF, ) - Click to enlarge FX Rates US markets are closed for the Presidents’ Day holiday, but it hasn’t prevented its pre-weekend gains giving a bullish tone to global equities. The S&P 500 and NASDAQ recovered from early weakness to close at new record levels before the weekend. Global equity markets are following suit today. The...

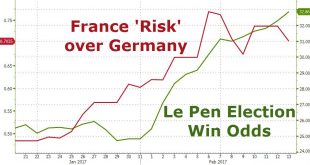

Read More »Here Are The Best Hedges Against A Le Pen Victory

On Friday, after it emerged that as part of Marine Le Pen’s strategic vision for France, should she win, is a return to the French franc as well as redenomination of some €1.7 billion in French (non-international law) bonds, both rating agencies and economists sounded the alarm, warning it would “amount to the largest sovereign default on record, nearly 10 times larger than the €200bn Greek debt restructuring in 2012,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org