Retail sales had a good month of November, or at least what counts as decent over the last five and a half years. Total retail sales (unadjusted) rose 6.35% last month, up from 4.9% (revised higher) in October. It was the highest rate of growth since the 29-day month of February 2016. For retailers, what matters is that it comes at the start of the Christmas shopping season. The question is why, or more so why now? Retail sales had been lagging, seriously weak throughout much of the middle parts of 2017. After rising at an almost normal clip in the back half of 2016, consumer spending materially softened starting in February. From that month until August, retail sales were up just 2.8% (seasonally-adjusted), or a

Topics:

Jeffrey P. Snider considers the following as important: consumer spending, currencies, economy, Featured, Federal Reserve/Monetary Policy, hurricanes, income, Inventory, Markets, newslettersent, Retail sales, The United States, U.S. Retail Sales

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

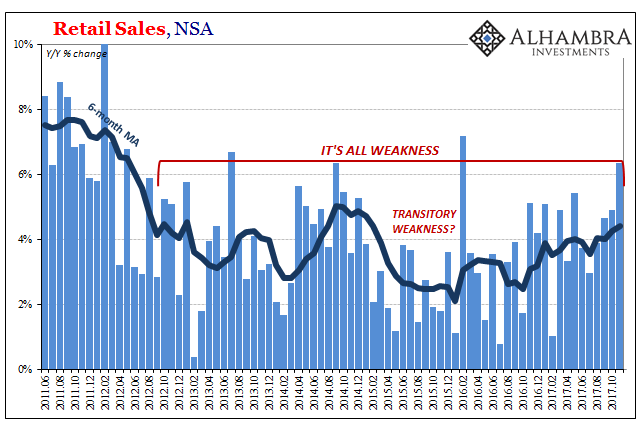

| Retail sales had a good month of November, or at least what counts as decent over the last five and a half years. Total retail sales (unadjusted) rose 6.35% last month, up from 4.9% (revised higher) in October. It was the highest rate of growth since the 29-day month of February 2016. For retailers, what matters is that it comes at the start of the Christmas shopping season.

The question is why, or more so why now? Retail sales had been lagging, seriously weak throughout much of the middle parts of 2017. After rising at an almost normal clip in the back half of 2016, consumer spending materially softened starting in February. From that month until August, retail sales were up just 2.8% (seasonally-adjusted), or a 3.3% annual rate of expansion closer to recession levels than accelerating consumer activity. |

US Retail Sales, Jun 2011 - Nov 2017 |

| In September, however, retail sales surged and have kept going for now three months in a row to November. In those three months, trade is up 3.3% (seasonally-adjusted) which works out to a ridiculous 14.3% annual rate. Either the economy suddenly flipped into 1984, or Harvey and Irma are leaving their first real imprint.

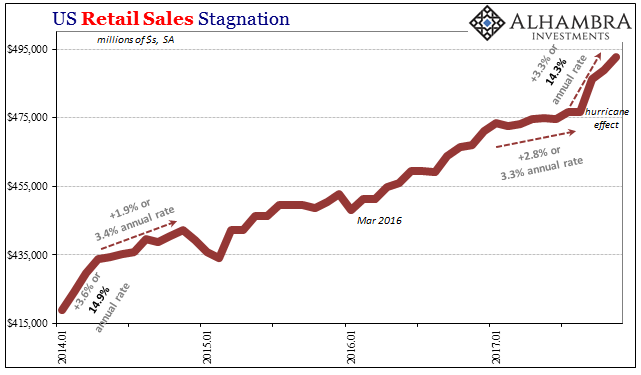

If the latter is the case, which seems quite likely, then we should expect flagging retail sales probably to start next year (after the holidays when the credit card bills come due, and then in 2018 insurance premiums in those storm-ravaged areas are “adjusted”). There is recent precedence for this kind of pause after a storm surge of spending. In early 2014, winter storms and the historic cold of that season’s Polar Vortex seriously undercut consumer activity to begin the wrong way what was supposed to be a fabulous economic year kicking off the long-awaited full recovery. Retail sales actually declined month-over-month in January 2014 (which suggested what was going on was more than the weather) and then jumped for three months afterward. In those three months, overall retail sales were up 3.6%, or a likewise ridiculous 14.9% annual rate. |

US Retail Sales, Jan 2014 - Nov 2017(see more posts on U.S. Retail Sales, ) |

| Following that rebound, rather than continue as economists had predicted, sales growth slowed dramatically. From May 2014 to that November, retail sales rose by just 1.9%, or a 3.4% annual rate again closer to recession than recovery. After November 2014, the economy fell into its “rising dollar” downturn in large part because of its weak starting point that year mischaracterized over and over as a very good one.

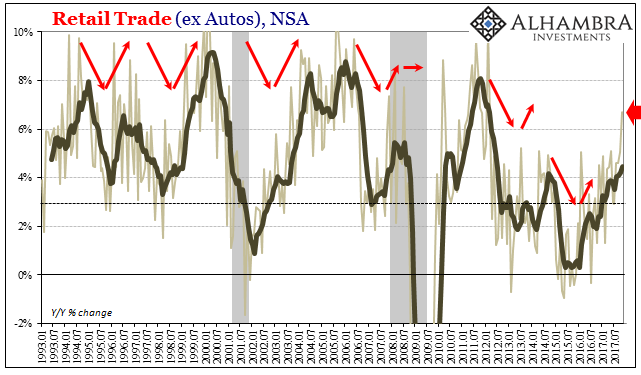

I have little doubt the same will recur, especially as some of the breakdowns in retail sales are so far out of the bounds of recent history. Retail Trade ex Autos, for instance, increased by 6.7% year-over-year (unadjusted) in November, by far the best estimate since the slowdown started in early 2012. |

US Retail Trade, Jan 1993 - Nov 2017 |

| Rather than suggest that something has changed, it really highlights, I believe, the anomalous nature of the number. Throughout the past almost six years, the mainstream has described the bad months as aberrations when in fact it has consistently been these decent ones that ultimately prove far too infrequent (as well as, like February 2016, for reasons unrelated to underlying economic strength). |

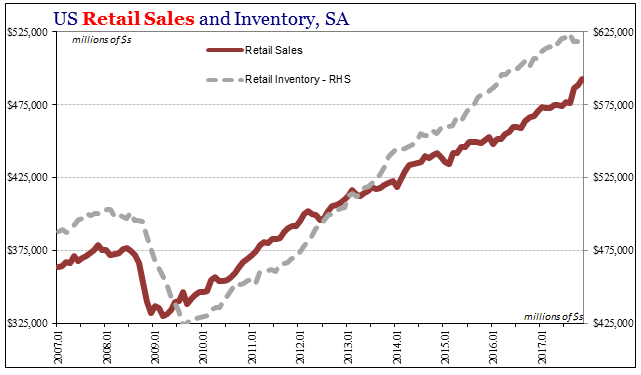

US Retail Sales and Inventory, Jan 2007 - Nov 2017(see more posts on U.S. Retail Sales, ) |

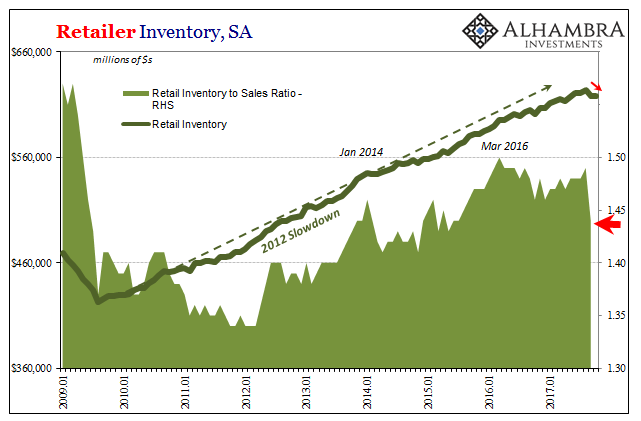

| There are some real benefits to the uptick in retail sales. Retail inventories, which had become highly bloated after the downturn in early 2015 and remained elevated throughout 2016, were drawn down in the aftermath of Harvey and Irma. With sales being boosted, inventory levels though still high aren’t nearly so now.

How retailers respond after all this will determine what that means; if they misinterpret the sales trend as real and therefore start rebuilding inventory stocks from where they are now, instead of letting them drop further, it could at first transfer the hurricane boost into (global) production but then make the later pullback that much more intensely negative. If retailers instead remain cautious about inventory as they have been (for good reason), it might mean continued softness in production but a better overall shape for the industry for having done it. |

US Retailer Inventory, Jan 2009 - Nov 2017 |

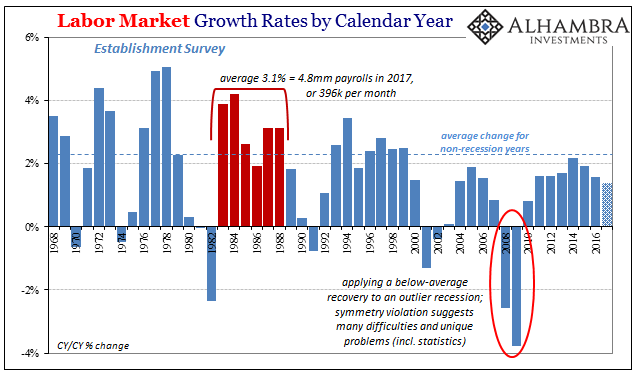

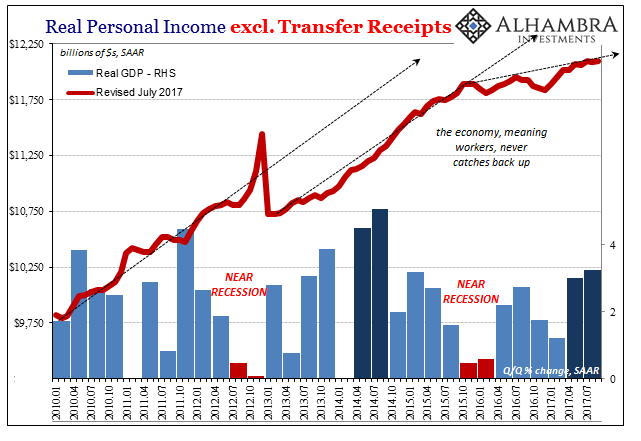

| Ultimately, consumer spending over the intermediate timeframe is determined not by sentiment (surely not the calculated sentiment of the various consumer surveys) or hurricanes but by income. That’s what happened in 2014, where despite all the rhetoric behind the labor market’s description of the best jobs market in decades it never translated into accelerating wage and income growth. |

US Labor Market Growth, 1968 - 2017 |

| The payroll reports this year are appreciably worse than those three years ago, and national (labor) income is growing at a clearly slower rate. The Personal Savings Rate has fallen to lows not seen since the housing bubble, and given these estimates there is good chance it is lower still in these past few months. There is, in the end, a very real limit on how far this can go. Fourteen percent annual growth since August is way, way over that limit. |

US Real Personal Income, Jan 2010 - Nov 2017 |

Tags: consumer spending,currencies,economy,Featured,Federal Reserve/Monetary Policy,hurricanes,income,Inventory,Markets,newslettersent,Retail sales,U.S. Retail Sales