Interview with Martin A. Armstrong, founder AE Global Solutions Inc. As we stand at the beginning of the new year, there’s a lot of hope by investors, business owners, citizens, all of us, that 2021 will be better than its predecessor. We all wish for an end to the pandemic, a return to normalcy, to social interactions and to productive life. However, as we all know, “wishing doesn’t make it so”, and being prepared for the risks and challenges ahead is a far more effective...

Read More »Godfrey Bloom: “The great central banking experiment has failed.”

These days, most mainstream news reports are being monopolized by the pandemic, the covid vaccine and all the new rules and lockdowns that are being enforced across the Western world, and this near-obsessive focus comes at the expense of a lot other important developments. The last story that managed to “dethrone” covid from the headlines was the US Presidential election, and even that reporting was largely through the prism of the pandemic. And yet, the earth hasn’t actually stopped...

Read More »Tyrants Are Waging War Against Their Own Citizens

As [D] Mayor de Blasio shuts down schools and restaurants in NYC yet AGAIN, and as cops in Australia arrest women on beaches for traveling outside of 5 KM from their homes, it’s clear that tyrants around the world are openly waging war against their own people. Claudio Grass joins me to discuss. [embedded content] You Might Also Like You cannot print your way to prosperity – Part II Looking at the damage inflicted upon...

Read More »Tyrants Are Waging War Against Their Own Citizens

As [D] Mayor de Blasio shuts down schools and restaurants in NYC yet AGAIN, and as cops in Australia arrest women on beaches for traveling outside of 5 KM from their homes, it’s clear that tyrants around the world are openly waging war against their own people. Claudio Grass joins me to discuss. [embedded content]

Read More »You cannot print your way to prosperity – Part I

Interview with Theodore Deden There might be a lot of conflicting opinions and disagreement these days about the right way to get out of this current crisis and to rebuild our economy and our society. One the very few things we can all agree on, however, is that the challenges and the disruptions we’re faced with today are simply unprecedented. There is no blueprint, no known formula for this kind of scenario. And yet, while the triggers of this crisis might be very different...

Read More »“We are expecting a new wave and we’re prepared for it.”

Interview with Robert Hartmann, Co-Owner ProAurum Over the last couple of months, we’ve witnessed unprecedented changes in the global economy, in the markets and in our societies. The corona crisis and the governmental measures that were introduced had a dramatic and direct effect on all of us, as investors and as citizens. That is especially true of precious metals investors. A new gold rush is now underway, with impressive price gains and...

Read More »“We are expecting a new wave and we’re prepared for it.”

Interview with Robert Hartmann, Co-Owner ProAurum Over the last couple of months, we’ve witnessed unprecedented changes in the global economy, in the markets and in our societies. The corona crisis and the governmental measures that were introduced had a dramatic and direct effect on all of us, as investors and as citizens. That is especially true of precious metals investors. A new gold rush is now underway, with impressive price gains and elevated demand levels that are...

Read More »A crisis is a terrible thing to waste – Part I

“You never want a serious crisis to go to waste. And what I mean by that, it’s an opportunity to do things you think you could not do before.” -Rahm Emanuel, Barack Obama’s Chief of Staff from 2009 to 2010. Only a couple of weeks ago, if anyone told you that your entire country would be basically shutting down, that events and public gatherings would be outlawed, that you’d be looking at empty shelves in your local supermarket and that the global stock market would...

Read More »A crisis is a terrible thing to waste – Part I

“You never want a serious crisis to go to waste. And what I mean by that, it’s an opportunity to do things you think you could not do before.” -Rahm Emanuel, Barack Obama’s Chief of Staff from 2009 to 2010. Only a couple of weeks ago, if anyone told you that your entire country would be basically shutting down, that events and public gatherings would be outlawed, that you’d be looking at empty shelves in your local supermarket and that the global stock market would be on the brink...

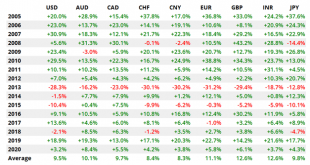

Read More »Gold is the 7th sense of financial markets

Interview with Ronald Stöferle – Part I As we embark on this new decade, there are plenty of good reasons to be optimistic about gold’s prospects. The global economy and the financial system are already stretched to a breaking point and demand for precious metals is heating up. This, of course, is plain for all to see, even as mainstream investors and analysts still refuse to face facts and prefer to focus on naïve hopes of an eternal expansion. These facts, however,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org