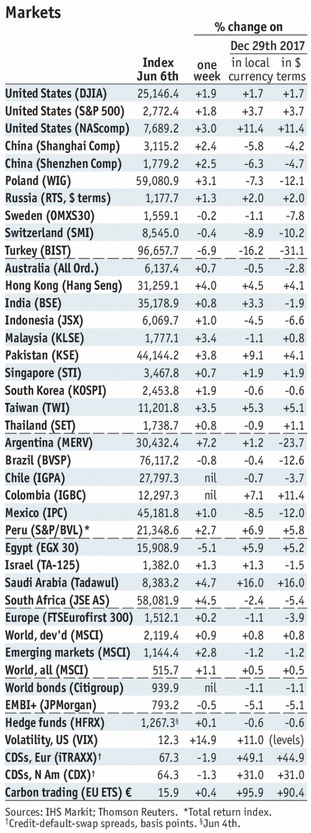

Stock Markets EM FX ended Friday on a mixed note, capping off a roller coaster week for some of the more vulnerable currencies. We expect continued efforts by EM policymakers to inject some stability into the markets. However, we believe the underlying dollar rally remains intact. Central bank meetings in the US, eurozone, and Japan this week are likely to drive home that point. Stock Markets Emerging Markets, June 6 Source: economist.com - Click to enlarge China China reports May money and new loan data this week, but no date has been set. It reports May retail sales and IP Thursday. The former is expected to rise 9.6% y/y while the latter is expected to rise 7.0% y/y. Overall, markets remain comfortable with

Topics:

Win Thin considers the following as important: 5) Global Macro, Brazil, Chile, China, Czech Republic, emerging markets, Featured, India, Israel, Mexico, newsletter, Russia, South Africa, Turkey, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stock MarketsEM FX ended Friday on a mixed note, capping off a roller coaster week for some of the more vulnerable currencies. We expect continued efforts by EM policymakers to inject some stability into the markets. However, we believe the underlying dollar rally remains intact. Central bank meetings in the US, eurozone, and Japan this week are likely to drive home that point. |

Stock Markets Emerging Markets, June 6 Source: economist.com - Click to enlarge |

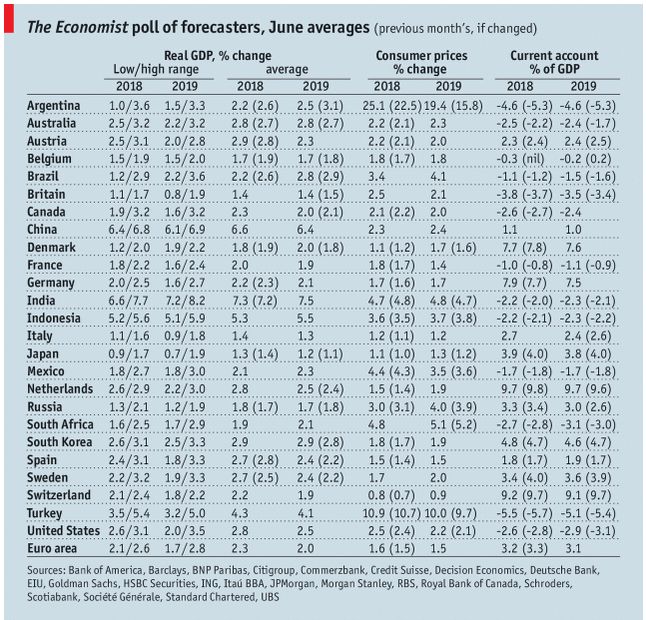

ChinaChina reports May money and new loan data this week, but no date has been set. It reports May retail sales and IP Thursday. The former is expected to rise 9.6% y/y while the latter is expected to rise 7.0% y/y. Overall, markets remain comfortable with the mainland economic outlook. Czech RepublicCzech Republic reports May CPI Monday, which is expected to rise 2.1% y/y vs. 1.9% in April. If so, it would be the highest rate since and January and back in the top half of the 1-3% target range. Central bank officials have sounded more hawkish lately. However, the next policy meeting June 27 seems too soon for a hike. IsraelIsrael central bank releases its minutes Monday. May trade will be reported Wednesday, followed by Q1 current account data Thursday. May CPI will be reported Friday, which is expected to rise 0.5% y/y vs. 0.4% in April. If so, inflation would still be well below the 1-3% target range. Next policy meeting is July 9, no change expected then. TurkeyTurkey reports April current account and Q1 GDP Monday. Growth is expected at 7.0% y/y vs. 7.3% in Q4, while the current account deficit is expected at -$5.2 bln. Turkey then reports April IP Tuesday, which is expected to rise 6.2% y/y vs. 7.6% in March. MexicoMexico reports April IP Monday. With the central bank likely to deliver another rate hike on June 20, the economic outlook has deteriorated. In addition, trade tensions with the US are not helping matters ahead of the July 1 election. SingaporeSingapore reports April retail sales Tuesday, which are expected to rise 1.8% y/y vs. -1.5% in March. The economy remains vulnerable and so we do not believe the MAS will tighten again at its next semiannual policy meeting in October. CPI rose only 0.1% y/y in April, though the MAS does not have an explicit inflation target. IndiaIndia reports May CPI and April IP Tuesday. The former is expected to rise 4.8% y/y vs. 4.6% in April, while the latter is expected to rise 6.0% y/y vs. 4.4% in March. May WPI will be reported Thursday, which is expected to rise 4.0% y/y vs. 3.2% in April. Next policy meeting is August 1. If price pressures continue to rise, another 25 bp hike then seems likely. South AfricaSouth Africa reports April retail sales Wednesday, which are expected to rise 4.2% y/y vs. 4.8% in March. Market sentiment remains sour after the weaker than expected Q1 GDP report, so investors will be keen to see if the slowdown carried over into Q2. For now, SARB is seen remaining on hold. Next policy meeting is July 19, no change expected then. BrazilBrazil reports April retail sales Wednesday. With significant COPOM tightening now priced in, the economic outlook has gotten weaker. Next policy meeting is June 20 and a 50 bp hike to 7.0% is expected. ChileChile central bank meets Wednesday and is expected to keep rates steady at 2.5%. CPI rose 2.0% y/y in May, right at the bottom of the 2-4% target range. The central bank has signaled an end to the easing cycle, but low price pressures will allow the bank to resume cutting if the economy were to slow. RussiaCentral Bank of Russia meets Friday and is expected to keep rates steady at 7.25%. However, the market is split. Of the 27 analysts polled by Bloomberg, 16 see steady rates and 11 see a 25 bp cut to 7.0%. Central bank officials tilted more dovish after May inflation data came in lower than expected. However, we think a rate cut this week may be too soon, especially given ongoing EM stresses. |

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, June 2018 Source: economist.com - Click to enlarge |

Tags: Brazil,Chile,China,Czech Republic,Emerging Markets,Featured,India,Israel,Mexico,newsletter,Russia,South Africa,Turkey,win-thin