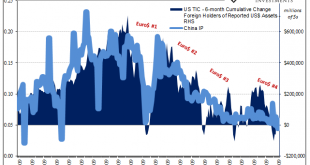

China’s growing troubles go way back long before trade wars ever showed up. It was Euro$ #2 that set this course in motion, and then Euro$ #3 which proved the country’s helplessness. It proved it not just to anyone willing to honestly evaluate the situation, it also established the danger to one key faction of Chinese officials. The entire world slowed in 2012 following #2, but until the bottom of #3 it wasn’t really clear what that might mean. For a very long time,...

Read More »FX Weekly Preview: The Week Ahead Excluding Brexit

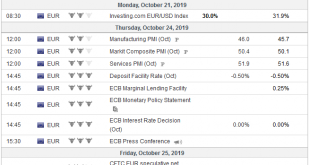

I feel a bit like the proverbial guy that asks, “Besides that, Mrs. Lincoln, how did you like the play?” in trying to discuss the week ahead without knowing the results of the UK Parliament’s decision on the new deal negotiated between Prime Minister Johnson and the EU. I will write a separate note about Brexit before the Asian open. However, there are several other developments next week that will help shape the investment climate. Europe is front and center. Three...

Read More »FX Daily, October 18: Markets Becalmed Ahead of the Week

Swiss Franc The Euro has risen by 0.15% to 1.0999 EUR/CHF and USD/CHF, October 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are ending the week on a subdued note as the UK Parliament decision on Saturday is awaited. The weaker Chinese Q3 GDP had little impact outside of China, where stocks fell over 1%. A brief suspension of hostilities by Turkey was sufficient for the US to lift...

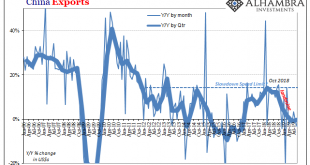

Read More »China’s Dollar Problem Puts the Sync In Globally Synchronized Downturn

Because the prevailing theory behind the global slowdown is “trade wars”, most if not all attention is focused on China. While the correct target, everyone is coming it at from the wrong direction. The world awaits a crash in Chinese exports engineered by US tariffs. It’s not happening, at least according to China’s official statistics. The reported numbers aren’t good by any stretch, but they aren’t perhaps as bad as imagined by the constant references to what we...

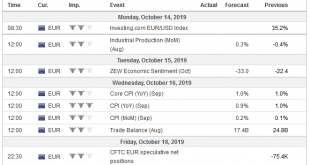

Read More »FX Daily, October 15: Non-Disruptive Brexit Hopes Remain Elevated

Swiss Franc The Euro has fallen by 0.16% to 1.0977 EUR/CHF and USD/CHF, October 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Ideas that a Brexit deal may be close is helping to firm sterling, while soft Chinese PPI offset the spike in food prices to show the weakness of the world’s second-largest economy. Minutes from the meeting of the Reserve Bank of Australia earlier this month kept a door open to a...

Read More »FX Daily, October 14: Optimism Took the Weekend Off

Swiss Franc The Euro has fallen by 0.16% to 1.0979 EUR/CHF and USD/CHF, October 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Japanese and Canadian markets are on holiday today. While the US bond market is closed, equities maintain their regular hours today. Asia Pacific equities rallied, led by 1% of more gains in China, Taiwan, South Korea, and Thailand. The buying did not continue in Europe, and after a...

Read More »FX Weekly Preview: Same Three Drivers in the Week Ahead but Changing Tones

Three themes have dominated the investment climate: US-China tensions, Brexit, and the policy response to the disinflationary forces. None have been resolved, which contributes to the uncertainty for businesses, households, and investors. However, the negativity that has prevailed is receding a little. It begins with the most substantive progress on Brexit in months, but also entails a possible new tariff truce between the US and China. Indeed, we irreverently...

Read More »EM Preview for the Week Ahead

EM benefited greatly from the improvement in US-China trade relations and quite possibly Brexit. The dollar is likely to remain under some pressure near-term as a result. Yet we must caution investors against getting too optimistic. The details of the partial trade deal still need to be worked out, while existing tariffs will still remain in place if the deal is signed next month as most expect. Brexit negotiations have accelerated but we note that any deal must...

Read More »FX Daily, October 10: Setback for the Greenback

Swiss Franc The Euro has risen by 0.37% to 1.0962 EUR/CHF and USD/CHF, October 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Conflicting headlines about US-China trade whipsawed the markets in Asia, but when things settled down, perhaps, like the partial deal that has been hinted, net-net little has changed. Asian equities were mixed, with the Nikkei, China’s indices, and HK gaining, while most of the...

Read More »FX Daily, October 9: Hope is Trying to Supplant Pessimism Today

Swiss Franc The Euro has risen by 0.35% to 1.0912 EUR/CHF and USD/CHF, October 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The 1.5% drop in the S&P 500 and the deterioration of US-China relations and the prospects of a no-deal Brexit failed did not carry over much into today’s activity. Asia Pacific equities were mostly a little lower, though China and India bucked the regional trend, while Korea was...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org