Bad Reputation Years ending in 7, such as the current year 2017, have a bad reputation among stock market participants. Large price declines tend to occur quite frequently in these years. Just think of 1987, the year in which the largest one-day decline in the US stock market in history took place: the Dow Jones Industrial Average plunged by 22.61 percent in a single trading day. Or recall the year 2007, which marked...

Read More »1987, 1997, 2007… Just How Crash-Prone are Years Ending in 7?

Bad Reputation Years ending in 7, such as the current year 2017, have a bad reputation among stock market participants. Large price declines tend to occur quite frequently in these years. Just think of 1987, the year in which the largest one-day decline in the US stock market in history took place: the Dow Jones Industrial Average plunged by 22.61 percent in a single trading day. Or recall the year 2007, which marked...

Read More »Donald Trump: Warmonger-in-Chief

Cryptic Pronouncements If a world conflagration, God forbid, should break out during the Trump Administration, its genesis will not be too hard to discover: the thin-skinned, immature, shallow, doofus who currently resides in the Oval Office! The commander-in-chief – a potential source of radiation? - Click to enlarge This past week, the Donald has continued his bellicose talk with both veiled and explicit threats...

Read More »Federal Reserve President Kashkari’s Masterful Distractions

The True Believer How is it that seemingly intelligent people, of apparent sound mind and rational thought, can stray so far off the beam? How come there are certain professions that reward their practitioners for their failures? The central banking and monetary policy vocation rings the bell on both accounts. Today we offer a brief case study in this regard. Photo credit: Linda Davidson / The Washington Post -...

Read More »Fed Quack Treatments are Causing the Stagnation

Bleeding the Patient to Health There’s something alluring about cure-alls and quick fixes. Who doesn’t want a magic panacea to make every illness or discomfort disappear? Such a yearning once compelled the best and the brightest minds to believe the impossible for over two thousand years. Instantaneous relief! No matter what your affliction is, snake oil cures them all. - Click to enlarge For example, from antiquity...

Read More »India: The Genie of Lawlessness is out of the Bottle

Recapitulation (Part XVI, the Last) Since the announcement of demonetization of Indian currency on 8th November 2016, I have written a large number of articles. The issue is not so much that the Indian Prime Minister, Narendra Modi, is a tyrant and extremely simplistic in his thinking (which he is), or that demonetization and the new sales tax system were horribly ill-conceived (which they were). Time erases all...

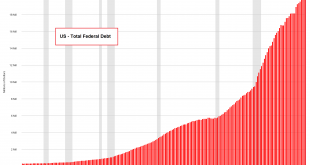

Read More »US Debt: To Hell In A Bucket

No-one Cares… “No one really cares about the U.S. federal debt,” remarked a colleague and Economic Prism reader earlier in the week. “You keep writing about it as if anyone gives a lick.” We could tell he was just warming up. So, we settled back into our chair and made ourselves comfortable. “The voters certainly don’t care about the federal debt,” he continued. “They keep electing the same spendthrifts to office. And...

Read More »21st Century Shoe-Shine Boys

Anecdotal Flags are Waved “If a shoeshine boy can predict where this market is going to go, then it’s no place for a man with a lot of money to lose.” – Joseph Kennedy It is actually a true story as far as we know – Joseph Kennedy, by all accounts an extremely shrewd businessman and investor (despite the fact that he had graduated in economics*), really did get his shoes shined on Wall Street one fine morning,...

Read More »The Government Debt Paradox: Pick Your Poison

Lasting Debt “Rule one: Never allow a crisis to go to waste,” said President Obama’s Chief of Staff Rahm Emanuel in November of 2008. “They are opportunities to do big things.” At the time of his remark, Emanuel was eager to exploit the 2008 financial crisis to raid the public treasury. With the passage of the American Recovery and Reinvestment Act in February 2009, Emanuel’s wish was granted. The Obama administration...

Read More »Christopher Columbus and the Falsification of History

Crazed Decision The Los Angeles City Council’s recent, crazed decision* to replace Christopher Columbus Day with one celebrating “indigenous peoples” can be traced to the falsification of history and denigration of European man which began in earnest in the 1960s throughout the educational establishment (from grade school through the universities), book publishing, and the print and electronic media. Christopher...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org