There are a lot of reasons why interest rates may have risen recently. The federal government is expected to post a larger deficit this year – and in future years – due to the tax cuts. Further exacerbating those concerns is the ongoing shrinkage of the Fed’s balance sheet. Increased supply and potentially decreased demand is not a recipe for higher prices. In addition, there is some fear that the ongoing trade...

Read More »Bi-Weekly Economic Review: Investing Is Not A Game of Perfect

The market volatility this year has been blamed on a lot of factors. The initial selloff was blamed on a hotter than expected wage number in the January employment report that supposedly sparked concerns about inflation – although a similar number this month wasn’t mentioned as a cause of last Friday’s selling. The unwinding of the short volatility trade exacerbated the situation and voila, 12% came off the market in a...

Read More »Bi-Weekly Economic Review: The New Normal Continues

There has been a lot of talk about the economic impact of the recent tax reform. All of it, including the analyses that include lots of fancy math, amounts to nothing more than speculation, usually informed by little more than the political bias of the analyst. I am guilty of that too to some degree but I don’t let my personal political views dictate how I view the economy for purposes of investing. I am, to put it...

Read More »Bi-Weekly Economic Review: A Weak Dollar Stirs A Toxic Stew

Economic Reports Employment We received several employment related reports in the first two weeks of the year. The rate of growth in employment has been slowing for some time – slowly – and these reports continue that trend. The JOLTS report showed a drop in job openings, hires and quits. The Fed has been talking about a tight labor market but this report peaked last July so that may not be as much a concern as they...

Read More »The Payroll Report To Focus On Is August’s, Not September’s

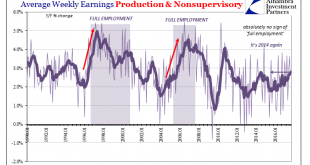

The hurricanes didn’t disappoint, causing major damage at least to the BLS. Precisely how much the statistics were affected by the disruptions in Texas and Florida really can’t be calculated, not that everyone won’t try. It makes this month’s payroll report a Rorschach test of sorts. You can pretty much make it out to be whatever you want. US Average Weekly Earnings, Jan 1990 - 2016(see more posts on U.S. Average...

Read More »Proving Q2 GDP The Anomaly, Incomes Yet Again Fail To Accelerate

One day after reporting a slightly better number for Q2 GDP, the BEA reports today that there is little reason to suspect it was anything more or lasting. The data for Personal Income and Spending shows that the dominant condition since 2012 remains in effect – “good” quarters, or whatever passes for one these days, are the anomaly. There still is no meaningful rebound in income. Real Personal Income excluding...

Read More »Bi-Weekly Economic Review: Ignore The Idiot

Of the economic releases of the past two weeks the one that got the most attention was the employment report. That report is seen by many market analysts as one of the most important and of course the Fed puts a lot of emphasis on it so the press spends an inordinate amount of time dissecting it. I don’t waste much time on it myself because it is subject to large revisions and has little predictive capability. In...

Read More »Bi-Weekly Economic Review: Attention Shoppers

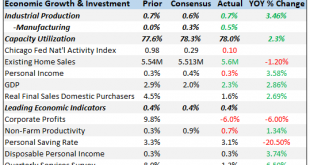

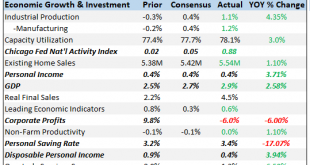

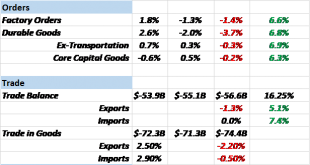

The majority of the economic reports over the last two weeks have been disappointing, less than the consensus expectations. The minor rebound in activity we’ve been tracking since last summer appears to have stalled. Retail sales continue to disappoint and inventory/sales ratios are once again rising – from already elevated levels. Even the positive reports were clouded by negative undertones. So far though our market...

Read More »Forced Finally To A Binary Labor Interpretation

JOLTS figures for the month of April 2017, released today, highlight what is in the end likely to be a more positive outcome for them. It has very little to do with the economy itself, as what we are witnessing is the culmination of extreme positions that have been made and estimated going all the way back to 2014. At that time, the BLS in its various data series suggested an almost perfect labor market acceleration...

Read More »The Anti-Perfect Jobs Condition

The irony of the unemployment rate for the Federal Reserve is that the lower it gets now the bigger the problem it is for officials. It has been up to this year their sole source of economic comfort. Throughout 2015, the Establishment Survey improperly contributed much the same sympathy, but even it no longer resides on the plus side of the official ledger. So many people may have exited the labor force in May that the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org