Awesome Forecasts and the Unknowable Future Back in late 2013 I wrote a piece on human nature which was in part inspired by the bullish exuberance exhibited by a MarketWatch article predicting the DJIA at 20,000 in the near term future. Yesterday afternoon, a bit over three years later, that prediction actually became reality and I’m sure the author of that article as well as many other like minded traders popped some champagne in celebration of their awesome ability to predict the future. Now don’t get me wrong, I’m happy for those guys and for the Dow Jones. Assuming of course that everyone involved actually put their money where their mouth was back then – which ever few do. And that in essence was the underlying message of my post. In yesterday’s update I briefly touched on hindsight bias and how we all have a knack for bending the past in our respective favor. Nobody wants to look stupid after all. And in hindsight, all of us would have liked to have bought the S&P 500 at 667 in 2008 and then traded it all the way up to just below 2300 today. A trader from the (near) future. Image via tumblr.com - Click to enlarge Except of course that we didn’t (please raise your hand if you did).

Topics:

Evil Speculator considers the following as important: Debt and the Fallacies of Paper Money, Featured, newslettersent, The Stock Market

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Awesome Forecasts and the Unknowable FutureBack in late 2013 I wrote a piece on human nature which was in part inspired by the bullish exuberance exhibited by a MarketWatch article predicting the DJIA at 20,000 in the near term future. Yesterday afternoon, a bit over three years later, that prediction actually became reality and I’m sure the author of that article as well as many other like minded traders popped some champagne in celebration of their awesome ability to predict the future. Now don’t get me wrong, I’m happy for those guys and for the Dow Jones. Assuming of course that everyone involved actually put their money where their mouth was back then – which ever few do. And that in essence was the underlying message of my post. In yesterday’s update I briefly touched on hindsight bias and how we all have a knack for bending the past in our respective favor. Nobody wants to look stupid after all. And in hindsight, all of us would have liked to have bought the S&P 500 at 667 in 2008 and then traded it all the way up to just below 2300 today. |

|

| Except of course that we didn’t (please raise your hand if you did). And that is quite a humbling lesson to learn in our ongoing quest to obtain riches from market participants who happen to disagree with us. It’s not that we didn’t foresee this event, actually many people probably did.

It is about how difficult it is to actually translate such information or ideas into profits. Back in 2008, as well as in 2013, there was no way of truly knowing where the DJIA or the S&P 500 would be trading all those years later. So what makes anyone think they know what the future holds – today? Over the eight plus years since the launch of the Evil Speculator trading blog, we have seen markets change, regulations change, and even the way we trade change (mainly due to mobile technology). We now compete with high frequency trading robots executing dozens of trades within nanoseconds. We even have to contend with online social media these days, which have the power to amplify a rumor into a market slide within mere minutes. If you think that predicting the level of the DJIA over the next week is difficult, then attempting to predict what may transpire several years down the line is not just foolish but borders on insanity. |

S&P 500 Index, Monthly S&P 500 Index, monthly – from utter despondency to foaming-at-the-mouth euphoria in eight years. The performance of the index is largely an artifact of run-away monetary inflation under the modern fiat money system, which has triggered a series of boom-bust cycles of increasing amplitude. The problem is that it takes more and more money creation to sustain bubble conditions and it cannot be blithely assumed that the effects will continue to remain confined to the prices of financial assets and capital goods - Click to enlarge |

Welcome to the FutureThe other day my wife sent me an article she had gleaned from her Kurzweil mailing list. Quite frankly, it gave me the chills. Apparently our esteemed EU leaders in Brussels have decided that it would be a great idea to introduce laws specific to robots that could give them civil rights regulations of their own, and set limits on how many human jobs they would be permitted to replace. |

EU bots, a.k.a. “electronic persons”. One wonders if there aren’t more important things for the eurocrats to worry about than the rights and obligations of machines. It sure appears though as if they have a lot of time on their hands. Then again, this urge to regulate things that don’t even exist yet, certainly tells us something about their pathological need to bring every nook and cranny of human life under bureaucratic control. Image credit: Getty Images - Click to enlarge |

| Not only may I be out of work sometime around 2025, but slapping my toaster for burning my slice of wheat may get me into legal trouble, at least if the EU has its way. The latter is of course a completely different story, as the future of the European Union is looking dimmer by the day. So perhaps it won’t come to this after all.

Instead of hover boards and flying cars we’ll be dealing with moody entitled hyper intelligent robots who will be able to perfectly learn a language or learn a trade in 15 minutes instead of 15 years. And they may have rights on top of all the obligatory regulations. A brave new world indeed! Maybe I can train one of them to run my blog and move my crusty butt to Aruba. Its jokes may be a bit stilted at first, but I’m sure version 2.0 will have that fixed in no time. Unless of course the damn thing is made in Germany. But all kidding aside, have any of you considered the impact of machine learning and artificial intelligence to our own immediate reality as traders? I’m not talking in perhaps ten or twenty years from now, but perhaps in three to five. As a matter of fact, I started to dabble with various aspects of machine learning in 2014 and what I found out after expending much time and effort was that it wasn’t ready for prime time just yet. But that can change quickly, especially if you throw advanced artificial intelligence and cloud computing into the mix. With AI we are talking about the potential of a semi-conscious intelligence which may soon not only exceed the realms of human intelligence and reasoning but keep growing from there – exponentially. Ray Kurzweil once called that moment in time ‘the singularity’ and it appears as though it is quickly approaching. Or perhaps it already has come and gone deep down in some government sponsored AI laboratory. Conclusion – Change will Keep AcceleratingThis means of course that the future not only remains absolutely unpredictable, but that the pace of change is going to keep accelerating. Mind, that doesn’t mean that technology will evolve on a linear or exponential curve. There may be setbacks triggered by wars and social chaos. Clearly though, the only reliable feature of life in the future will continue to be change itself. Good luck trying to predict what it will look like. Or the financial markets for that matter. This article was penned by The Mole and has originally appeared at the Evil Speculator. This version is lightly edited by PT. |

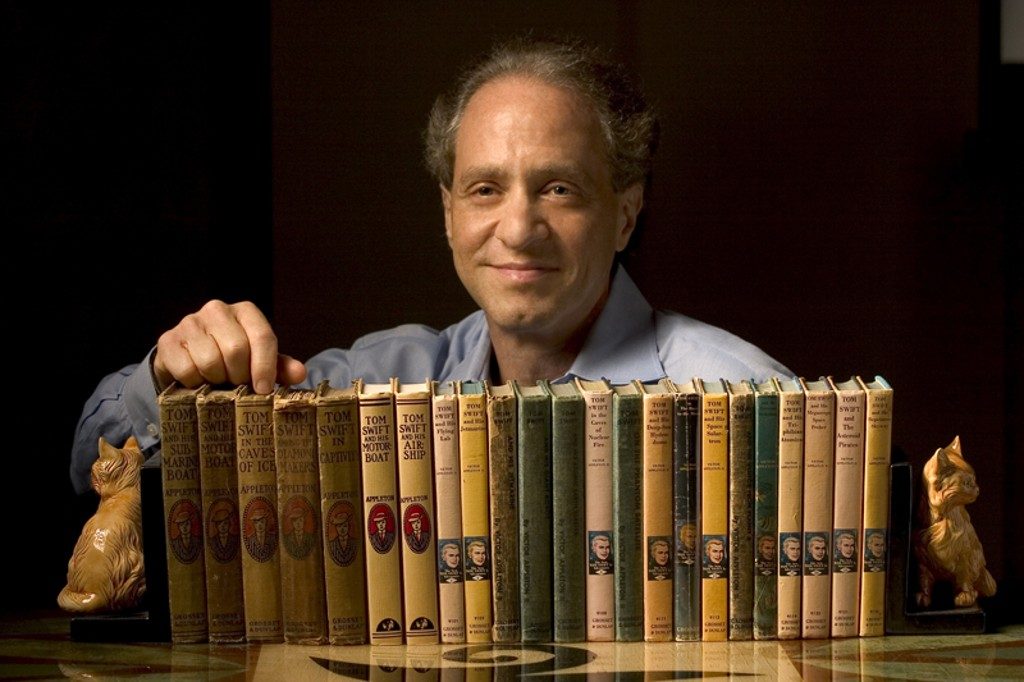

Inventor and entrepreneur Raymond Kurzweil, who popularized the term “singularity”, which was originally used by John von Neumann in the 1950s in the context of accelerating change caused by technological progress. In 1965, I.J. Good adopted the term to specifically describe the emergence of artificial intelligence, which he believed would immediately start improving itself and quickly become a super-intelligence, with change eventually progressing at incomprehensible rates. This is the also the sense in which Kurzweil employs the term, i.e., he holds that runaway technological progress will be triggered by the emergence of AI. The idea is essentially extrapolating from Moore’s law, which posits unceasing exponential growth in transistor density (and by implication, computing speeds). Many critics of Kurzweil’s thesis have made themselves heard over time. In our opinion, the most valid criticisms focus on the fact that an increase in processing and calculation power is not equivalent to creating human-type intelligence. It won’t magically bring about the emergence of consciousness, hence a digital “artificial intelligence” would lack motives, desires, beliefs, etc. In his 1989 book The Emperor’s New Mind, physicist Roger Penrose argues that a Turing machine (and therefore a digital computer) cannot attain consciousness, which he considers to be a non-algorithmic phenomenon. He enlarges on an argument made earlier by philosopher John R. Lucas (it has since become known as the Penrose-Lucas argument). The argument is based on Goedel’s 1931 proof of his incompleteness theorems. Goedel noted that a theory expressing elementary arithmetic cannot be both consistent and complete. Moreover, every consistent formal arithmetic theory contains an arithmetical statement that is true, but cannot be proved by the theory itself (praxeologists may be reminded of Mises’ remark that there are things beyond which we cannot inquire; praxeological reasoning is based on the action axiom, which represents this threshold – at the same time, the truth of the action axiom cannot be denied without getting entangled in insoluble contradictions). The Lucas-Penrose argument states that while a formal arithmetic system cannot demonstrate its own consistency or prove its incompleteness in line with Goedel’s theorem, human mathematicians are in fact capable of proving Goedelian results. Therefore, they cannot be described as formal proof systems, which shows that their thought is non-algorithmic. This in turn contradicts the notion that the human mind is merely a matter of computation or computational power. [Note: we are merely providing pointers for those interested in such ideas, which obviously require more in-depth study]. Photo credit: Michael Lutch - Click to enlarge |

Chart by: BigCharts

Chart and image captions by PT

Tags: Featured,newslettersent,The Stock Market