Don’t let “traditional biases” stop you from diversifying into gold – Dalio on Linkedin “Risks are now rising and do not appear appropriately priced in” warns founder of world’s largest hedge fund Geo-political risk from North Korea & “risk of hellacious war” Risk that U.S. debt ceiling not raised; technical US default Safe haven gold likely to benefit by more than dollar, treasuries Investors should allocate at...

Read More »The Secret History Of The Banking Crisis

Accounts of the financial crisis leave out the story of the secretive deals between banks that kept the show on the road. How long can the system be propped up for? - Click to enlarge It is a decade since the first tremors of what would become the Great Financial Crisis began to convulse global markets. Across the world from China and South Korea, to Ukraine, Greece, Brexit Britain and Trump’s America it has shaken...

Read More »“Sovereign Bond Prices, Haircuts, and Maturity,” IMF, 2017

IMF Working Paper 17/119, May 2017, with Tamon Asonuma and Romain Ranciere. PDF. Rejecting a common assumption in the sovereign debt literature, we document that creditor losses (“haircuts”) during sovereign restructuring episodes are asymmetric across debt instruments. We code a comprehensive dataset on instrument-specific haircuts for 28 debt restructurings with private creditors in 1999–2015 and find that haircuts on shorter-term debt are larger than those on debt of longer maturity....

Read More »Puerto Rico’s Debt Restructuring

On Econofact, Daniel Bergstresser provides background information on Puerto Rico’s debt crisis. From his text: Unlike U.S. municipalities, a U.S. territory cannot resort to Chapter 9 of the Bankruptcy act. The island’s economy benefited from corporate tax exemptions (until 2006) and from tax exemptions on interest paid by municipal bonds issued by Puerto Rico and its agencies (“triple tax exemption”). Total bond indebtedness (face value) amounts to over $70 billion, about 70 percent of...

Read More »Zimbabwe’s Monetary Policy

On his blog, JP Koning provides an account of recent monetary policy in Zimbabwe: The country dollarized in 2008. The central bank offered USD deposit accounts for banks, specifically for inter bank payments. But these accounts were not fully backed by USDs, or the central bank rationed access to USDs for other reasons (early 2016). Banks got squeezed, bank customers started a run, and the government imposed withdrawal limits. Retailers started to charge higher prices for “plastic money”...

Read More »Predictors of Default

On Science of Us, Seth Stephens-Davidowitz reports about predictors of loan repayment choices. … language that potential borrowers use is a strong predictor of their probability of paying back. And it is an important indicator even if you control for other relevant information lenders were able to obtain about those potential borrowers, including credit ratings and income. … Here are the phrases used in loan applications by people most likely to pay them back: debt-free, lower interest...

Read More »100 Years Ago, Russian Stocks Had A Very Bad Day

In recent months, Ray Dalio seems to be undergoing a deep midlife and identity crisis, which has not only led to dramatic recent management changes at the world’s largest hedge fund, Bridgewater, but also resulted in some fairly spectacular cognitive dissonance, as Dalio first praised, then slammed, president Trump. Yesterday. in the latest expression of his building anti-Trumpian sentiment, Bridgewater released a...

Read More »Currency Denomination Risk in the Euro Area

In the FT (Alphaville), Marcello Minnena explains what type of currency denominations of Euro area sovereign debt constitute credit events; and how markets assess the risk of such denominations. After the Greek default in 2012 new ISDA standards entered into force: contracts made since 2014 protect against euro area countries redenominating their debt into new national currencies [unless the debt is redenominated] into a reserve currency: the US dollar, the Canadian dollar, the British...

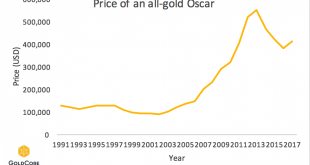

Read More »The Oscars – Gold Plated and Debased Like Dollar

The Oscars - Worth Their Weight in Gold? 89th Oscars to air this weekend Oscars have been dipped in 24 karat gold since 1929 If the Oscars were made of solid gold they would weigh 330 ounces 330 ounces of gold is worth $408,210 at today's prices (nearly €400k & £330k) Oscars cannot be sold, making them a tricky investment piece Steven Spielberg keeps his gold Oscar with the Academy for ‘safe-keeping’ Shows importance of owning gold in safest ways Price of gold has climbed from $20.67...

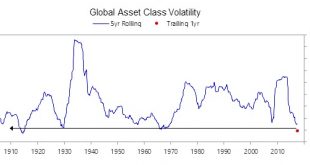

Read More »The VIX Will Be Over 100 due to Central Bank Created Tail Risk

By EconMatters We discuss the manner in which Central Banks have destroyed financial markets, and have the stage for what I label as the Red Swan Event in this video. When the Swiss National Bank holds risky Tech stocks in its portfolio, we are in unchartered territory! We had the Financial Crisis of 2008, and instead of learning from the mistakes of incentivizing excessive risk taking, the Central Banks were allowed to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org