Preventing the Last Crisis Clear thinking and discerning rigor when it comes to the twisted state of present economic policy matters brings with it many physical ailments. A permanent state of disbelief, for instance, manifests in dry eyes and droopy shoulders. So, too, a curious skepticism produces etched forehead lines and nighttime bruxism. The terrible scourge of bruxism and its potentially terrifying...

Read More »S&P 500 Index: A Single Day Beats the Entire Week!

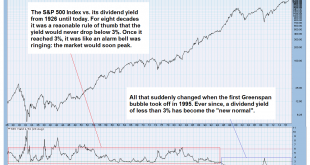

Recurring Phenomena Many market participants believe simple phenomena in the stock market are purely random events and cannot recur consistently. Indeed, there is probably no stock market “rule” that will remain valid forever. However, there continue to be certain statistical phenomena in the stock market – even quite simple ones – that have shown a tendency to persist for very long time periods. In today’s report I...

Read More »Hidden Forces of Economics

Waiting for the Flood We have noticed a proliferation of pundits, newsletter hawkers, and even mainstream market analysts focusing on one aspect of the bitcoin market. Big money, institutional money, public markets money, is soon to flood into bitcoin. Or so they say. We will not offer our guess as to whether this is true. Instead, we want to point out something that should be self-evident. If big money is soon to come...

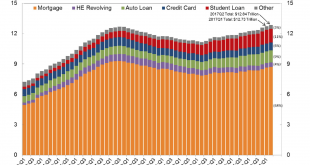

Read More »Why There Will Be No 11th Hour Debt Ceiling Deal

Milestones in the Pursuit of Insolvency A new milestone on the American populaces’ collective pursuit of insolvency was reached this week. According to a report published on Tuesday by the Federal Reserve Bank of New York, total U.S. household debt jumped to a new record high of $12.84 trillion during the second quarter. This included an increase of $552 billion from a year ago. United States Consumer DebtUS consumer...

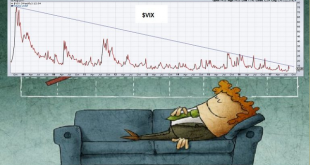

Read More »Is Historically Low Volatility About to Expand?

Suspicion Asleep You have probably noticed it already: stock market volatility has recently all but disappeared. This raises an important question for every investor: Has the market established a permanent plateau of low volatility, or is the current period of low volatility just the calm before the storm? When such questions regarding future market trends arise, it is often worthwhile to examine market history. For...

Read More »Yanking the Bank of Japan’s Chain

Mathematical Certainties Based on the simple reflection that arithmetic is more than just an abstraction, we offer a modest observation. The social safety nets of industrialized economies, including the United States, have frayed at the edges. Soon the safety net’s fabric will snap. This recognition is not an opinion. Rather, it’s a matter of basic arithmetic. The economy cannot sustain the government obligations...

Read More »Prepare for Another Market Face Pounding

“Better than Goldilocks” “Markets make opinions,” goes the old Wall Street adage. Indeed, this sounds like a nifty thing to say. But what does it really mean? The bears discover Mrs. Locks in their bed and it seems they are less than happy. [PT] Perhaps this means that after a long period of rising stocks prices otherwise intelligent people conceive of clever explanations for why the good times will carry on. ...

Read More »What Went Wrong With the 21st Century?

Fools and Rascals And it’s time, time, time And it’s time, time, time It’s time, time, time that you love And it’s time, time, time… – Tom Waits [embedded content] Tom Waits rasps about time POITOU, FRANCE – “So how much did you make last night?” “We made about $15,000,” came the reply from our eldest son, a keen cryptocurrency investor. “Bitcoin briefly pierced the $3,500 mark – an all-time high. The market cap of...

Read More »Views From the Top of the Skyscraper Index

Views From the Top of the Skyscraper Index On a warm Friday Los Angeles morning in spring of 2016, we found ourselves standing at the busy corner of Wilshire Boulevard and South Figueroa Street. We were walking back to our office following a client wire brushing for events beyond our control. But we had other thoughts on our mind. Standing amid a mob of pedestrians, we gazed up at the skeleton frame of what would...

Read More »Incrementum Advisory Board Meeting, Q3 2017

Global Monetary Architecture The quarterly Incrementum Advisory Board meeting was held last week (the full transcript is available for download below). Our regulars Dr. Frank Shostak and Jim Rickards were unable to attend this time, but we were joined by special guest Luke Gromen of research house “Forest for the Trees” (FFTT; readers will find free samples of the FFTT newsletter at the site and in case you want to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org