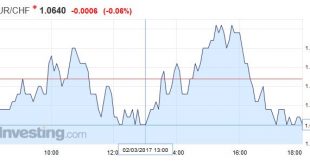

Swiss Franc EUR/CHF - Euro Swiss Franc, March 02(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge FX Rates The US dollar is bid against the major currencies as the combination the increased expectation of a Fed rate hike and the President’s commitment to fiscal stimulus buoys sentiment. The dollar-bloc, where speculators in the futures market, have grown a net long position, are leading the...

Read More »Great Graphic: Fed’s Real Broad Trade Weighted Dollar

To begin assessing the dollar’s impact on the US economy, nominal bilateral exchange rates may be misleading. From a policymakers’ point of view, the real broad trade weighted measure is more important. The Federal Reserve tracks it on a monthly basis. This measure of the dollar snapped a four-month advancing streak ended in January with a marginal loss (0.05%). Last month, the real broad trade weighted measure fell...

Read More »FX Daily, March 01: Greenback Bounces, More Fed than Trump

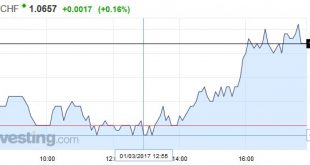

Swiss Franc EUR/CHF - Euro Swiss Franc, March 01(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The pound to Swiss Franc rate has now slipped below 1.25, a trend I did say I expected to take shape this month. Whilst some commentators do foresee the pound finding some strength once Article 50 is triggered I believe there is a strong likelihood that we will actually be more likely to see the pound...

Read More »FX Daily, March 01: Greenback Bounces, More Fed than Trump

Swiss Franc EUR/CHF - Euro Swiss Franc, March 01(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The pound to Swiss Franc rate has now slipped below 1.25, a trend I did say I expected to take shape this month. Whilst some commentators do foresee the pound finding some strength once Article 50 is triggered I believe there is a strong likelihood that we will actually be more likely to see the pound...

Read More »Beware the Ides of March

Summary: Numerous events converge in the middle of March. We still lean toward a May hike rate than March. Wilders may garner a plurality of the vote in the Netherlands, but is unlikely to form a government for want of coalition partners. How will the Republican US Congress and President deal with the debt ceiling? T.S. Eliot tells us that April is the cruelest month. A great poet he was, but a trader he was...

Read More »FX Daily, February 28: Markets Little Changed as Breakout is Awaited

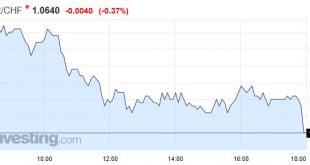

Swiss Franc EUR/CHF - Euro Swiss Franc, February 28(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge GBP/CHF GBH CHF continues to see a volatile period with the general global uncertainty which has seen investors favour the safe haven currency. GBP CHF currently sits at 1.25 for this pair and there is resistance at these levels which is preventing the pound from driving higher. Brexit is now...

Read More »The Misplaced Animosity toward Imports

Summary: Pity imports, they are misunderstood. Imports create jobs directly and indirectly. Restricting US imports would likely also curb exports. The mercantilist inclination by the Trump Administration makes it seem as if exports are good and create jobs and imports are bad and cost jobs. This is simply not true. This assessment is not based on newfangled thinking about trade. Rather Adam Smith argued...

Read More »FX Daily, February 27: Asia Stumbles, Europe Recovers, Waiting for Trump

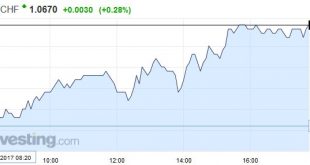

Swiss Franc EUR/CHF - Euro Swiss Franc, February 27(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The late recovery in US equities before the weekend did little good for Asian markets. Nearly all the Asian equity markets moved lower, led by the 1.0% decline in Japan’s Topix. It was the third successive loss for the Topix, which is the long losing streak of the year so far. The MSCI Asia Pacific Index...

Read More »Weekly Speculative Position: More EUR Shorts, Less CHF Shorts .. Again

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

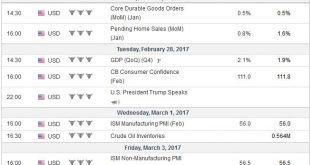

Read More »FX Weekly Preview: Macroeconomics and Psychology

United States There is a broad consensus around the macroeconomic picture. The headwinds slowing the US economy in H1 16 have eased, and above trend growth in H2 16 appears to be carrying into 2017. Q4 16 GDP is expected to be revised to 2.1% up from 1.8%. Many economists appear to accept that a good part, though not all, of the decline in the estimated trend growth in the US, is a function of demographic...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org