Noch ist Chinas Wirtschaft weitgehend abgeschottet: Blick auf die Skyline von Shanghai. Foto: Vincent Isore (Getty) Letzte Woche hat ein Bericht der EU-Handelskammer über das geschäftliche Umfeld in China für grosse Aufmerksamkeit gesorgt. Das starke Medienecho war berechtigt, denn es geht in diesem Bericht um existenzielle Fragen der europäischen Wirtschaft und um die Zukunft des Welthandelssystems. Zwei Botschaften wurden besonders hervorgehoben: Grosse Teile des chinesischen Marktes...

Read More »Emerging Markets: Preview of the Week Ahead

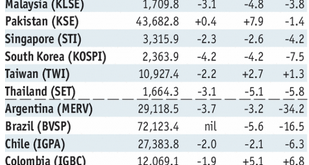

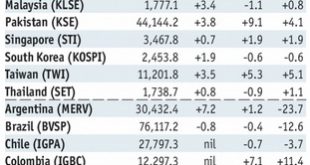

Stock Markets EM FX ended Friday mixed, and capped off a mixed week overall as the dollar’s broad-based rally was sidetracked. EM may start the week on an upbeat after PBOC cut reserve requirements over the weekend. Best EM performers last week were ARS, MXN, and TRY while the worst were THB, IDR, and BRL. Stock Markets Emerging Markets, June 20 - Click to enlarge Indonesia Indonesia reports May trade Monday....

Read More »Bi-Weekly Economic Review (VIDEO)

[embedded content] Information and opinions about the economy and markets from Alhambra Investments CEO Joe Calhoun. Related posts: Bi-Weekly Economic Review: Bi-Weekly Economic Review – VIDEO Bi-Weekly Economic Review – VIDEO Weekly SNB Intervention Update: SNB Resumes Interventions Cookie policy Privacy Policy Bi-Weekly Economic Review: Oil,...

Read More »Bi-Weekly Economic Review:

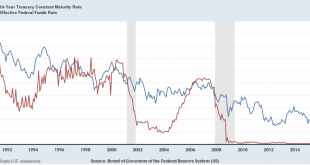

Is the rate hiking cycle almost done? Not the question on everyone’s minds right now so a good time to ask it, I think. A couple of items caught my attention recently that made me at least think about the possibility. There has been for some time now a large short position held by speculators in the futures market for Treasuries. Speculators have been making large and consistent bets that Treasury prices would fall....

Read More »Global Asset Allocation Update

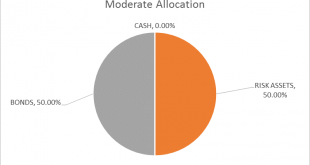

The risk budget is unchanged this month. For the moderate risk investor the allocation to bonds and risk assets is evenly split. There are changes this month within the asset classes. How far are we from the end of this cycle? When will the next recession arrive and more importantly when will stocks and other markets start to anticipate a slowdown? These are critical questions for investors and ones that can’t be...

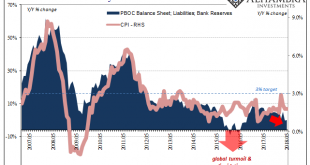

Read More »Chinese Inflation And Money Contributions To EM’s

The People’s Bank of China won’t update its balance sheet numbers for May until later this month. Last month, as expected, the Chinese central bank allowed bank reserves to contract for the first time in nearly two years. It is, I believe, all part of the reprioritization of monetary policy goals toward CNY. How well it works in practice remains to be seen. Authorities are not simply contracting one important form of...

Read More »Konsolidierung am chinesischen Immobilienmarkt

Hannes Boller, Senior Portfolio Manager bei Fisch AM Der ungebändigte Bauboom in China scheint ein Ende zu haben. Hannes Boller, Experte für Corporate Bonds bei Fisch Asset Management in Zürich, gibt eine aktuelle Einschätzung zum chinesischen Immobilienmarkt ab und zeigt, wieso die Konsolidierungen chancenreiche Investments bieten. "Der chinesische Immobilienmarkt wird erwachsen, die wilden...

Read More »Bi-Weekly Economic Review – VIDEO

[embedded content] Interview with Joe Calhoun about BiWeekly Economic Review 15/06/2018. Related posts: Bi-Weekly Economic Review: As Good As It Gets? Bi-Weekly Economic Review – VIDEO Weekly SNB Intervention Update: SNB Resumes Interventions Bi-Weekly Economic Review: Oil, Interest Rates & Economic Growth Bi-Weekly Economic Review Bi-Weekly...

Read More »A Slight Hint Of A 2011 Feel

Whenever a big bank is rumored to be in unexpected merger talks, that’s always a good sign, right? The name Deutsche Bank keeps popping up as it has for several years now, this is merely representative of what’s wrong inside of a global system that can’t ever get fixed. In this one case, we have a couple of perpetuated conventional myths colliding into what is still potentially grave misfortune. As noted last time, I...

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM FX ended Friday on a mixed note, capping off a roller coaster week for some of the more vulnerable currencies. We expect continued efforts by EM policymakers to inject some stability into the markets. However, we believe the underlying dollar rally remains intact. Central bank meetings in the US, eurozone, and Japan this week are likely to drive home that point. Stock Markets Emerging Markets, June 6...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org