Share this article It’s been a fantastic year for physical precious metals owners and by many accounts, the best is yet to come. All the issues we’ve been warning against for years, including inflation, currency debasement and government suppression of individual financial liberty have started boiling over in a way that is so obvious, that even the most naive citizen can clearly comprehend. Despite the efforts by politicians and institutional leaders to convince the taxpayers not to...

Read More »Another One Inverts, The Retching Cat Reaches Treasuries

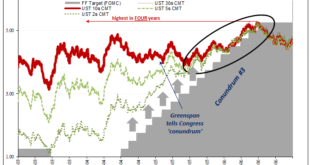

As Alan Greenspan’s rate hikes closed in, longer-term Treasury yields were forced upward as the flattening yield curve left no more room for their blatant defiance. By mid-2005, though, the market wasn’t ready to fully price the downside risks which had already led to that worrisome curve shape (very flat). While all sorts of bad potential could be reasonably surmised, none of it seemed imminent or definite. Thus, between July 2005 and June 2006, the entire curve...

Read More »How Dumb Is the Fed?

Bent and Distorted POITOU, FRANCE – This morning, we are wondering: How dumb is the Fed? The question was prompted by this comment by former Fed insider Chris Whalen at The Institutional Risk Analyst blog. [O]ur message to the folks in Jackson Hole this week [at the annual central banker meeting there] is that the end of the Fed’s reckless experiment in social engineering via QE and near-zero interest rates will end...

Read More »Optimal Lunacy

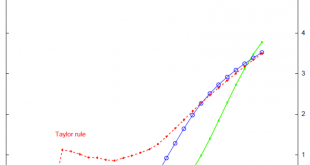

In June 2012, Janet Yellen, then the Vice Chairman of the Federal Reserve, addressed an audience in Boston with what for the time seemed like a radical departure. It was the latest in a string of them, for conditions throughout the “recovery” period never did quite seem to hit the recovery stride. Because of that, there was constant stream of trial balloons suggesting how the Federal Reserve might try to overcome this...

Read More »Are Rate Hikes Bad For Gold?

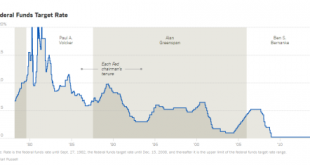

Here are two different looks at Fed rate hikes since Volcker. The charts are the same, but one presentation is a lot funnier than the other. Federal Funds Target RateThe above image from the New York Times article A History of Fed Leaders and Interest Rates. - Click to enlarge Here’s an alternative view courtesy of @HedgeEye. - Click to enlarge Let’s take the fist chart and see what correlations exist between...

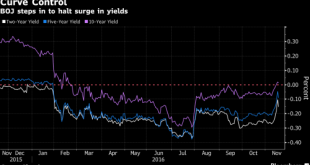

Read More »BOJ “Fires Warning At Bond Market” Sending Global Yields, Dollar Lower; All Eyes On Yellen

Yesterday morning we noted why, in light of the ongoing global bond rout, all eyes would be on the BOJ, and specifically whether Kuroda would engage his "Yield control" operation to stabilize the steepness of the JGB yield curve and implicitly support global bond yields in what DB said would be "full blown helicopter money" where the "BoJ is flying the copter over the US and may be about to become the new US government’s best friend." And sure enough that is precisely what Kuroda did last...

Read More »Ending a Taking Economy and Creating a Giving Economy (Part 1)

I am proud to have published essays by Zeus Y. since 2008. Part 2 will be published tomorrow. Ending a Taking Economy and Creating a Giving Economy: Confronting the Zero Interest Rate Policy (ZIRP) and Taking Effective Action by Zeus Yiamouyiannis (guest essay) Introduction The world can no longer afford a taking economy, where “make a killing” is the motto. Together we need to create a giving and sharing economy that...

Read More »The Trump Risk: Will President Trump Trigger a Recession?

Home of the Brave? BALTIMORE – It is a bright summer day outside. A dry breeze sweeps down Cathedral Street and blows away the hot, humid air. It is hard for us to imagine that anything bad could happen today. But bad things do happen – even on nice days. The weather was fine when General Custer rode out to the Little Bighorn, too. Over the weekend, we worked at putting up a board fence – with half-round treated...

Read More »Economy “Improves”, Americans Get Poorer

Cartoon by Bob Rich No Surprises BALTIMORE – We were not surprised by the big news last week. We saw it coming. Figures from the Conference Board research group revealed productivity sinking for the first time in three decades. We promised to explain why it was such a big deal. Rate hike fantasies have been a recurring theme since 2009. Given that the market for federal funds is dead as a doornail (banks continue to hold huge excess reserves with the Fed and therefore have no need to...

Read More »The Power Elite: Bumbling Incompetents

Geniuses in Charge BALTIMORE, Maryland – Is there any smarter group of homo sapiens on the planet? Or in all of history? We’re talking about Fed economists, of course. Not only did they avoid another Great Depression by bold absurdity…giving the economy more of the one thing of which it clearly had too much – debt. They also carefully monitored the economy’s progress so as to avoid any backsliding into normalcy. And where do we get this penetrating appraisal? From the Fed economists...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org