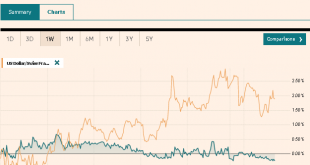

Swiss Franc The Euro has risen by 0.45% to 1.0587 EUR/CHF and USD/CHF, March 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: In HG Wells’ “War of the Worlds,” the common cold repelled a Martian invasion. Now, a novel coronavirus is disrupting everything and everywhere. Global equities continue to get hammered, though the apparent relative resilience of Japan may have spurred some buying of Japanese equities....

Read More »FX Daily, March 19: ECB’s Bazooka Support Bonds but not the Euro

Swiss Franc The Euro has fallen by 0.32% to 1.0531 EUR/CHF and USD/CHF, March 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It is not just that the dollar soared while stocks and bonds continued to plunge. The dollar’s strength is, in effect, a powerful short-covering rally. It was used to fund a great part of the global circuit of capital. The circuit of capital is in reverse now, and the funding currency...

Read More »FX Daily, March 18: Bonds Join Equities in the Carnage

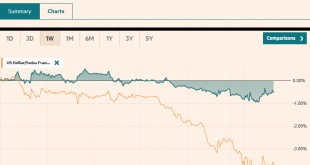

Swiss Franc The Euro has fallen by 0.27% to 1.0537 EUR/CHF and USD/CHF, March 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A new phase of the market turmoil is at hand. Bonds are no longer proving to be the safe haven for investors fleeing stocks. The tremendous fiscal and monetary efforts, with more likely to come, have sparked a dramatic rise in yields. Meanwhile, equities are getting crushed again....

Read More »FX Daily, March 16: Monday Blues: Fed Moves Bigly and Stocks Slump

Swiss Franc The Euro has fallen by 0.01% to 1.0541 EUR/CHF and USD/CHF, March 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Federal Reserve and central banks in the Asia Pacific region acted forcefully, but were unable to ease the consternation of investors. The Reserve Bank of New Zealand cut key rates by 75 bp. The Bank of Japan appears to have doubled its ETF purchase target to JPY12 trillion, and...

Read More »FX Daily, March 9: Monday Meltdown

Swiss Franc The Euro has risen by 0.07% to 1.059 EUR/CHF and USD/CHF, March 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities plunged, and yields sank as the coronavirus threatens a global recession. The oil price war signaled by Saudi Arabia and Russia aggravates the desperate situation. Equities markets in the Asia Pacific region slumped 3-7%. The Shanghai Composite was fell 3%. The Nikkei was off by...

Read More »FX Daily, March 4: Equities Trade Higher, While Yields Continue to Fall

Swiss Franc The Euro has fallen by 0.49% to 1.0627 EUR/CHF and USD/CHF, March 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The G7 delivered up a nothing burger than was shortly followed by a 50 bp Fed cut. The equity market seemed to enjoy it briefly and extended Monday’s dramatic gains, before falling out of bed. The S&P 500 lost about 2.2%, while the Dow Industrial slumped 3%, but shortly after the...

Read More »FX Daily, March 2: Central Banks’ Words of Assurance have Short Life

Swiss Franc The Euro has risen by 0.10% to 1.0632 EUR/CHF and USD/CHF, March 2(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Comments beginning with Powell before the weekend, and BOJ and BOE earlier today promising support have saw equity markets briefly stabilize after last week’s dramatic moves. The G7 will hold a teleconference this week, but speculation of a coordinated rate move does not seem...

Read More »FX Daily, February 28: Fallout Accelerates

Swiss Franc The Euro has fallen by 0.34% to 1.0606 EUR/CHF and USD/CHF, February 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The dramatic response by investors to Covid-19 continues unabated and worse. The slide is accelerating. The S&P 500 posted a 4.4% loss yesterday, its worst session since 2011, and the sell-off is continuing. Many markets in Asia Pacific, including Japan, China, Korea, Australia,...

Read More »FX Daily, February 14: Investors Continue to Look Past the Coronavirus

Swiss Franc The Euro has risen by 0.24% to 1.0641 EUR/CHF and USD/CHF, February 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets are heading into the weekend, still trying to look past the coronavirus despite the new cases in Hubei. Tokyo was a notable exception in the Asia Pacific region, as the other major equity markets, like in Hong Kong, China, Taiwan, South Korea, and Australia,...

Read More »FX Daily, February 12: The Greenback Slips in Subdued Activity

Swiss Franc The Euro has fallen by 0.08% to 1.064 EUR/CHF and USD/CHF, February 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors appear to be increasingly looking past the latest coronavirus from China as new afflictions slow. Despite the soggy close of US equities yesterday, Asia Pacific bourses are nearly all higher, led by more than 1% gains in Singapore and Thailand. The Dow Jones Stoxx 600 is...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org