1) Indonesia announced it will allow full foreign ownership in many local industries in an effort to boost foreign investment 2) The Thai military government called a referendum on the new constitution on July 31 3) Poland’s ruling Law and Justice party dropped its backing for candidate Wnorowski to join the MPC 4) The IMF is starting to warn Ukraine 5) Press reports suggest some slippage in Brazil’s fiscal consolidation efforts 6) Mexico’s Finance Minister Videgaray acknowledged...

Read More »Liberty and the 500 Euro Note

The internecine pitch battle between ECB President Draghi and the man who may very well be his successor, Bundesbank President Weidmann opened a new front this week. It is over the future of the 500 euro note. Practically, every initiative by Draghi has been resisted by the Bundesbank. Sometimes it puts the Bundesbank at odds with Berlin, like over the Outright Market Transactions (OMT), which has not been operationalized. Still, after unsuccessfully blocking the program, Weidmann...

Read More »Liberty and the 500 Euro Note

The internecine pitch battle between ECB President Draghi and the man who may very well be his successor, Bundesbank President Weidmann opened a new front this week. It is over the future of the 500 euro note. Practically, every initiative by Draghi has been resisted by the Bundesbank. Sometimes it puts the Bundesbank at odds with Berlin, like over the Outright Market Transactions (OMT), which has not been operationalized. Still, after unsuccessfully blocking the program, Weidmann...

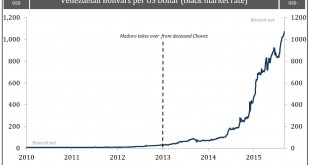

Read More »Can Maduro Mayhem Last to 2017

Things are turning increasingly ugly in Venezuela between President Maduro and the opposition MUD. The core political problem after December 2015 elections is the PSUV are now using the courts to neuter any opposition voices that formally hold a legislative majority to start holding the government to account. Right on cue, Mr. Maduro just railed a decree through the Supreme Court (TSJ) giving him total control over budgetary measures, utilize any property, suspect constitutional rights...

Read More »Can Maduro Mayhem Last to 2017

Things are turning increasingly ugly in Venezuela between President Maduro and the opposition MUD. The core political problem after December 2015 elections is the PSUV are now using the courts to neuter any opposition voices that formally hold a legislative majority to start holding the government to account. Right on cue, Mr. Maduro just railed a decree through the Supreme Court (TSJ) giving him total control over budgetary measures, utilize any property, suspect constitutional rights...

Read More »Global Markets Trying to End Week on Upbeat

The US S&P 500 closed above 1950 for the first time since January 6. Global equity markets are broadly higher in response. At the same time, ahead of the G20 meeting, the world's second and third-largest economies have signaled additional stimulus will be forthcoming. In Japan, the Abe government is reportedly considering a front-loaded supplemental budget for the start of the new fiscal year. The disappointing CPI figures reported earlier today, with headline and core measure...

Read More »Global Markets Trying to End Week on Upbeat

The US S&P 500 closed above 1950 for the first time since January 6. Global equity markets are broadly higher in response. At the same time, ahead of the G20 meeting, the world's second and third-largest economies have signaled additional stimulus will be forthcoming. In Japan, the Abe government is reportedly considering a front-loaded supplemental budget for the start of the new fiscal year. The disappointing CPI figures reported earlier today, with headline and core measure...

Read More »G20 Meeting is no Jedi Council

The G20 finance ministers and central bankers will meet in Shanghai starting tomorrow. From some quarters, there is a sense of urgency. The IMF, for example, is likely to cut its world GDP forecast of 3.4% this year. That forecast is not even two months old. The tightening of global financial conditions, exemplified by the sharp drop in share prices over the last six weeks is heightening anxiety among policymakers and investors alike. The IMF has called for a strong national and...

Read More »G20 Meeting is no Jedi Council

The G20 finance ministers and central bankers will meet in Shanghai starting tomorrow. From some quarters, there is a sense of urgency. The IMF, for example, is likely to cut its world GDP forecast of 3.4% this year. That forecast is not even two months old. The tightening of global financial conditions, exemplified by the sharp drop in share prices over the last six weeks is heightening anxiety among policymakers and investors alike. The IMF has called for a strong national and...

Read More »Market Anxiety Heightened, Oil and Stocks Head Lower, Sterling Can’t Catch a Bid

A confluence of factors are raising anxiety levels among investors, and it is being expressed in heightened volatility. The S&P 500 was turned back yesterday from the key 1945 level, and global equities are falling today. The over-production of oil is set to continue to Saudi Arabia denies intentions to cut output, and the Iranians scoffed at suggestions of freezing output. API reported another large rise in US crude stocks, which points to upside risks on the consensus estimate...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org