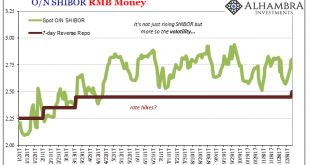

The PBOC has two seemingly competing objectives that in reality are one and the same. Overnight, China’s central bank raised two of its money rates. The rate it charges mostly the biggest banks for access to the Medium-term Lending Facility (MLF) was increased by 5 bps to 3.25%. In addition, its reverse repo interest settings were also moved up by 5 bps each at the various tenors (to 2.50% for the 7-day, 2.80% for the...

Read More »Retail Sales Bounce (Way) Too Much

Retail sales had a good month of November, or at least what counts as decent over the last five and a half years. Total retail sales (unadjusted) rose 6.35% last month, up from 4.9% (revised higher) in October. It was the highest rate of growth since the 29-day month of February 2016. For retailers, what matters is that it comes at the start of the Christmas shopping season. The question is why, or more so why now?...

Read More »Bi-Weekly Economic Review: Animal Spirits Haunt The Market

The economic data over the last two weeks continued the better than expected trend. Some of the data was quite good and makes one wonder if maybe, just maybe, we are finally ready to break out of the economic doldrums. Is it possible that all that new normal, secular stagnation stuff was just a lack of animal spirits? Is it possible that the mere anticipation of tax cuts was sufficient to break us out of the 2% growth...

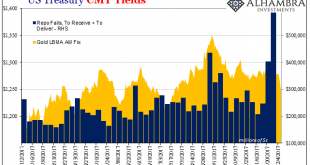

Read More »Chart of the Week: Collateral

It’s been a week of quite righteous focus on collateral. The 4-week bill equivalent yield closes it at just 114 bps, with only three days left before the RRP “floor” is moved up by the FOMC to 125 bps. That’s too much premium in price, though we know why given what FRBNY reported for repo fails last week. With all that, there’s really nothing much to say about what’s below. OK, there is, but I’ll save that for next...

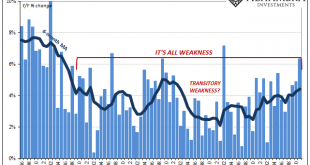

Read More »China Exports and Industrial Production: Revisiting Once More The True Worst Case

As weird as it may seem at first, the primary economic problem right now is that the global economy looks like it is growing again. There is no doubt that it continues on an upturn, but the mere fact that whatever economic statistic has a positive sign in front of it ends up being classified as some variant of strong. That’s how this works in mainstream analysis, this absence of any sort of gradation where if it’s...

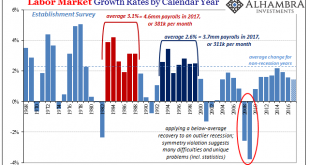

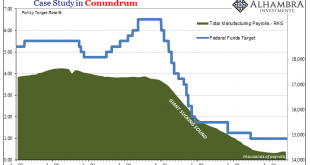

Read More »Defining The Economy Through Payrolls

The year 2000 was a transition year in a lot of ways. Though Y2K amounted to mild mass hysteria, people did have to get used to writing the date with 20 in front of the year rather than 19. It was a new millennium (depending on your view of Year 0) that seemed to have started off under the best possible terms. Not only were stocks on fire at the outset, the economy was, too. The idea of this “new economy” leading...

Read More »A Race To The Potential Behind Bitcoin

The timing just never seems to fall in our favor. If we had had this conversation ten years ago as would have been appropriate, then this evolution might have fell perfectly in our collective laps. Just as the global financial system, really the international, interbank monetary system of the eurodollar, was crashing all around us, the genesis block of the Bitcoin blockchain was hard coded. Within it contained very...

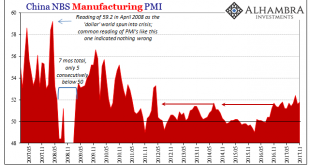

Read More »Three Years Ago QE, Last Year It Was China, Now It’s Taxes

China’s National Bureau of Statistics reported last week that the official manufacturing PMI for that country rose from 51.6 in October to 51.8 in November. Since “analysts” were expecting 51.4 (Reuters poll of Economists) it was taken as a positive sign. The same was largely true for the official non-manufacturing PMI, rising like its counterpart here from 54.3 the month prior to 54.8 last month. China Manufacturing...

Read More »Giant Sucking Sound Sucks (Far) More Than US Industry Now

There are two possibilities with regard to stubbornly weak US imports in 2017. The first is the more obvious, meaning that the domestic goods economy despite its upturn last year isn’t actually doing anything positive other than no longer being in contraction. The second would be tremendously helpful given the circumstances of American labor in the whole 21st century so far. In other words, perhaps US consumers really...

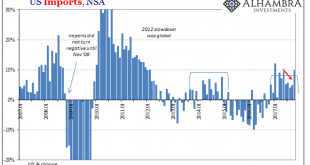

Read More »Reduced Trade Terms Salute The Flattened Curve

The Census Bureau reported earlier today that US imports of foreign goods jumped 9.9% year-over-year in October. That is the second largest increase since February 2012, just less than the 12% import growth recorded for January earlier this year. US Imports, Jan 2007 - 2017 - Click to enlarge In both monthly cases, however, the almost normal rates of increase which would have at least suggested moving closer to a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org