Black Friday was once the king of all shopping. A retailer could make its year up on that one day, often by gimmicking its way to insane single-day volume. Those days, however, are certainly over. Though the day after Thanksgiving still means a great deal, as the annual flood of viral consumer brawl videos demonstrate, it’s just not what it once was. The change has meant something in terms of economic commentary, too....

Read More »Durable Goods Only About Halfway To Real Reflation

Durable goods were boosted for a second month by the after-effects of Harvey and Irma. New orders excluding those from transportation industries rose 8.5% year-over-year in October 2017, a slight acceleration from the 6.5% average of the four previous months. Shipments of durable goods (ex transportation) also rose by 8% last month. US Core Durable Goods Orders, Jan 1993 - Jan 2017(see more posts on U.S. Core Durable...

Read More »Bi-Weekly Economic Review: A Whirlwind of Data

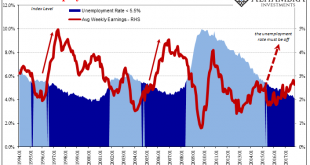

The economic data of the last two weeks was generally better than expected, the Citigroup Economic Surprise index near the highs of the year. Still, as I’ve warned repeatedly over the last few years, better than expected should not be confused with good. We go through mini-cycles all the time, the economy ebbing and flowing through the course of a business cycle. This being a particularly long half cycle, it has had...

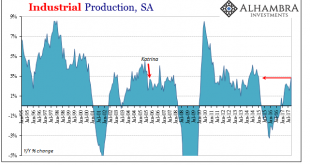

Read More »Industrial Production Still Reflating

Industrial Production benefited from a hurricane rebound in October 2017, rising 2.9% above October 2016. US Industrial Production, Jan 1995 - Nov 2017(see more posts on U.S. Industrial Production, ) - Click to enlarge That is the highest growth rate in nearly three years going back to January 2015. With IP lagging behind the rest of the manufacturing turnaround, this may be the best growth rate the sector will...

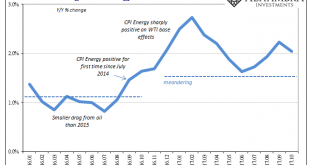

Read More »Can’t Hide From The CPI

On the vital matter of missing symmetry, consumer price indices across the world keep suggesting there remains none. Recoveries were called “V” shaped for a reason. Any economy knocked down would be as intense in getting back up, normal cyclical forces creating momentum for that to (only) happen. In the context of the past three years, symmetry is still nowhere to be found. It’s confounding even central bankers who up...

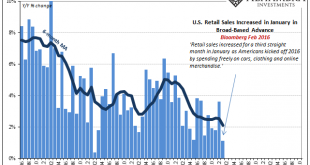

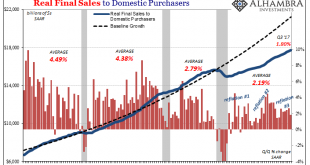

Read More »Retail Sales (US) Are Exhibit #1

In January 2016, everything came to a head. The oil price crash (2nd time), currency chaos, global turmoil, and even a second stock market liquidation were all being absorbed by the global economy. The disruptions were far worse overseas, thus the global part of global turmoil, but the US economy, too, was showing clear signs of distress. A manufacturing recession had emerged which would only ever be the case on weak...

Read More »What Central Banks Have Done Is What They’re Actually Good At

As a natural progression from the analysis of one historical bond “bubble” to the latest, it’s statements like the one below that ironically help it continue. One primary manifestation of low Treasury rates is the deepening mistrust constantly fomented in markets by the media equivalent of the boy who cries recovery. That narrative “has ruffled a few feathers,” BMO Capital Markets strategists Ian Lyngen and Aaron Kohli...

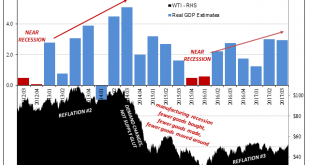

Read More »Globally Synchronized Downside Risks

Oil prices were riding high after several weeks of steady, significant gains. It’s never really clear what it is that might actually move markets in the short run, whether for crude it was Saudi Arabia’s escalating activities or other geopolitical concerns. Behind those, the idea of “globally synchronized growth” that is supposedly occurring for the first time since before the Great “Recession” while it may not have...

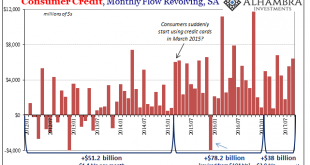

Read More »Consumer Credit Both Accelerating and Decelerating Toward The Same Thing

Federal Reserve revisions to the Consumer Credit series have created some discontinuities in the data. Changes were applied cumulatively to December 2015 alone, rather than revising downward the whole data series prior to that month. The Fed therefore estimates $3.531 trillion in outstanding consumer credit (seasonally-adjusted) in November 2015, and then just $3.417 trillion the following month. Of that $114.3 billion...

Read More »Aligning Politics To economics

There is no argument that the New Deal of the 1930’s completely changed the political situation in America, including the fundamental relationship of the government to its people. The way it came about was entirely familiar, a sense from among a large (enough) portion of the general population that the paradigm of the time no longer worked. It was only for whichever political party that spoke honestly to that...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org