We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade...

Read More »Number of vacant homes rises again in Vaud

© Sam74100 | Dreamstime At 1 June 2017, 3,650 empty homes, of which 2,655 were for rent and 995 for sale, were on the market in Vaud. This brought the vacancy rate to 0.9%, a rise of 0.1% compared to the year before. This rise follows an increase of 0.1% in 2016 from a rate of 0.7% in 2015. The market is considered balanced when the vacancy rate reaches 1.5%. The last time it was above this mark in Vaud was in 1999....

Read More »Where there’s smoke, there’s political fire

A poster in a Swiss shop window advertises the sale of legal cannabis The rising popularity of marijuana that doesn’t make you high – a product known as “cannabis light” or “CBD cannabis” – is causing a headache for Swiss politicians. It is sold in many Swiss shops and generates millions of Swiss francs in sales. Swiss authorities now ban growing, selling or consuming cannabis with a THC content, the main psychoactive...

Read More »“Financial Crisis” In 2017 Or By End Of 2018 – Prepare Now

“Financial Crisis Of Historic Proportions” Is “Bearing Down On Us” John Mauldin of Mauldin Economics latest research note, Prepare for Turbulence, is excellent and a must read warning about the coming financial crisis. Mind refreshed from what sounds like a wonderful honeymoon and having had the time to read some books outside his “comfort zone” he has come to the conclusion that we are on the verge of a “major...

Read More »Sterling, McCafferty, and BOE Policy

Summary: BOE hawk is arguing for a sooner unwind of QE. He did not favor the renewed asset purchases after the referendum. Sterling has been meeting resistance near $1.30 for past two months. Sterling’s advance today is being attributed to comments by a member of the Bank of England’s Monetary Policy Committee McCafferty. However, we suspect it was a news item that was used to justify the price gains that was...

Read More »US S&P 500 Index, Federal Funds Target, Manufacturing Payrolls, US Imports and US Banking Data: All Conundrums Matter

Since we are this week hypocritically obsessing over monetary policy, particularly the federal funds rate end of it, it’s as good a time as any to review the full history of 21st century “conundrum.” Janet Yellen’s Fed has run itself afoul of the bond market, just as Alan Greenspan’s Fed did in the middle 2000’s. But that latter example wasn’t truly the first conundrum for monetary policy. There remain a great many...

Read More »FX Daily, July 18: Dollar Dumped on Doubts on US Economic Agenda

Swiss Franc The Euro has fallen by 0.20% to 1.1007 CHF. EUR/CHF and USD/CHF, July 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates News of the defection of two more Republican Senators doomed the Senate attempt to replace and repeal America’s national health care. The failure to replace the system dubbed Obamacare, despite the Republican majority in both legislative...

Read More »Stockholm Syndrome – Precious Metals Supply and Demand

Hostages of Irredeemable Scrip Stockholm Syndrome is defined as “…a condition that causes hostages to develop a psychological alliance with their captors as a survival strategy during captivity.” While observers would expect kidnapping victims to fear and loathe the gang who imprison and threaten them, the reality is that some don’t. There is a loose analogy between being held hostage and being an investor in a regime...

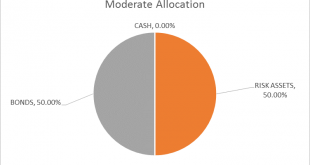

Read More »Global Asset Allocation Update: Not Yet

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolio this month. Growth and inflation expectations rose somewhat since last month’s update. The change is minor though and within the range of what we’ve seen in recent months. The most significant change from last month is the continued...

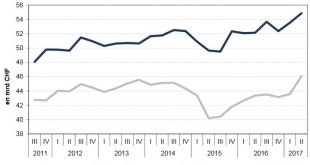

Read More »UBS worried about departing baby-boomers

Swiss unemployment services have been dealing with more and more older people. - Click to enlarge Switzerland is facing a medium-term future of labour market shortages and ratcheting pension costs, according to the latest economic outlook report by UBS bank. The quarterly appraisal,external link launched Thursday in Zurich, highlighted a paradox in the current shape of the Swiss labour market. Firstly, more and more...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org