ECB President Draghi was unable to arrest the US dollar’s slide and euro’s surge. But he did not try particularly hard. While many investors are a bit stumped by the pace and magnitude of the dollar’s slump, Draghi seemed to imply that it was perfectly understandable given the recovery of the eurozone economy. The economy is the strongest it has been in more than a decade, but the US is no slouch. The US reports the...

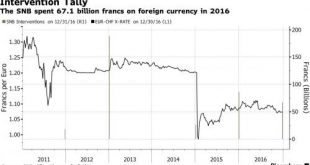

Read More »SNB Spent $68 Billion On Currency Manipulation In 2016

While Donald Trump has repeatedly expressed his displeasure with China for manipulating its currency, he appears to have recently figured out that over the past 2 years Beijing has been spending hundreds of billions in dollar to strengthen, not weaken, the Yuan and to halt the ~$1 trillion in capital flight from China. But while everyone knows that the biggest currency manipulation in the world, and perhaps the Milky...

Read More »FX Traders Have To (Re)Learn A New Skill

Dear FX traders: forget the dot plot, and prepare to learn a new – or to some forgotten – skill: how to read trade flows. As Bloomberg’s Vincent Cignarella and Andrea Wong point out, currency traders accustomed to analyzing the Fed’s dot plot and monthly U.S. jobs figures to predict the direction of the world’s reserve currency are having to learn, or in some cases re-learn, a largely forgotten ability: how to...

Read More »Cool Video: Bearish Case for Euro and Prospect of Currency Wars

Still in London as this part of the business trip is winding down. I had the privilege of going over to the Bloomberg office today and spoke with Vonnie Quinn and Mark Burton about the euro’s outlook and whether the US should have a strong or weak dollar.I sketch out my idea that the (upside) correction in the euro began in mid-December around following the Fed’s hike. Over the last couple weeks, I have been...

Read More »Trump and the Dollar

Summary: US official comments on the FX market appear to have increased in frequency. They are mostly warnings about a strong dollar, but not all comments are dollar-negative. Policy is the ultimate driver but comments pose headline risk. Although in office less than a fortnight, the new US Administration is showing a disregard not only for the domestic convention but international agreements like on...

Read More »Talk of Secret Shanghai Agreement is a Distraction

(I have been sick with pneumonia but am just about back. I expect to resume my commentary tomorrow. Here is my overdue monthly column for a Chinese paper. Thanks to everyone for their support.)Conspiracy theories have run amok. After several years of claiming countries were engaged in currency wars, or attempts to drive their currencies down to achieve export advantage, many reporters and analysts announced a volte-face. At the late February G20 meeting in Shanghai, a secret...

Read More »Are Central Banks Running Out of Steam?

In the old days, before the world was awash in capital with nowhere to go, an announcement of monetary easing was generally considered a good thing, a sign that central bankers were on the job. Historically, in all but the most extreme circumstances, lower interest rates have tended to spur economic activity, with the contemporaneous effect of supporting risky assets. But we are clearly living in an extreme circumstance, and after eight years of such announcements from central banks, it’s...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org