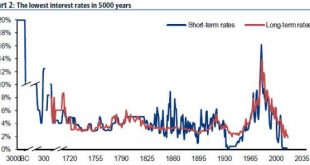

In the long run, as someone once said, we are all dead, but in the meantime, as BofAML’s Michael Hartnett provides a stunning tour de force of the last 5000 years illustrates long-run trends in the return, volatility, valuation & ownership of financial assets, interest rates & bond yields, economic growth, inflation & debt… The Longest Pictures reveals the astonishing history investors are living through...

Read More »Frontrunning: May 31

Major Bourses on Course to End Month Sharply Higher (WSJ) Brent crude lower on strong Middle East oil output (Reuters) Treasuries Lose Their Lead Over Shares as Fed Moves Toward Shift (BBG) Lost Decade for Value Stocks Tests Faithful Who Say End is Nigh (BBG) Iraqi army pause at southern edge of Falluja as IS fights back (Reuters) Risky Reprise of Debt Binge Stars U.S. Companies Not Consumers (BBG) The Untold Story Behind Saudi Arabia’s 41-Year U.S. Debt Secret (BBG) Nuns With Guns: The...

Read More »Futures Flat, Gold Rises On Weaker Dollar As Traders Focus On OPEC, Payrolls

After yesterday's US and UK market holidays which resulted in a session of unchanged global stocks, US futures are largely where they left off Friday, up fractionally, and just under 2,100. Bonds fell as the Federal Reserve moves closer to raising interest rates amid signs inflation is picking up. Oil headed for its longest run of monthly gains in five years, while stocks declined in Europe. Treasuries retreated in the first full day of trading since Yellen said late Friday that the improving...

Read More »Spain Sells 3x Oversubscribed 50-Year Bond

Following a scramble by European nations to issue ultra long-dated government paper, which saw France and Belgium sell 50-year bonds last month, while Ireland and Belgium went all the way and issued century bonds, with even Switzerland locking in 42-year paper yesterday, moments ago Spain was the latest to extend maturities all the way to 2066 when it sold €3 billion in 50 year bonds at Midswaps+50. According to MarketNews, the issue was over 3 times oversubscribed with the orderbook...

Read More »Guess Which Major Bank Loses The Most From Brexit?

Banks have been lobbying intensively against Brexit. Among those leading the charge is Goldman Sachs. For three years, the bank’s executives have publicly warned about the downsides of leaving the EU... and now we know why (hint - it's not concern for the common man). As The Wall Street Journal reports, about a decade ago, Goldman launched project “Armada,” a plan for a hulking European headquarters on the site of an old telephone exchange in London. Unbundling this kind of structure...

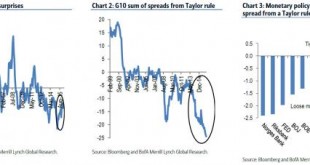

Read More »Bank Of America Reveals “The Next Big Trade”

Markets have stopped focusing on what central banks are doing and are "positioning for what they believe central banks may or may not do," according to BofA's Athanasios Vamvakidis as he tells FX traders to "prepare to fight the central banks," as the market reaction to central bank policies this year reflects transition to a new regime, in which investors start speculating which central bank will have to give up easing policies first. The market has started testing the central banks In...

Read More »Credit figures confirm our 2016 euro growth forecast

Strong money-supply growth in February enables us to maintain our forecast for euro area real GDP growth unchanged at 1.8% in 2016. Euro area bank credit flows increased again in February, in line with other indicators such as the ECB’s Bank Lending Survey (see the chart below) and quite remarkably given the challenging financial context in February. We continue to believe that the credit cycle has legs. Moreover, we expect the ECB’s new Targeted Long Term Refinancing Operations (TLTRO...

Read More »Euro area business surveys regain some momentum in March

Hard activity data for the euro area have improved since January, but downside risks still dominate despite the ECB’s support. At the very least, monetary policy looks set to remain exceptionally accommodative for an extended period of time. Euro area business surveys (PMIs and IFO) showed renewed signs of life in March after the drops seen in the first two months of the year. Surveys also highlighted the contrasting trend between the manufacturing sector, dented by a subdued external...

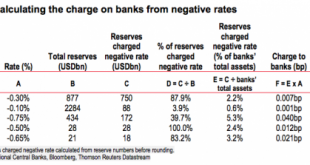

Read More »The ECB delivers a bigger-than-expected package to support bank lending

The ECB announced measures that exceeded expectations, targeting the refi rate, its monthly asset purchases, a new corporate bonds purchase programme, new TLTROs and a negative rate. The deposit rate was cut as expected, but Draghi said that “no more cuts” were anticipated at this stage. The ECB’s Governing Council delivered a comprehensive policy package that exceeded market expectations by a large margin. The 10bp deposit rate cut to -0.40% was expected but other measures were not,...

Read More »HSBC Looks At “Life Below Zero,” Says “Helicopter Money” May Be The Only Savior

In many ways, 2016 has been the year that the world woke up to how far down Krugman’s rabbit hole (trademark) DM central bankers have plunged in a largely futile effort to resuscitate global growth. For whatever reason, Haruhiko Kuroda’s move into NIRP seemed to spark a heretofore unseen level of public debate about the drawbacks of negative rates. Indeed, NIRP became so prevalent in the public consciousness that celebrities began to discuss central bank policy on Twitter. When we say “for...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org