Long before there was the infamous German inflation of 1923, the Reichsbank created the scenario of monetary debasement. Original Article: "The Reichsbank: Germany's Central Bank Lays Foundation of Monetary Disaster" This Audio Mises Wire is generously sponsored by Christopher Condon. [embedded content] Tags: Featured,newsletter...

Read More »Notes from the Digital Gulag

As the author of Google Archipelago: The Digital Gulag and the Simulation of Freedom, I guess I should not be surprised to find myself squarely in the digital gulag—banished, perhaps permanently, from Twitter and Facebook. Twitter permanently suspended my account several weeks ago, mere days before Elon Musk took over the helm. Although I cannot be sure, I may have been banned because I suggested that the transgender movement is part of a multipronged neo-Malthusian...

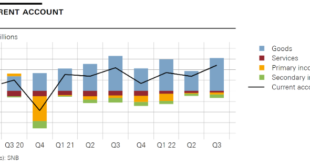

Read More »Swiss balance of payments and international investment position: Q3 2022

Overview In the third quarter of 2022, the current account surplus amounted to CHF 24 billion – a very high figure from a long-term perspective. This was attributable to the high surplus in goods trade and the relatively low deficits in services trade and in primary income. Compared to the same quarter of 2021, however, the increase in the current account balance (CHF 2 billion) was moderate because the basis for comparison was also high. In the financial account,...

Read More »Year End Message to Our Readers – Offline From 23rd December to 2nd January

Fintech News Switzerland would like to take this opportunity to wish all our readers a Merry Christmas and a very Happy New Year. We will be taking a break from the 23rd December 2022 to the 2nd January 2023. Until then, you can access some of our year-end articles that may be of interest to you. We look forward to seeing you all again on the 3rd January 2023! Crypto Winter Wipes Out 72,000 Bitcoin Millionaires in 2022 [embedded content] BIS: New Global Bank...

Read More »Grover Cleveland Presented the Best Example of a True Liberal Populist

Six years after the election of Donald Trump, the Republican Party is still adrift. On the one hand, the GOP has embraced an antiestablishment and populist message. On the other hand, Republicans have not quite figured out how to balance populism with classically liberal values like constitutionalism and free markets. Indeed, populism and classical liberalism seem to be in direct conflict. Questions remain about how Republican populists will regulate (or not...

Read More »Ukraine’s War with Russia Has Nothing to Do With Freedom

Yesterday, Ukrainian President Volodymyr Zelensky appeared before a joint session of Congress to plead for more billions of dollars of U.S. taxpayer money to help Ukraine in its war with Russia. One particular sentence in Zelensky’s address caught my attention: “We Ukrainians will also go through our war of independence and freedom with dignity and success.” The sentence prompted an enormous applause from the members of Congress. There is one big problem...

Read More »What’s Your Line in the Sand? The $25 Burger?

The gag reflex kicks in at some point and we walk away because it is no longer worth the price. Everyone has a line in the sand when it comes to inflated prices they refuse to pay. For one Walmart shopper I observed, it was a carton of eggs for close to $10. She announced her line in the sand verbally, with great force and sincerity. What’s your line in the sand, the point at which you simply refuse to pay the asking price? Is it the $25 burger? Or is it the $50 for...

Read More »Quarterly Bulletin Q4/2022

Monetary policy report Report for the attention of the Governing Board of the Swiss National Bank for its quarterly assessment of December 2022 The report describes economic and monetary developments in Switzerland and explains the inflation forecast. It shows how the SNB views the economic situation and the implications for monetary policy it draws from this assessment. The first section (‘Monetary policy decision of 15 December 2022’) is an excerpt from the press...

Read More »Student Debt: It Is and Has Been a Personal Choice

The Supreme Court of the United States will hear plaintiff and defendant oral arguments for Biden v. Nebraska in February 2023. That case will determine whether the Biden administration has the constitutional authority to forgive student loan debt and thereby make taxpayers responsible for the debts that students have incurred. This past year President Biden announced that his administration would forgive federal student loans. According to the Congressional Budget...

Read More »Secession: Why the Regime Tolerates Self-Determination for Foreigners, but Not for Americans

Opponents of secession in the United States often choose from several reasons as to why no member state of the United States should be allowed to separate from the rest of the confederation. Some antisecessionists say it’s bad for national security reasons. Others oppose secession for nationalistic reasons, declaring that “we”—whoever that is—shouldn’t “give up on America.” Antisecessionists Believe Self-Determination Leads to “Bad” Laws One of the most popular...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org