Stock Markets EM FX ended Friday on a week note and capped of another generally negative week. Worst performers last week were ARS, BRL, and TRY while the best were ZAR, RUB, and KRW. We remain negative on EM FX and look for losses to continue. US retail sales data Tuesday pose further downside risks to EM FX. Stock Markets Emerging Markets, May 08 - Click to enlarge India India reports April WPI and...

Read More »What China’s Trade Conditions Say About The Right Side Of ‘L’

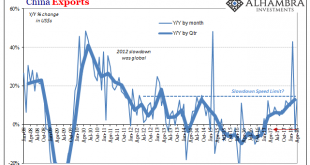

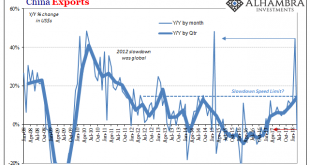

Chinese exports rose 12.9% year-over-year in April 2018. China Exports, Jan 2008 - Apr 2018(see more posts on China Exports, ) - Click to enlarge Imports were up 20.9%. As always, both numbers sound impressive but they are far short of rates consistent with a growing global economy. China’s participation in global growth, synchronized or not, is a must. The lack of acceleration on the export side tells us a lot...

Read More »Watching Imports

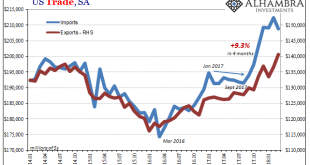

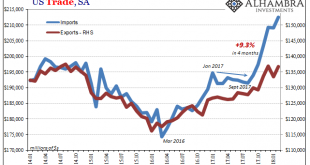

The US trade deficit, a sensitive political topic these days, declined sharply in March. It had expanded significantly (more deficit) in January and February, reaching nearly -$76 billion (seasonally adjusted) in the latter month, before posting -$68 billion in the latest figures. Exports rose while imports fell in March, making for the largest single month change in the trade condition in many years. That may mean...

Read More »FX Daily, May 08: Dollar Races Ahead

Swiss Franc The Euro has fallen by 0.56% to 1.1885 CHF. EUR/CHF and USD/CHF, May 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar’s surge continues. The Dollar Index is testing the space above 93.00. A month ago it was below 90. It does not appear to require fresh developments. The market continues to trade as if there are short dollar positions that are...

Read More »Emerging Markets Preview: The Week Ahead

Stock Markets EM FX came under intense selling pressures last week. The worst performers were ARS, TRY, and MXN while the best were PHP, KRW, and TWD. US rates are likely to remain the key driver for EM FX, and so PPI and CPI data will be closely watched this week. We believe EM FX will remain under pressure. Stock Markets Emerging Markets, May 08 - Click to enlarge Indonesia Indonesia reports Q1 GDP Monday,...

Read More »Chinas historische Wende

Arbeiter vor einem Kraftwerk in Peking. Foto: Michael Reynolds (Keystone) Die Entwicklung der CO2-Konzentration in der Atmosphäre hängt ganz wesentlich davon ab, wie sich die Kohleproduktion entwickeln wird. Die letzten zwei Jahrzehnte waren diesbezüglich wenig ermutigend. China und zunehmend auch Indien fuhren ihre Produktion hoch. 2015 betrug der Anteil der Kohle an der globalen Primärenergie-Produktion (TPES) 28 Prozent gegenüber 24,5 Prozent im Jahr 1971. Die folgende Grafik zeigt...

Read More »China’s Exports Are Interesting, But It’s Their Imports Where Reflation Lives or Dies

Last month Chinese trade statistics left us with several key questions. Export growth was a clear outlier, with outbound trade rising nearly 45% year-over-year in February 2018. There were the usual Golden Week distortions to consider, made more disruptive by the timing of it this year as different from last year. And then we have to consider possible effects of tariffs and restrictions at the start of what is called a...

Read More »US Imports Don’t Quite Match Chinese Exports

In early 2015, a contract dispute between dockworkers’ unions and 29 ports on the West Coast of the US escalated into what was a slowdown strike. Cargoes piled up especially at some of the largest facilities like those in Oakland, LA, and Long Beach, threatening substantial economic costs far and away from just those directly involved. Each side predictably blamed the other for it. Management’s view: The ILWU has...

Read More »Neue Schweizer Plattform für Kryptowährungs-Brokerage

Mike Hofer, Partner, Wholsale & Institutional BCB Group BCB Group, ein führender globaler Kryptowährungs-Broker mit Sitz in London, lanciert seine Prime Brokerage Lösung für institutionelle Anleger. Diese ist darauf ausgelegt, dass Kunden ihren Investoren Zugang zu zahlreichen Krypotwährungen bieten können. BCB Group plant zudem eine Tochtergesellschaft in der Schweiz zu errichten. Die BCB...

Read More »FX Daily, April 02: Monday Blues

Swiss Franc The Euro has fallen by 0.03% to 1.1746 CHF. EUR/CHF and USD/CHF, April 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar drifted a little lower in Asia to start the week while equities had a slightly heavier bias. The MSCI Asia Pacific Index slipped 0.1%. European bourses are mostly closed for the extended Easter holiday, while the S&P is...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org