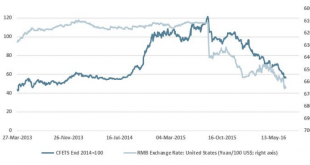

Summary Don’t be fooled, the yuan has fallen more against its basket that against the dollar this year. It is not clear what China means by stable. Market forces appear to be moving in the same direction as officials wish. Here are two Great Graphics that portray two time series: the dollar-yuan exchange rate and the yuan against a trade-weighted basket. The first chart comes from a highly reputable...

Read More »SIBOR Forex Banking Fraud – another FX rate rigging scandal

Forex has been the big banks secret gold mine, supporting their other losing operations (like normal banking business, lending, etc.). To a large extent this has been unraveling, and this SIBOR lawsuit is another attack on their risk free profit center (FX). Read the entire lawsuit released by Elite E Services here in full. More than 50 unknown defendants and about 20 known FX banks are named in the case, submitted...

Read More »Some question price of Swiss stocks as safe haven status awakened

Investec Switzerland. Swiss stocks, dislodged in 2015 as a haven from European volatility, have seen the status restored following Brexit — so much that some investors are balking at valuations. After trailing shares from Germany to France and Italy for most the past year, the Swiss Market Index is finding a new appeal in the fallout of the U.K. vote to leave the European Union. Investors buying up...

Read More »FX Daily, July 06: Dollar and Yen Advance Amid Growing Investor Angst

Swiss Franc Once again the SNB was heavily intervening and the pound fell against both euro and CHF.Thanks to SNB interventions, the Euro did not even dip under 1.08. Click to enlarge. Brexit What a difference a few days make. Many saw last week’s equity market advance a sign that Brexit anxiety was overdone. However, quarter-end position adjustments appear to have been misread. Equity markets are falling now....

Read More »Return of the Repressed: Europe’s Unresolved Banking Crisis

Summary The IMF identified three banks that posted the most significant systemic risks. It has been overshadowed by new pressure on Italy’s banks, and. Three UK commercial real estate funds have been frozen to prevent redemptions. The conventional narrative has it backward. It worries about the threats to stability emanating from the periphery in Europe. Policymakers, investors, and economists still refer to...

Read More »Yahoo Finance Editor “We’re Suffering Of Too Much Democracy”

Following James Traub’s mind-numbingly-elitist rebuttal of the democratic rights of “we, the people” in favor of allowing “they, the elite” to ensure the average joe doesn’t run with scissors, “It’s time for the elites to rise up against the ignorant masses.” The Brexit has laid bare the political schism of our time. It’s not about the left vs. the right; it’s about the sane vs. the mindlessly angry… The Guardian’s...

Read More »Planet Debt

Low Interest Rate Persons She is a low-interest-rate person. She has always been a low-interest-rate person. And I must be honest. I am a low-interest-rate person. If we raise interest rates, and if the dollar starts getting too strong, we’re going to have some very major problems. — Donald Trump BALTIMORE – With startling clarity, the presumptive Republican presidential nominee described himself – and Fed chief...

Read More »Gold Silver Update for Purists

Net Lines It’s that dreaded day after Independence Day. The weather is gorgeous and I don’t really feel like trading either. The thought of just phoning it in had occurred to me, but as the new month just rolled over I thought I may as well take another peek at our monthly charts. Which uncovered quite some interesting perspectives that I’m eager to share. But no worries – we’re keeping it light and easy...

Read More »Gold Siver Update for Purists

Net Lines It’s that dreaded day after Independence Day. The weather is gorgeous and I don’t really feel like trading either. The thought of just phoning it in had occurred to me, but as the new month just rolled over I thought I may as well take another peek at our monthly charts. Which uncovered quite some interesting perspectives that I’m eager to share. But no worries – we’re keeping it light and easy...

Read More »Is Carney the Sole Adult in UK’s Political Morass?

Summary Sterling has fallen to $1.3050. Two real estate funds have suspended trading (liquidation). Constitutional crisis over who has authority to trigger Article 50 may have begun. Sterling is continuing to move lower. It has tested the $1.3050 area in the North American morning, having been under pressure through the Asian session and the European morning. That the UK economy is slowing down, materially, as...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org