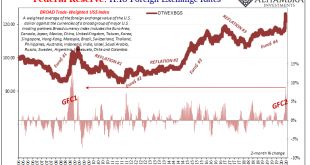

According to the Federal Reserve’s calculations, the US dollar in Q1 pulled off its best quarter in more than twenty years – though it really didn’t need the full quarter to do it. The last time the Fed’s trade-weighed dollar index managed to appreciate farther than the 7.1% it had in the first three months of 2020, the year was 1997 during its final quarter when almost the whole of Asia was just about to get clobbered. In second place (now third) for the dollar’s...

Read More »An International Puppet Show

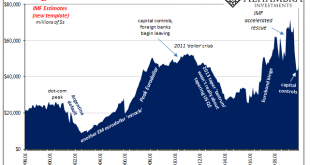

It’s actually pretty easy to see why the IMF is in a hurry to secure more resources. I’m not talking about potential bailout candidates banging down the doors; that’s already happened. The fund itself is doing two contradictory things simultaneously: telling the world, repeatedly, that it has a highly encouraging $1 trillion in bailout capacity at the same time it goes begging to vastly increase that amount. Very reassuring. The IMF is becoming like the Federal...

Read More »The Greenspan Bell

What set me off down the rabbit hole trying to chase modern money’s proliferation of products originally was the distinct lack of curiosity on the subject. This was the nineties, after all, where economic growth grew on trees. Reportedly. Why on Earth would anyone purposefully go looking for the tiniest cracks in the dam? My very first day on the job, as an intern my first boss told me to prepare myself. I was embarking on a career in the most absurd industry...

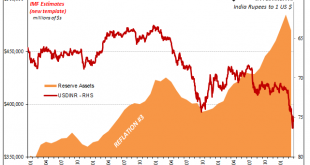

Read More »(No) Dollars And (No) Sense: Eighty Argentinas

India like many emerging market countries around the world holds an enormous stockpile of foreign exchange reserves. According to the latest weekly calculation published by the Reserve Bank of India (RBI), the country’s central bank, that total was a bit less than half a trillion. While it sounds impressive, when the month began the balance was much closer to that mark. Over the last several crisis-filled weeks, officials in India have been fighting against a...

Read More »Time Again For Triple Digit Dollar

Being a member of the institutional “elite” means never having to say you’re sorry; or even admit that you have no idea what you are doing. For Christine Lagarde, Mario Draghi’s retirement from the European Central Bank could not have come at a more opportune moment. Fresh off the Argentina debacle, she failed herself upward to an even better gig. Lagarde had staked a lot on the organization’s largest ever rescue plan. It was a show of force meant to shore up...

Read More »You Shouldn’t Miss The Cupom

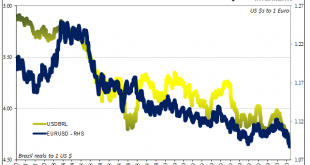

I actually wanted to focus on this yesterday but confirmation wasn’t forthcoming until today. So, it ended up being a broader note on the dollar which only included some mention of Brazil in passing. Still a worthwhile couple of minutes. There were rumors that Banco (central) do Brasil was intervening or was going to intervene in its local currency markets, which may be an important signal. More of swaps that aren’t really currency swaps (which you can read about...

Read More »Two Years And Now It’s Getting Serious

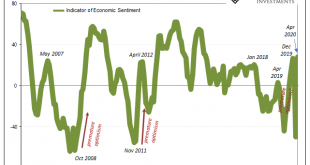

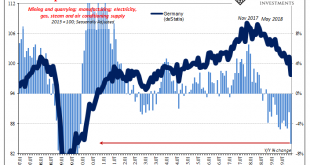

We knew German Industrial Production for December 2019 was going to be ugly given what deStatis had reported for factory orders yesterday. In all likelihood, Germany’s industrial economy ended last year sinking and maybe too quickly. What was actually reported, however, exceeded every pessimistic guess and expectation – by a lot. IP absolutely plummeted in the final month of 2019. Compared to the prior December, the index was down an alarming 6.7%. Minus seven...

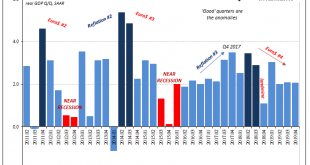

Read More »Three Straight Quarters of 2 percent, And Yet Each One Very Different

Headline GDP growth during the fourth quarter of 2019 was 2.05849% (continuously compounded annual rate), slightly lower than the (revised) 2.08169% during Q3. For the year, the Bureau of Economic Analysis (BEA) puts total real output at $19.07 trillion, or annual growth of 2.33% and down from 2.93% in 2018. Last year was weaker than 2017, the second lowest out of the six since 2013. And that’s where the good news ends. Eurodollar Disruption, Peaks &...

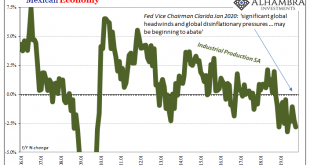

Read More »Not Abating, Not By A Longshot

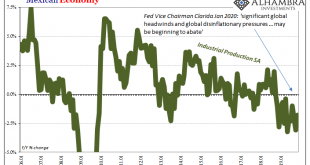

Since I advertised the release last week, here’s Mexico’s update to Industrial Production in November 2019. The level of production was estimated to have fallen by 1.8% from November 2018. It was up marginally on a seasonally-adjusted basis from its low in October. That doesn’t sound like much, -1.8%, but apart from recent months this would’ve been the third worst result since 2009. Mexico has rarely experienced that kind of seemingly mild contraction. It signals...

Read More »Global Headwinds and Disinflationary Pressures

I’m going to go back to Mexico for the third day in a row. First it was imports (meaning Mexico’s exports) then automobile manufacturing and now Industrial Production. I’ll probably come back to this tomorrow when INEGI updates that last number for November 2019. For now, through October will do just fine, especially in light of where automobile production is headed (ICYMI, off the bottom of the charts). Mexico is, as I’ve been writing this week, the presumed...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org