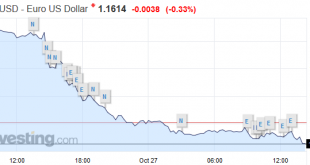

The focus in Europe has been Catalonia’s push for independence and the attempt by Madrid to prevent it. Tomorrow’s ECB meeting, where more details about next year’s asset purchases, is also awaited. There are three developments that we suspect have been overshadowed but are still instructive. First, the ECB reported that its balance sheet shrank last week. With the ECB set to take another baby step toward the exit, many...

Read More »Distinct Lack of Good Faith, Part ??

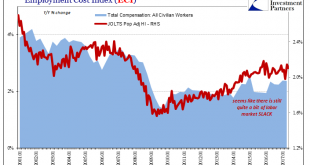

It was a busy weekend in retrospect, starting with Janet Yellen and other central bankers uncomfortably facing a global media that has become (for once) increasingly unconvinced. Reporters, really, don’t have much choice. The Federal Reserve Chairman might not be aware of just how much she has used the “transitory” qualifier since 2015, but others can’t be helped from noticing. At the Group of Thirty’s International...

Read More »Global Inflation Continues To Underwhelm

Chinese producer prices accelerated in September 2017, while consumer price increases slowed. The National Bureau of Statistics reported this weekend that China’s PPI was up 6.9% year-over-year, a quicker pace than the 6.3% estimated for August and a 5.5% rate in July. Earlier in the year producer prices were driven mostly by 2016’s oil rebound, along with those in the rest of the global economy, but in recent months...

Read More »Eurozone: Distinct Lack of Good Faith

The erosion of social order in any historical or geographic context is gradual; until it isn’t. Germany has always followed a keen sense of this process, having experienced it to every possible extreme between the World Wars. Hyperinflationary collapse doesn’t happen overnight; it took three years for the Weimar mark to disintegrate, and then Weimar Germany. Even Nazism wasn’t all it once. What was required was...

Read More »Global Asset Allocation Update: Step Away From The Portfolio

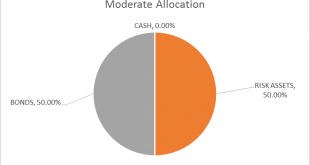

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolios this month. The post Fed meeting market reaction was a bit surprising in its intensity. The actions of the Fed were, to my mind anyway, pretty much as expected but apparently the algorithms that move markets today were singing from a...

Read More »Boris Johnson Threatens To Resign If Theresa May “Goes Against His Brexit Demands”, Pound Rises

In confirmation that Theresa May’s upcoming Florence speech this Friday is not only what many have called “the most important day for Brexit since the referendum”, but also the most opaque, the Telegraph reports that UK Foreign Secretary Boris Johnson will resign as before the weekend if Theresa May veers towards a “Swiss-style” arrangement with the EU in her upcoming speech. The Foreign Secretary believes he will have...

Read More »Global Asset Allocation Update: No Upside To Credit

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are other changes to the portfolio though so please read on. As I write this the stock market is in the process of taking a dive (well if 1.4% is a “dive”) and one can’t help but wonder if the long awaited and anticipated correction is finally at hand. Which means,...

Read More »Data Dependent: Interest Rates Have Nowhere To Go

In October 2015, Federal Reserve Vice Chairman Bill Dudley admitted that the US economy might be slowing. In the typically understated fashion befitting the usual clownshow, he merely was acknowledging what was by then pretty obvious to anyone outside the economics profession. Dudley was at that moment, however, undaunted. His eye was cast toward the unemployment rate and that was nothing but encouraging no matter the...

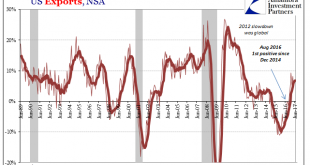

Read More »U.S. Export/Import: Losing Economic Trade

The oil effect continued to recede in late spring for more than just WTI prices or inflation rates. US trade on both sides, inbound and outbound, while still positive has stalled since the winter. US Exports, Jun 1989-2017 - Click to enlarge Exports grew by just 6.2% year-over-year (NSA) in June 2017, about the same pace as estimated in December 2016. After contracting for nearly two years, twenty-two months...

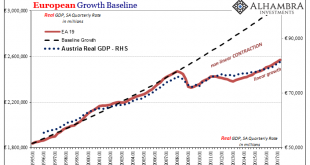

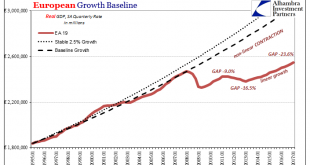

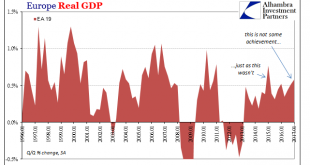

Read More »Europe’s Non-linear

Europe is as we all are. Ben Bernanke wrote a few years ago that his tenure at the Fed must have been a success in his view because the US economy didn’t perform as badly as Europe’s. As usual, this technically true comparison is for any meaningful purpose irrelevant. For one, the European economy underperformed before 2008, too. Second, after 2008, really August 9, 2007, there isn’t nearly as much difference as...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org