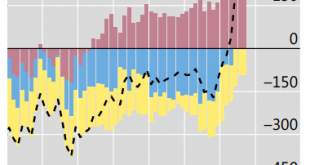

When I write that there are no winners around the world, what I mean is more comprehensive than just the trade wars. On that one narrow account, of course there are winners and losers. The Chinese are big losers, as the Census Bureau numbers plainly show (as well as China’s own). But even the winners of the trade wars find themselves wondering where all the spoils are. They may be winners because of it but somehow they all still end up in the losing column. Late...

Read More »Everything Comes Down To Which Way The Dollar Is Leaning

Is the global economy on the mend as everyone at least here in America is now assuming? For anyone else to attempt to answer that question, they might first have to figure out what went wrong in the first place. Most have simply assumed, and continue to assume, it has been fallout from the “trade wars.” That is a demonstrably false guess, one easily dispelled by the facts. A trade war produces winners from its losers. But we cannot find a single one. There have...

Read More »A Repo Deluge…of Necessary Data

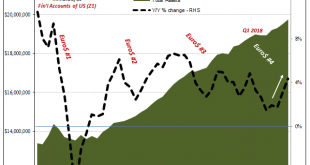

Just in time for more discussions about repo, the Federal Reserve delivers. Not in terms of the repo market, mind you, despite what you hear bandied about in the financial media the Fed doesn’t actually go there. Its repo operations are more RINO’s – repo in name only. No, what the US central bank actually contributes is more helpful data. Since our goal is to use that data to produce the best possible, most accurate interpretation of the facts, the depth and...

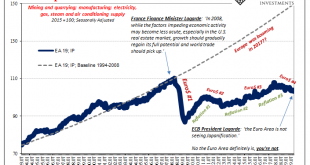

Read More »Lagarde Channels Past Self As To Japan Going Global

As France’s Finance Minister, Christine Lagarde objected strenuously to Ben Bernanke’s second act. Hinted at in August 2010, QE2 was finally unleashed in November to global condemnation. Where “trade wars” fill media pages today, “currency wars” did back then. The Americans were undertaking beggar-thy-neighbor policies to unfairly weaken the dollar. The neighbor everyone though most likely to be sponged off of was Europe. The day after the Fed’s second launch,...

Read More »If Trade Wars Couldn’t, Might Pig Wars Change Xi’s Mind?

Forget about trade wars, or even the eurodollar’s ever-present squeeze on China’s monetary system. For the Communist Chinese government, its first priority has been changed by unforeseen circumstances. At the worst possible time, food prices are skyrocketing. A country’s population will sit still for a great many injustices. From economic decay to corruption and rising authoritarianism, the line between back alley grumbling and open rebellion is usually a thick...

Read More »The BIS Misses An Opportunity To Get Consistent With The Facts

Much has been made about the repo market since mid-September. Much continues to be made about it. The question is why. It is now near the middle of December and repo looks dicey despite repo operations and a not-QE small-scale asset purchase intended to increase the level of bank reserves. Always the focus on “funds” which may be available. It was John Adams who took on the task of defending several British soldiers on trial for the Boston Massacre. A wholly...

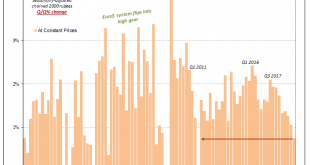

Read More »European Economy: A Time Recession

Eurostat confirmed earlier today that Europe has so far avoided recession. At least, it hasn’t experienced what Economists call a cyclical peak. During the third quarter of 2019, Real GDP expanded by a thoroughly unimpressive +0.235% (Q/Q). This was a slight acceleration from a revised +0.185% the quarter before. The real question, though, is whether the business cycle approach means anything in this day and age. I don’t think it does, and that’s a big part of why...

Read More »More Signals Of The Downturn, Globally Synchronized

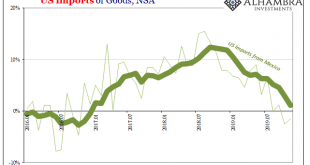

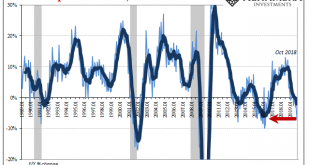

For US importers, October is their month. And it makes perfect sense how it would be. With the Christmas season about to kick into full swing each and every November, the time for retailers to stock up in hearty anticipation is in the weeks beforehand. The goods, a good many future Christmas presents, find themselves in transit from all over the world during the month of October. For the Census Bureau’s trade data, that means this is the month that shines above...

Read More »The Risen (euro)Dollar

Back in April, while she was quietly jockeying to make sure her name was placed at the top of the list to succeed Mario Draghi at the ECB, Christine Lagarde detoured into the topic of central bank independence. At a joint press conference held with the Governor of the Reserve Bank of South Africa, Lesetja Kganyago, as the Managing Director of the IMF Lagarde was asked specifically about President Trump’s habit of tweeting disdain in the direction of the Federal...

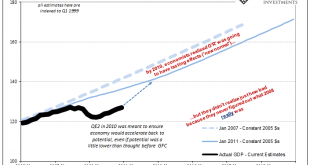

Read More »The Big One, The Smoking Gun

It wasn’t just the unemployment rate which was one of the key reasons why Economists and central bankers (redundant) felt confident enough to inspire 2017’s inflation hysteria. There was actually another piece to it, a bigger piece potentially complimentary and corroborative bit of conjecture. I write “conjecture” because despite how all this is presented in the media there’s very little precision to any of it. In many ways, if you pay close enough attention you...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org