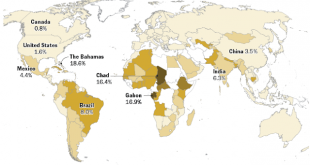

The Trump Administration argues that other countries have been taking unfair advantage of the US on trade for years, and what many are calling a trade war is really only the US finally saying enough. The US has taken many several countries, including China, to the WTO for trade violations and wins the vast majority of cases it has brought. It has become fashionable to talk about reciprocity and intuitively has much...

Read More »Global Asset Allocation Update – (VIDEO)

[embedded content] Economic thoughts and analysis from Alhambra Investments CEO Joe Calhoun. Related posts: Global Asset Allocation Update Global Asset Allocation Update Global Asset Allocation Update Global Asset Allocation Update Global Asset Allocation Update: Tariffs Don’t Warrant A Change…Yet Global Asset Allocation Update: The Certainty of...

Read More »Emerging Markets: Preview of the Week Ahead

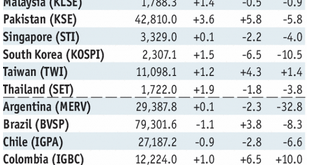

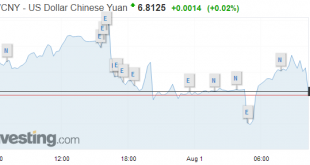

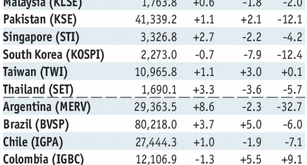

Stock Markets EM FX has come under pressure again due to ongoing trade tensions and rising US rates but saw some modest relief Friday after the PBOC announcement on FX forwards. This helped EM FX stabilize, but we do not think the negative fundamental backdrop has changed. Best performers last week were MXN, PHP, and PEN while the worst were TRY, ZAR, and KRW. Stock Markets Emerging Markets, August 01 - Click...

Read More »Global Asset Allocation Update

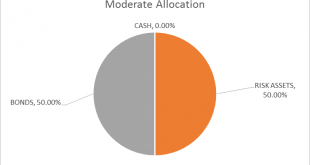

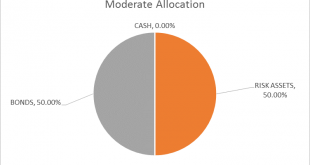

The risk budget is unchanged again this month. For the moderate risk investor, the allocation between bonds and risk assets is evenly split. The only change to the portfolio is the one I wrote about last week, an exchange of TIP for SHY. Interest rates are on the rise again, the 10 year Treasury yield punching through 3% again this morning. That is an indication that growth and/or inflation expectations have risen...

Read More »Tensions Beyond Trade

Chinese officials do not seem to appreciate the extent of its isolation. The disruption from the US as Trump positions the US as a revisionist power-one that wants to alter the world order, which it was instrumental in constructing, may have obscured the fact that China’s practices are a source of frustration and animosity broadly and widely. Chinese officials do not seem to understand why Europe, for example, does not...

Read More »Emerging Markets: Week Ahead Preview

Stock Markets EM FX enjoyed a respite from the ongoing selling pressures, with most currencies up on the week vs. the dollar. Best performers were CLP, MXN, and ZAR while the worst were TRY, CNY, and COP. BOJ, Fed, and BOE meetings this week may pose some risks to EM FX. Stock Markets Emerging Markets, July 25 - Click to enlarge South Africa South Africa reports June money, loan, and budget data Monday. June...

Read More »Global Asset Allocation Update

Note: This will be a short update. We are shifting the timing of some of our reports. The monthly Global Asset Allocation update will now be published in the first week of the month, aiming for the first of each month. I’ll put out a full report next week. The Bi-Weekly Economic Review is shifting to a monthly update, published on the 15th of each month. We are doing this to make room for some new reports, podcasts and...

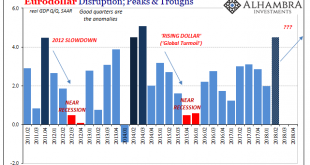

Read More »The Top of GDP

In 1999, real GDP growth in the United States was 4.69% (Q4 over Q4). In 1998, it was 4.9989%. These were annual not quarterly rates, meaning that for two years straight GDP expanded by better than 4.5%. Individual quarters within those years obviously varied, but at the end of the day the economy was clearly booming. It also helped that these particular two years followed two good ones before them. GDP growth in 1997...

Read More »Bi-Weekly Economic Review

This will be a fairly quick update as I just posted a Mid-Year Review yesterday that covers a lot of the same ground. There were, as you’ll see below, some fairly positive reports since the last update but the markets are not responding to the better data. Markets seem to be more focused on the trade wars and the potential fallout. I would also note that at least some of the recent strength in the data is related to...

Read More »Mid-Year Global Markets Update

Volatility returned to markets with a vengeance in the first half of this year. 2018 started off as an extension of last year when volatility was almost wholly absent. Stocks roared out of the starting gate, up almost every day until January 26th. And then – whoosh. What took nearly a month to gain took just 6 trading days to give back and then some. Since that correction, the S&P 500 has traded in a range with a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org