Swiss Franc The Euro has risen by 0.15% to 1.0675 EUR/CHF and USD/CHF, February 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors are taking solace from reports indicating that the increase in the new coronavirus at ground zero (Hubei) is slowing. After the S&P 500 reversed early losses yesterday to close at new record highs helped keep the bullish sentiment intact. Benchmarks in Hong Kong, South...

Read More »FX Weekly Preview: US Soars while Rivals are Hobbled

We are approaching the mid-point of the first quarter, and the coronavirus from China is the new key development for businesses and investors. The economic impact appears to be still growing as the disruption to supply chains, production, and demand continues. The re-opening of China from the extended Lunar New Year holiday brought some relief to the markets as officials ensured ample liquidity, leaned against short selling, and offered concessions to businesses...

Read More »FX Daily, January 30: Contagion Impact not Peaked, Weighs on Risk Appetites

Swiss Franc The Euro has fallen by 0.21% to 1.0689 EUR/CHF and USD/CHF, January 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The ongoing concerns about the geometric progression of the new coronavirus continues to swamp other considerations for investors. Risk continues to be unwound, as the World Health Organization meets to decide if this is indeed a global health emergency. Several large equity markets...

Read More »FX Daily, January 29: Escaped from a Crocodile’s Mouth, Entered a Tiger’s Mouth

Swiss Franc The Euro has risen by 0.10% to 1.0731 EUR/CHF and USD/CHF, January 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: This colorful Malay saying captures the spirit of the animal spirits. Narrowly escaping an escalation of a trade war between the world’s two largest economies, the outbreak of a deadly virus has spurred moves, especially the sell-off in stocks and rally in bonds, for which many...

Read More »FX Weekly Preview: The Week Ahead and Why the FOMC Meeting may not be the Most Interesting

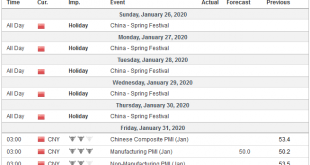

The week ahead is arguably the most important here at the start of 2020. The Federal Reserve and the Bank of England meet. The US and the eurozone report initial estimates of Q4 19 GDP. The eurozone also reports its preliminary estimate of January CPI. China returns from the extended Lunar New Year celebration and reports its official PMI. Japan will report December retail sales and industrial production. These data points will provide insight into the state of the...

Read More »FX Daily, January 17: China and the UK Surprise in Opposite Directions

Swiss Franc The Euro has risen by 0.06% to 1.0745 EUR/CHF and USD/CHF, January 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Helped by new record highs in the US, global stocks are moving higher today. Nearly all the markets in the Asia Pacific region advanced and the seventh consecutive weekly rally is the longest in a couple of years. Europe’s Dow Jones Stoxx 600 is at new record highs and appears set to...

Read More »FX Weekly Preview: Back to Macro?

The US-China trade conflict and then US-Iran confrontation distracted investors from the macroeconomic drivers of the capital markets. It is not that there is really much closure with the exogenous issues, but they are in a less challenging place, at least on the surface. A Chinese delegation, led by the Vice-Premier Liu He, who spearheaded the negotiations, will participate in the signing ceremony on January 15.. While China has agreed to buy $200 bln more of US...

Read More »FX Daily, January 8: Hopes of De-Escalation Help Markets Stabilize

Swiss Franc The Euro has fallen by 0.27% to 1.079 EUR/CHF and USD/CHF, January 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Iranian retaliatory missile strike on Iraqi-bases housing US forces initially sparked a dramatic risk-off response throughout the capital markets. The muted response by the US coupled with signals from Tehran that it had “concluded” its proportionate measures saw the markets...

Read More »FX Daily, January 03: Geopolitics Saps Risk Appetite

Swiss Franc The Euro has fallen by 0.10% to 1.0837 EUR/CHF and USD/CHF, January 3(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Iran’s Ayatollah Ali Khamenei has threatened “severe retaliation” for the US attacked that killed an important head of a force within the Islamic Revolutionary Guard. At the same time, reports indicate that North Korea’s Kim Jong Un is no longer pledging to halt its nuclear weapons...

Read More »The Turn

The year is winding down quietly, and the last week of 2019 is likely to be more of the same. The general mood of the market is quite different than a year ago. Then investors had marked down equities dramatically amid fears of what was perceived as a synchronized downturn. Now with additional monetary easing in the pipeline and renewed expansion of the Federal Reserve and European Central Bank’s balance sheets, risk appetites have been stoked. Previously, the notion...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org