Every three months the rate of interest used to set the rents in Switzerland is reviewed. If it goes down some renters have the right to request a decrease in rent. If it goes up landlords can push up rents. This time the rate remained at 1.25%, however it looks set to rise next year. The interest rate used to set the reference rate is the average rate on Swiss mortgage loans outstanding at 30 September 2022. The average rate was 1.18%, up from 1.17% from the second...

Read More »Pay rise agreed for Switzerland’s public sector workers

© Robert Buchel | Dreamstime.com On 2 December 2022, Switzerland’s Federal Council agreed to boost the salaries of those working for the federal government by 2.5% in 2023. Inflation, which was 3% at the end of November 2022, has fuelled demands for higher pay. During negotiations, staff representatives pushed for a pay deal that fully made up for inflation. However, finance minister Ueli Maurer pointed out that Switzerland’s already negative budget should be...

Read More »Renewables and EVs in the Grip of Lesseps Syndrome

Most people are familiar with the Panama Canal, but they probably don’t know the first effort to build the Panama Canal, spanning almost a decade, was by France. Facing considerable initial naysaying and ridicule, Ferdinand de Lesseps had the acumen and drive to construct the Suez Canal. Success was realized after overcoming many obstacles and difficulties. Naturally enough, France turned to him to build a sea-level canal in Panama. Minority technical reports...

Read More »Attention turns to US Jobs while the Yen’s Surge Continues

Overview: There have been significant moves in the capital markets this week and participants are turning cautious ahead of the US employment report. After the US equity market rally stalled yesterday, nearly all the Asia Pacific bourses fell today. The strength of the yen (~3.8% this week) has weighed on Japanese equities (Nikkei -1.8% this week) and spurred the BOJ to buy ETFs today for the first time in five months. Europe’s Stoxx 600 is nursing a small loss as...

Read More »Swiss Consumer Price Index in November 2022: +3.0 percent YoY, 0.0 percent MoM

01.12.2022 – The consumer price index (CPI) remained stable in November 2022 compared with the previous month, remaining at 104.6 points (December 2020 = 100). Inflation was +3.0% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO). The stability of the index compared with the previous month is the result of opposing trends that offset each other overall. Prices for housing rentals, gas and fuels increased,...

Read More »Credit Suisse looks to speed up cuts as revenue outlook worsens

Credit Suisse shares fell to a fresh record low on Thursday © Keystone / Michael Buholzer Swiss bank Credit Suisse is looking for ways to accelerate cost cuts announced just weeks ago as client outflows and a slowdown in activity weigh on its revenue outlook, according to three people with knowledge of the talks. The cost savings are likely to involve more job cuts than previously announced for the first wave of reductions, including in its mainstay wealth...

Read More »Deflation Is Not a Problem: Reversing It Is

The yearly growth rate of the Consumer Price Index (CPI) fell to 7.7 percent in October from 8.2 percent in September. Note that in October 2021 the yearly growth rate stood at 6.2 percent. Some experts are of the view that it is quite likely that the momentum of the CPI might have peaked. We suggest that the decline in the yearly growth rate of the CPI is from the sharp decline in the momentum of money supply. The yearly growth rate of our monetary measure for the...

Read More »On Secession and Small States

The international system we live in today is a system composed of numerous states. There are, in fact, about two hundred of them, most of which exercise a substantial amount of autonomy and sovereignty. They are functionally independent states. Moreover, the number of sovereign states in the world has nearly tripled since 1945. Because of this, the international order has become much more decentralized over the past eighty years, and this is largely due to the...

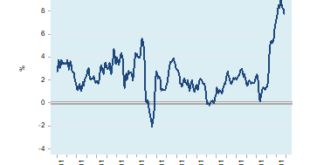

Read More »December 2022 Monthly

As the year of aggressive monetary tightening winds down, the Federal Reserve, the European Central Bank, and the Bank of England will likely slow the pace of rate hikes. All three delivered 75 bp hikes in November and will probably hike by 50 bp this month and moderate the pace again in the first part of next year.Price pressures remain elevated even if near or slightly past the peaks. The G10 central banks are not finished tightening, though central banks from...

Read More »The way forward:

A practical roadmap to reclaiming individual and financial sovereignty – Part II of II Essential ingredients There have always been people with a passion for liberty. Since the earliest historical records, we can find questioners, dissenters, “trouble makers”, contrarians and all kinds of free and inquisitive minds. In this day and age, however, technology has played a decisive role in the influence they can have. Sure, the “bad guys” might be taking...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org