Swiss Franc EUR/CHF - Euro Swiss Franc, March 01(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The pound to Swiss Franc rate has now slipped below 1.25, a trend I did say I expected to take shape this month. Whilst some commentators do foresee the pound finding some strength once Article 50 is triggered I believe there is a strong likelihood that we will actually be more likely to see the pound falter. Brexit concerns are not just going to evaporate however positive the government is over what has been taking place. The overall likelihood is we will actually start to see the pound decline as we get closer to the triggering of Article 50 as investor concerns over the economic and political outlook for the UK take shape. Most commentators believe the pound will remain at the mercy of politics and the global view of just how the UK economy is performing. This actually sits quite interestingly with the Swiss Franc which as a safe haven currency actually benefits from global political uncertainty. Despite having a lower interest rate in fact, a negative interest rate the Swiss Franc benefits from investor confidence.

Topics:

Marc Chandler considers the following as important: AUD, CAD, China Manufacturing PMI, China Non-Manufacturing PMI, EUR, EUR/CHF, Eurozone Manufacturing PMI, Featured, France Manufacturing PMI, FX Trends, GBP, GBP/CHF, Germany Manufacturing PMI, Germany Unemployment n.s.a., Japan Manufacturing PMI, JPY, newslettersent, Spain Manufacturing PMI, U.K. Manufacturing PMI, U.S. ISM Manufacturing PMI, U.S. Manufacturing PMI, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss Franc |

EUR/CHF - Euro Swiss Franc, March 01(see more posts on EUR/CHF, ) |

GBP/CHFThe pound to Swiss Franc rate has now slipped below 1.25, a trend I did say I expected to take shape this month. Whilst some commentators do foresee the pound finding some strength once Article 50 is triggered I believe there is a strong likelihood that we will actually be more likely to see the pound falter. Brexit concerns are not just going to evaporate however positive the government is over what has been taking place. The overall likelihood is we will actually start to see the pound decline as we get closer to the triggering of Article 50 as investor concerns over the economic and political outlook for the UK take shape. Most commentators believe the pound will remain at the mercy of politics and the global view of just how the UK economy is performing. This actually sits quite interestingly with the Swiss Franc which as a safe haven currency actually benefits from global political uncertainty. Despite having a lower interest rate in fact, a negative interest rate the Swiss Franc benefits from investor confidence. Investors have a high degree of faith in the independence and control the Swiss National Bank have over the Franc, holding the Swissie is seen as a hedge against uncertainty elsewhere. The Brexit is absolutely a factor which would lead to uncertainty in global politics and the global economy so it is right to expect a strong and more expensive Swiss Franc on the back of this trend. Article 50 is likely to become more and more of a topic in the next couple of weeks. Markets are taking a more favourable view of the pending outcome and negotiations with a view to seeing the UK and any deal in a more positive light. Theresa May is absolutely going for a ‘hard Brexit’ with a view to securing what she believes will be the best deal for the UK even if it means turning hers and the UL’s back on what is perceived as a bad deal for the UK. |

GBP/CHF - British Pound Swiss Franc, March 01(see more posts on GBP/CHF, ) |

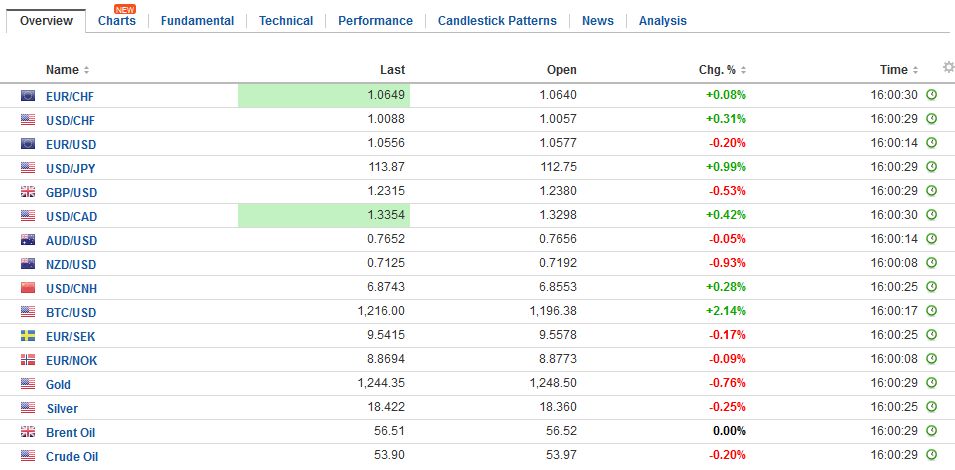

FX RatesThe much-anticipated speech by US President Trump was light on the details that investors interested in, like the tax reform, infrastructure initiative, and deregulation. There appears to be an agreement to repeal the national healthcare, but there is no consensus on its replacement. The gains in the US dollar appear to be more a function of shifting expectations of Fed policy than new clarity on fiscal policy. By Bloomberg’s calculation, there is now an 82% chance the Fed hikes in two weeks. Our interpolation puts the odds at 74%. New York Fed President Dudley’s remark that an increase in rates has become “more compelling” was the catalyst. |

FX Performance, March 01 2017 Movers and Shakers Source: Dukascopy - Click to enlarge |

| Seven Fed officials are still set to speak this week. Governor Brainard speaks after the US markets close today. Although she is not part of the Fed’s leadership core, her insight last year, and particularly the importance of the international settings, was important. On Friday, both Fischer and Yellen speak. Given the proximity of the March 15 FOMC meeting, it would be the last significant opportunity to try to shape market expectations.

The US dollar is stronger against all the major currencies but the Australian dollar. News that Australia’s economy expanded 1.1% in Q4 16, among the strongest quarterly performances in the past five years lent support to the Aussie, which continues to encounters offers around $0.7700. It found bids near $0.7640, which need to be absorbed before it can test the lower end of the recent range near $0.7600. |

FX Daily Rates, March 01 |

| The euro is finding little traction. The euro stalled near $1.0630 yesterday, as it did last week as well. Since that high, the euro has slid a full cent before finding support near $1.0525. Two weeks ago, the US premium over Germany on two-year money was less than 200 bp. It is now near 215 bp, a new extreme since the late 1990s. We suspect North American dealers will be reluctant to sell the euro without first squeezing the intraday shorts established in the European morning. The $1.0560-$1.0580 may offer initial resistance now. |

FX Performance, March 01 |

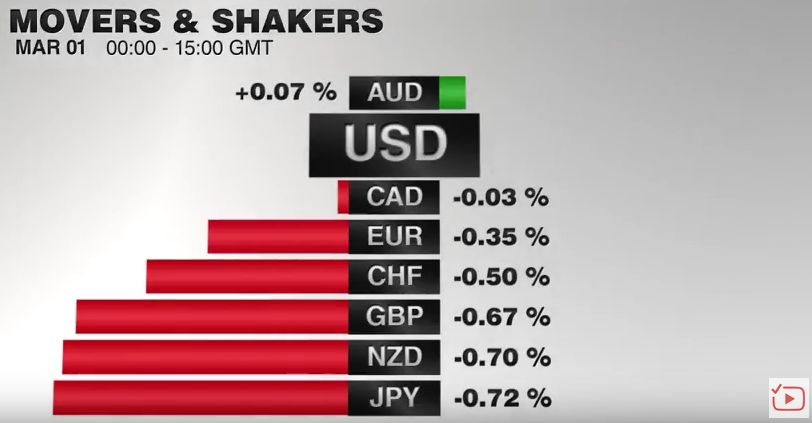

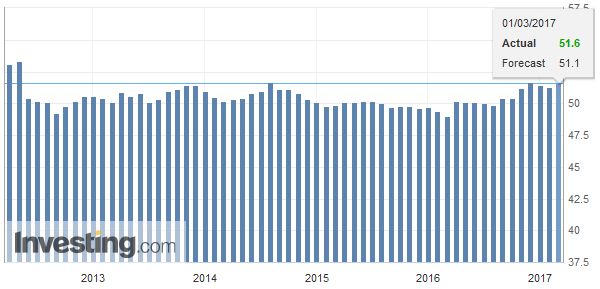

ChinaThe story behind Australia’s recovery after the contraction in Q3 was a dramatic (9.1%) improvement in the terms of trade, due to the rise in iron ore and coal prices. This, in turn, seems to be a function of the stabilization of the Chinese economy. News earlier today showed that Chinese manufacturing PMI is rising to 51.6 in February from 51.3 in January. Output, new orders, and business expectations improved. |

China Manufacturing PMI, February 2017(see more posts on China Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

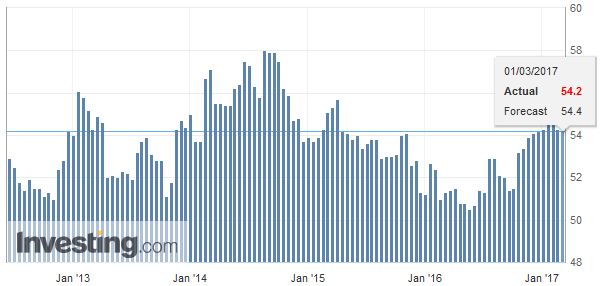

| The non-manufacturing PMI slipped to 54.2 from 54.6. |

China Non-Manufacturing PMI, February 2017(see more posts on China Non-Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

JapanThe dollar briefly traded below JPY112 yesterday and now is trading near JPY113.65. Japan did report stronger than expected Q4 capex (3.8% vs. 0.8% expectations), and record corporate profits in Q4. However, the weight on the yen appears to be emanating from the rate differentials, and in particular the rise in US yields. The 10-year premium to be garnered in the US over Japan stands near 2.36% today. It finished last week near 2.24%. Yesterday, the dollar recorded a bullish hammer candlestick pattern and the follow through buying today, has lifted the greenback to test the JPY113.70 area, which corresponds to a 61.8% retracement of the dollar’s slide from February 15’s test on JPY115 to yesterday’s low near JPY111.70, near the lows seen in the first half of February. The JPY115.00 would be the next target if the JPY113.75 can be overcome. |

Japan Manufacturing PMI, February 2017(see more posts on Japan Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

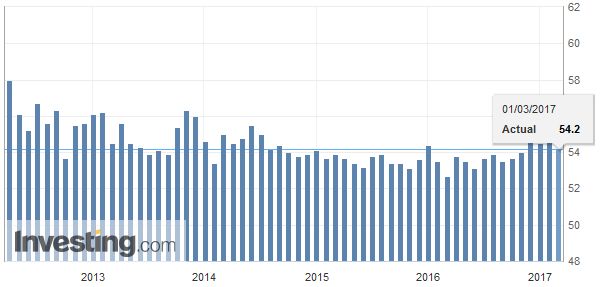

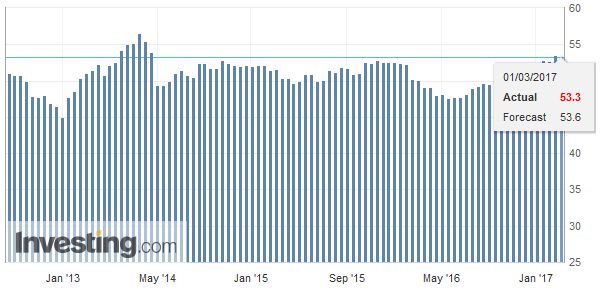

EurozoneThe February eurozone manufacturing PMI ticked down from the flash (55.5) to 55.4, but it is still better than the 55.2 January reading and is the highest since the time series began in early 2014. |

Eurozone Manufacturing PMI, February 2017(see more posts on Eurozone Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

SpainEuropean politics are also very much in the news today. Fillon’s campaign in France appears to be in trouble, and there are reports suggesting that he may step down (though denied) and replaced by rival Juppe. In the Netherlands, which goes to the polls in a fortnight, the Freedom Party has slipped into second place according to the latest poll of polls, for the first time since last November. |

Spain Manufacturing PMI, February 2017(see more posts on Spain Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

France |

France Manufacturing PMI, February 2017(see more posts on France Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

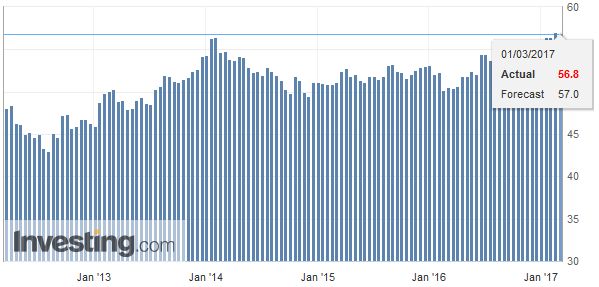

GermanyThe minor lower revision seems to stem from German where the flash manufacturing reading of 57.0 was revised to 56.8. Separately, |

Germany Manufacturing PMI, February 2017(see more posts on Germany Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

| Germany reported a somewhat larger than expected fall in unemployment (-14k rather than -10k). |

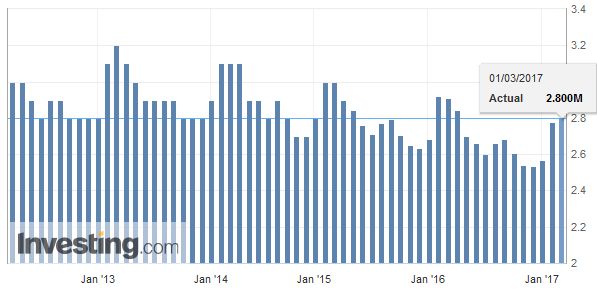

Germany Unemployment n.s.a. February 2017(see more posts on Germany Unemployment n.s.a., ) Source: Investing.com - Click to enlarge |

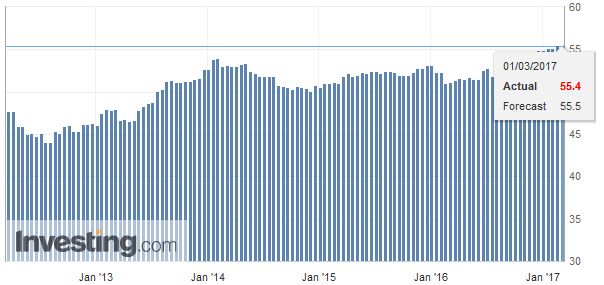

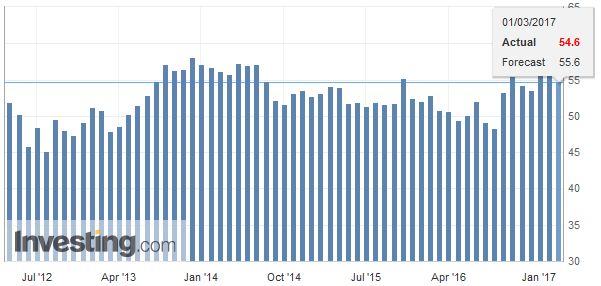

United KingdomThe UK reported strong house prices and mortgage approvals, but the February manufacturing PMI fell more than expected. The 54.6 reading compares with the January reading of 55.7 (revised form 55.9) and the median expectation on the Bloomberg survey for a 55.8 reading. Yesterday was the first time since January 20 that sterling closed bel0w $1.24. It has barely been able to trade above the old support (now resistance) today. Initial support is seen near $1.2345, which corresponds to a 50% retracment of the rally from the January 16 dip below $1.20. It is also last month’s low. A convincing break could spur a move toward $1.2260-$1.2300. |

U.K. Manufacturing PMI, February 2017(see more posts on U.K. Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

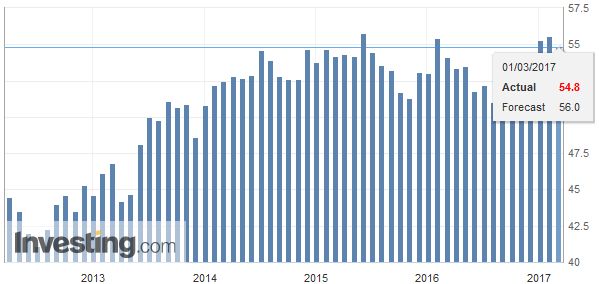

United StatesThe US economy calendar is chock-full of economic reports, culminating with the Beige Book late in the session. |

U.S. Manufacturing PMI, February 2017(see more posts on U.S. Manufacturing PMI, ) Source: investing.com - Click to enlarge |

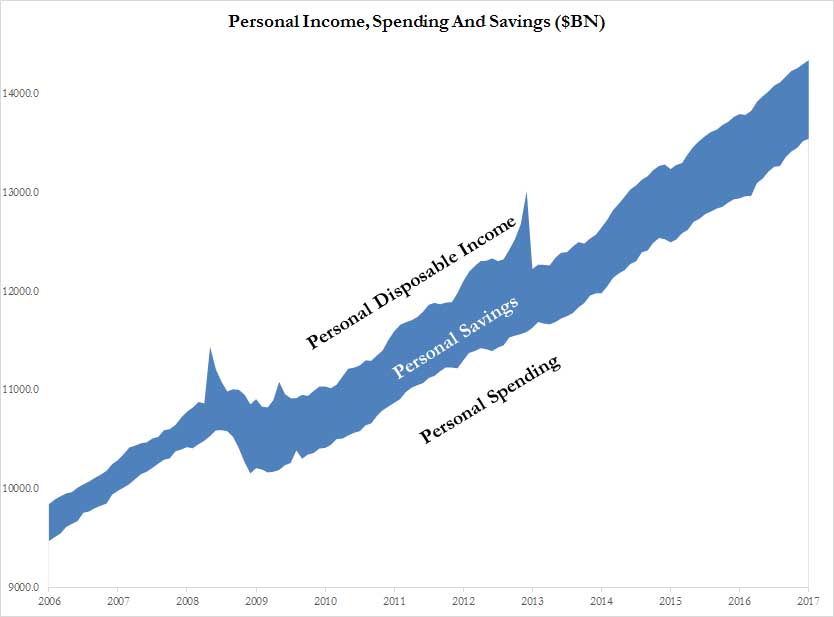

| Personal income and consumption data will impact Q1 GDP forecasts. The core PCE deflator is expected to be unchanged at 1.7%, though the risk appears on the upside. |

U.S. Personal Consumption 2006-2017 Source: macro.economicblogs.org - Click to enlarge |

| January construction spending could inform GDP forecasts. |

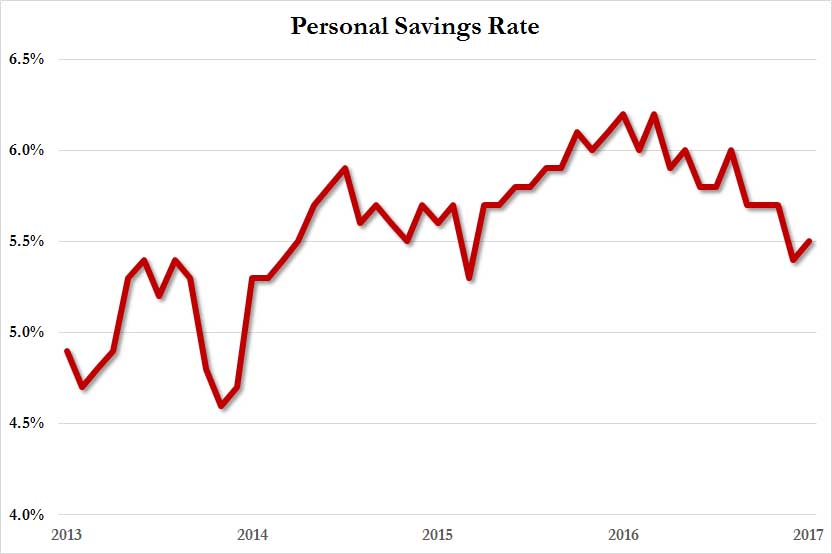

U.S. Personal Savings Rate, January 2017 Source: macro.economicblogs.org - Click to enlarge |

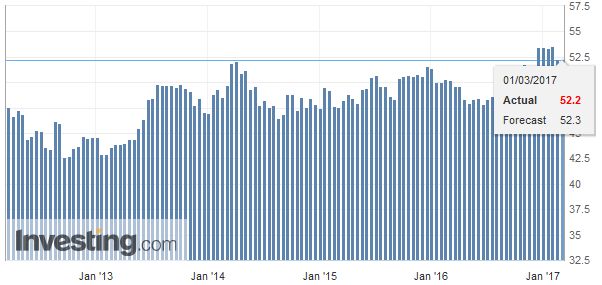

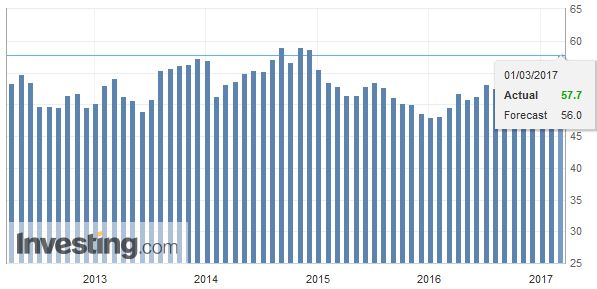

| The ISM manufacturing report for February can also impact the market and growth/inflation expectations.

The Bank of Canada meets and is widely expected to keep rates steady. The strengthening of the US economy is good for Canada. The Canadian dollar is the weakest major currency over the past five sessions, losing about 1.2%. The greenback pushed above CAD1.33 yesterday for the first time in a month and has seen mild follow through buying today. The next important technical area is CAD1.3360-CAD1.3390, which corresponds with the high for the year and the 61.8% retracement objective of the down move from the high at the end of the year near CAD1.36. |

U.S. ISM Manufacturing Purchasing Managers Index (PMI) February 2017(see more posts on U.S. ISM Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,China Manufacturing PMI,China Non-Manufacturing PMI,EUR/CHF,Eurozone Manufacturing PMI,Featured,France Manufacturing PMI,GBP/CHF,Germany Manufacturing PMI,Germany Unemployment n.s.a.,Japan Manufacturing PMI,newslettersent,Spain Manufacturing PMI,U.K. Manufacturing PMI,U.S. ISM Manufacturing PMI,U.S. Manufacturing PMI